Living in a COVID-19 World

Most of us have stopped asking, "When will it be over?" and have started wondering how we can live with COVID-19 – and how it will change our behaviour from now on. In the context of restructuring, as we saw during the recent Canadian federal election, bankruptcy and insolvency have become topics of increased interest in political and wider circles. This might mean we can expect a greater focus on regulatory reform in this area. We anticipate that changes to the Canadian system will evolve incrementally through judicial interpretation of pre-existing concepts or minor changes to existing legislation. In this issue of Davies Insolvency Now, we turn our focus to one such legislative reform: the good faith amendment.

We analyze current insolvency statistics and note that the Canadian insolvency landscape remained quiet in the second quarter of 2021 compared to both 2019 and 2020. While the insolvency numbers continue to remain steady or drop, the state of business stability is worth a closer look. In the first part, we examine the second quarter of 2021 and conduct a checkup on how businesses managed as Canada ended most of its lockdowns and vaccines were shipped across the country. In the second part, we take a deep dive into the good faith doctrine.

Part A: Q2 2021 Observations

CCAA FILINGS

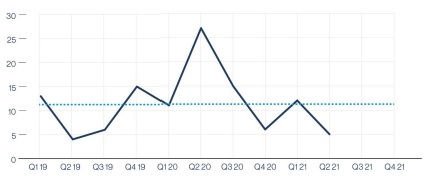

At the national level, the quarterly numbers of filings under the Companies' Creditors Arrangement Act (CCAA) significantly decreased from a peak of more than 25 during Q2 2020. Despite a slight uptick to an average of 12 in Q1 2021, proceedings have decreased to their second-lowest number, five, since Q1 2019 (see Figure 1).

Figure 1: CCAA Restructurings in Canada

As we noted in our previous issue, many businesses re-evaluated their financial viability as the pandemic's second wave dragged on and lockdowns were re-introduced, with a noticeable increase in the overall number of CCAA filings in Q1 2021. However, entering the second quarter, Canada's vaccine rollout picked up speed and the economic outlook improved, despite a third wave of cases. Creditors and businesses were likely willing to hold out a bit longer as a "vaccinated summer" became a reality and cash-flush consumers appeared keen to spend their savings on things other than houses. According to the recent Canadian Economic Recovery Tracker developed by Export Development Canada, the second quarter of 2021 saw solid growth of business and consumer sentiment. In particular, the Bloomberg/ Nanos Canadian Confidence Index reached 66.4 by the end of June 2021, the highest record since 2008, compared to an average of 56.5 in January 2021.

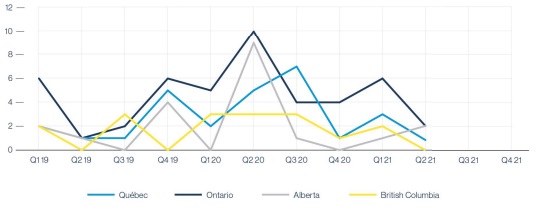

The decrease in the number of filings in Q2 2021 compared to Q1 2021 was recorded in all provinces. In particular, as shown in Figure 2, the number of filings in Ontario dropped from six in the previous quarter to only two in the most recent quarter. British Columbia, for the first time since the beginning of the COVID-19 pandemic, recorded no CCAA proceedings in Q2.

Figure 2: CCAA Proceedings by Province

The pandemic continues to have a concentrated impact on certain industries in Canada. The mining and oil & gas extraction sectors recorded the most filings in the second quarter of 2021, constituting three of the five total filings (see Figure 3). Manufacturing was the other sector in which CCAA proceedings were commenced; however, Q2 filing numbers were lower than in the previous quarter.

The retail sector appears to have adjusted to the COVID-19 environment and reported only one CCAA proceeding in Q1 2021 and zero in Q2 2021. Similarly, agriculture, forestry, fishing and hunting experienced decreases for two quarters in a row, with no filings in the most recent quarter and only one in Q1 2021.

All these vulnerable industries are still showing CCAA proceedings at levels below their Q2/Q3 2020 peaks, and the numbers are very much in line with their 2019 levels.

Co-authored by Patrick White and Victoria Li.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.