To increase the consistency between the Law on Securities (2019) and Decree 155/2020/ND-CP (Decree 155), the Ministry of Finance (MOF) issued Circular 51/2021/TT-BTC on 30 June 2021 (Circular 51). This new regulation provides guidance on the obligations of organisations and individuals engaged in foreign investment activities in the Vietnamese securities market. Circular 51 came into effect on 16 August 2021, replacing Circular 123/2015/TT-BTC (Circular 123). In this legal update, we will discuss the highlights and takeaways from Circular 51.

1. Scope

Circular 51 applies to the following organisations and individuals:

- Foreign investors and groups of affiliated foreign investors;

- Depository members, clearing members, securities companies, securities-investment fund management companies, branches of foreign fund management companies in Vietnam, issuers of foreign depositary certificates, and business entities in which more than 50% of the charter capital is held by foreign investors;

- Depository members, clearing members, securities companies, securities-investment fund management companies, branches of foreign fund management companies in Vietnam, issuers of foreign depositary certificates, and business entities in which more than 50% of the charter capital is held by foreign investors;

- The Vietnam Securities Depository and Clearing Corporation (VSDCC), Vietnam Stock Exchange (VNX) and its subsidiaries; and

- Other relevant authorities, organisations and individuals.

2. Obligations of Foreign Investors and Issuers

2.1 Market Manipulation and Prohibited Trading Acts

Decree 51 introduces strict compliance rules for foreign investors and their trading representatives. In particular, they must ensure that investment transactions in Vietnam's securities market, including those performed by their affiliated entities, do not deliberately create false supply or demand, manipulate the price of securities or perform other trading acts prohibited by law.

2.2 Payment of Taxes, Fees, and Other Liabilities

Foreign investors and issuers of foreign depository certificates must declare, pay and finalise taxes, fees, charges and service fees related to securities activities in Vietnam as required by Vietnamese laws.

2.3 Information Disclosure Requirements

Compared to Circular 123, Circular 51 includes a new reporting requirement applicable to groups of affiliated foreign investors. Accordingly, a group of affiliated foreign investors must appoint either a depository member, securities company, securities-investment fund management company or its representative office or another organisation or authorised individual to fulfil the ownership and information disclosure requirements in accordance with applicable laws. A notification of the appointment or authorisation, and replacement thereof, must be prepared in statutory form. It must then be submitted to the State Securities Commission (SSC) and VNX's subsidiary within 24 hours of the appointment, authorisation or replacement coming into force. Meanwhile, any change in the number of foreign investors in a group of affiliated investors must be reported to the same authorities within seven working days.

3. Opening Depository Accounts

Under Circular 51, foreign investors may open one security depository account at a single depository bank for each issued security trading code. Additionally, foreign investors may also open one security depository account per securities company.

4. Obligations of Organisations Providing Services to Foreign Investors

4 .1. Specific Entities

Under Circular 51, securities companies, securities investment fund management companies, branches of foreign fund management companies in Vietnam and business entities in which foreign investors hold more than 50% of the charter capital must ensure compliance with the securities and securities laws market. Furthermore, they must fairly and reasonably allocate assets to each client in accordance with signed agreements, separate trading orders and the investment instructions of both foreign and local investors as well as their own. Where applicable, they must ensure compliance with relevant laws on foreign ownership ratios in Vietnamese companies when performing their services.

4.2. Trading Representatives

Under Circular 51, trading representatives must always comply with Vietnam's securities laws and other relevant legislation when conducting transactions for foreign investors. They must also follow trading and payment instructions of foreign investors and not directly make investment decisions - including the selection of securities, quantity, price, etc. - without trading instructions from foreign investors.

4.3. Depository Members

Depository members must make and keep records and documents. These must record asset depository activities on the depository accounts of organisations and individuals granted securities trading codes. These must also be provided as required to the competent authorities.

4.4. Clearing Members

Circular 51 introduces new obligations for clearing members not contained in Circular 123. This amendment is consistent with the governing Law on Securities. Under Circular 51, clearing members must now:

- Circular 51 introduces new obligations for clearing members not contained in Circular 123. This amendment is consistent with the governing Law on Securities. Under Circular 51, clearing members must now:

- Retain sufficient documents regarding the clearing and settlement of securities transactions of entities granted securities trading codes;

- Adequately, promptly and accurately provide information to the authorities upon their request; and

- Directly submit reports and provide documents (lists, data, figures and other paperwork) to the SSC upon request.

The Law on Securities and Decree 155 define clearing members as "securities companies, commercial banks, branches of foreign banks licensed by the SSC to provide securities clearing, and payment services, and accepted by VSDCC as a clearing member."

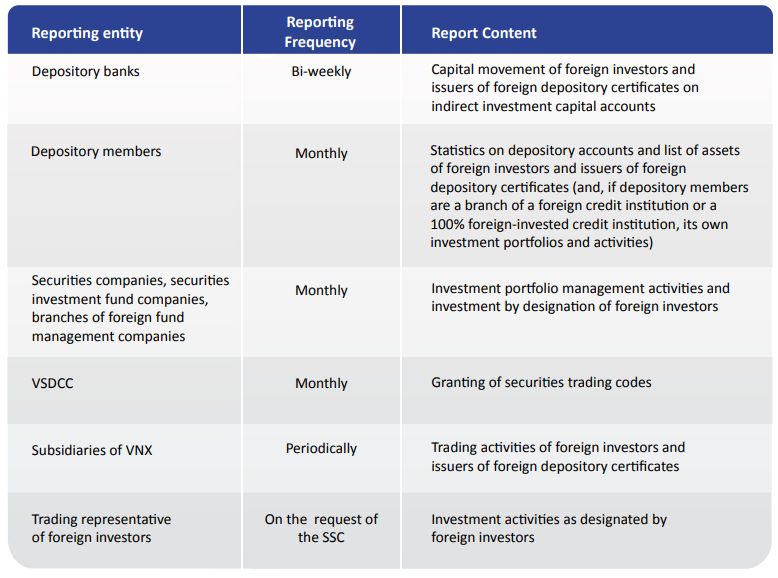

5. Reporting regime

Circular 51 sets out the following reporting regime:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.