As noted in previous bulletins,1 we continue to monitor announcements of Indigenous equity investments in energy and related infrastructure projects in Canada. This bulletin provides an update on trends we have observed in recent Indigenous equity investments over the previous two years, from 2022-2024 YTD.

Indigenous equity investments in these projects are key towards advancing economic reconciliation with Indigenous Peoples. They are also key for managing project risk by helping to align the interests of the parties and facilitating Indigenous support and consent for a project.

To date, we have reviewed 135 energy and related infrastructure projects across Canada that are partially or wholly owned by Indigenous Peoples.2 These projects include Indigenous equity investments in projects spanning over 15 years. However, 28% of the Indigenous equity investments we reviewed occurred only in the last two years, from 2022-2024 YTD.

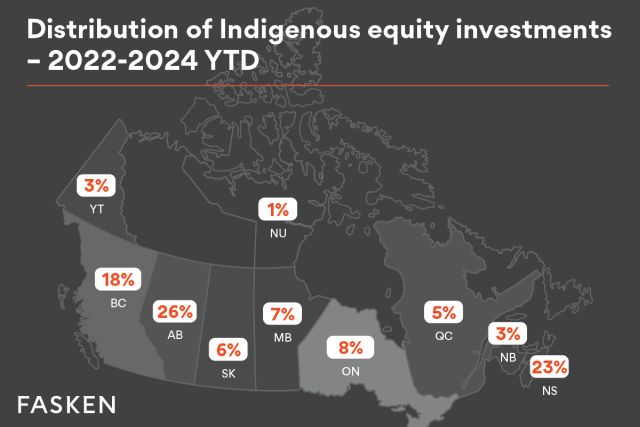

1. Distribution of Indigenous Equity Investments Across Canada

In a previous bulletin, we predicted continued growth of Indigenous equity investments in Alberta given the strong financing support available through the Alberta Indigenous Opportunities Corporation ("AIOC") Loan Guarantee Program.3 This prediction was correct: in 2022-2024 YTD, Alberta had the most Indigenous equity investments in Canada, with 26% of equity investment announcements located in Alberta. This represents a recent trend: as reported in our previous bulletin, Alberta comprised only 10% of all Indigenous equity investments in our database. As anticipated, the AIOC provided funding to just under half of these recent projects.

Nova Scotia, perhaps unexpectedly, had the second-highest number of Indigenous equity investments in Canada, with 23% of new announcements, the vast majority of which were wind generation. Again, this is a recent trend: as noted in our previous bulletin, across all Indigenous equity investments previously reported, only 10% were in Nova Scotia. As a result, some of the earlier front-runners like Ontario have fallen behind.

New equity investment announcements in 2022-2024 YTD were for projects located in nearly all provinces and territories, with the exception of only PEI and Northwest Territories. The distribution across other provinces was as follows: BC: 18%; AB: 26%; SK: 6%; MB: 7%; ON: 8%; QC: 5%; NB: 3%; NS: 23%; YT: 3%; and NU: 1%.4

With the recent announcement of a federal Indigenous equity loan guarantee program, as well as a program announced for British Columbia and a loan program from Canada Infrastructure Bank specifically to support the BC Hydro 2024 Call For Power, we can expect to see a more equal distribution across provinces and territories moving forward, with perhaps BC regaining some ground.

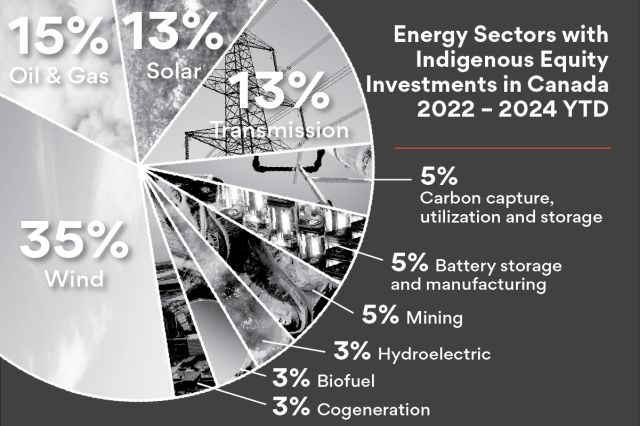

2. Breakdown Across Sectors

Wind was the dominate sector for Indigenous equity investments in 2022-2024 YTD, bringing in 35% of new Indigenous equity investment announcements. Oil & gas related infrastructure followed representing 15% of Indigenous equity investments during this time period. Other sectors represented included solar generation (13%), electricity transmission (13%), carbon capture, utilization and storage (5%), battery storage and manufacturing (5%), mining (5%), hydroelectric (3%), biofuel (3%), cogeneration (3%).

We note that this represents a change from values reported in our previous bulletin, which reported a near-even split between hydroelectric and wind generation projects leading Indigenous equity investments.5 Historically hydroelectric generation has made up a large proportion of Indigenous equity investments in Canada, particularly in BC. However, wind appears to have become a much more common project type for Indigenous investment over the last two years, particularly in eastern Canada, which we expect is consistent with investment in the renewable energy sector generally.

3. Project Value Relative to Equity Interest

Based on our analysis of projects where this information is reported, it appears that minority Indigenous-owned projects tend to be higher value than majority Indigenous-owned projects. This trend continues to correspond with the projects announced in 2022-2024 YTD: more minority Indigenous-owned projects were related to oil and gas infrastructure, while more majority Indigenous-owned projects were related to lower-cost wind and solar projects. As more funding sources become available to provide financing for large-scale Indigenous equity investments, we expect the median value of majority owned projects will rise to help close this gap.

4. Number of Indigenous Communities Involved 2022-2024 YTD

We have identified at least 111 Indigenous communities that obtained or announced an equity interest investment in 2022-2024 YTD. Of these Indigenous communities, 22% had more than one equity investment during this time.

Notably, 49% of new equity investments were owned by only one Indigenous community, while 51% of the new equity investments were owned by two or more. Of projects owned by multiple Indigenous communities, the median number of Indigenous communities involved in a project was six, up to a high of 23 Indigenous communities.6

5. Conclusions

We will continue to monitor announcements of new Indigenous equity investments. With the recent federal budget announcement of a $5 billion National Indigenous Loan Guarantee Program for "sector-agnostic" natural resource and energy projects,7 and other sources of loans and loan guarantee programs becoming available, we expect to see strong continued growth in both the number and value of Indigenous equity investments across Canada. We also expect to see new growth in provinces and territories that do not currently have provincial or territorial loan guarantee programs in place.8

Footnotes

1. See "Four Trends in Equity Participation in Canada" (6 March 2023), online: Fasken https://www.fasken.com/en/knowledge/2023/03/6-four-trends-in-indigenous-equity-participation-in-canada and "Indigenous Equity in Energy Infrastructure Projects in Canada" (22 November 2023), online: Fasken https://www.fasken.com/en/knowledge/2023/11/indigenous-equity-in-energy-and-infrastructure-projects-in-canada.

2. Our database includes energy and related infrastructure projects jointly owned by an Indigenous community and non-Indigenous partner, as well as large-scale 100% Indigenous-owned projects (e.g. projects with a generating capacity of greater than 1 MW, transmission lines, etc.). Note that several new projects are announced every month; this update uses data last updated April 15, 2024. Our analysis is based solely on publicly available information that we have reviewed regarding Indigenous ownership in energy and related infrastructure projects, which is not consistently reported, and does not necessarily reflect an exhaustive analysis of all such investments. Given the limited information available, it is likely that some of these observations are not statistically significant.

3. See "Indigenous Equity in Energy Infrastructure Projects in Canada" (22 November 2023), online: Fasken https://www.fasken.com/en/knowledge/2023/11/indigenous-equity-in-energy-and-infrastructure-projects-in-canada. For more information on the AIOC, see our recent bulletin: "Current and Announced Funding Programs for Indigenous Equity in Canada" (2 April 2024), online: Fasken https://www.fasken.com/en/knowledge/2024/04/current-and-announced-funding-programs-for-indigenous-equity-in-canada.

4. Note that some projects span multiple provinces.

5. See "Indigenous Equity in Energy Infrastructure Projects in Canada" (22 November 2023), online: Fasken https://www.fasken.com/en/knowledge/2023/11/indigenous-equity-in-energy-and-infrastructure-projects-in-canada.

6. See the Athabasca Trunkline, available online: Alberta Indigenous Opportunities Corporation, "Athabasca Trunkline" (2024), online: Alberta Indigenous Opportunities Corporation https://theaioc.com/projects/athabaska-trunkline/.

7. See Canada, Department of Finance Canada, Budget 2024, (Ottawa: Department of Finance Canada, 2024) at PDF 299-301, online (pdf): Government of Canada https://budget.canada.ca/2024/report-rapport/budget-2024.pdf.

8. For a recent overview of current and announced funding programs across Canada, see our recent bulletin: "Current and Announced Funding Programs for Indigenous Equity in Canada" (2 April 2024), online: Fasken https://www.fasken.com/en/knowledge/2024/04/current-and-announced-funding-programs-for-indigenous-equity-in-canada.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.