As per the latest GSR 127(E) of DPIIT (Department of promotion of Industry and Internal Trade) dated 19th February 2019, an entity shall be considered a start-up:

- Up to a period of 10 years from the date of incorporation/registration as private limited company ( Under Companies Act, 2013) or partnership firm (under section 59 of Partnership Act, 1932) or Limited Liability Partnership (Under Limited Liability Partnership Act,2008) .

- For any of the financial years, the turnover of the company since incorporation/registration has not exceeded 100 crore rupees.

- The entity is working towards Innovation, development or improvement of products or process or services or it is a scalable business model with high potential of employment generation or wealth creation.

Note:

- An entity shall cease to be a Start-up on completion of ten years from the date of its incorporation/ registration or if its turnover for any previous year exceeds one hundred crore rupees.

- Break-up part or reconstruction of an existing entity will not make it a start-up.

- Micro-enterprises can be recognised as Start-ups if they acquire DIPP (Department of Industrial Policy and Promotion) Recognition.

- All entities wishing to avail start-up benefits must register themselves as a start-up and get DIPP recognition after meeting the abovementioned criteria.

With so many upcoming start-ups, it is a must to know what laws govern the respective sector to be secure and create a stable business. The very first and also the most important step in securing your start-up is choosing the right type of business form for your endeavour. Accordingly, the way your company will be taxed is also laid down and other benefits will be decided.

Business formation

Legally, a business venture can be registered as below mentioned. Each of these forms have their own benefits that can yield extreme benefit and productivity when rightly combined with the start-up mark.

- Sole proprietorship: Such form of business type is good for one person ventures, usually where the capital is funded by a single person who wishes to take direct responsibility of their company. A sole proprietorship means that the company is owned by single individual. It is also good for Home-grown businesses where the owner is the product or service creator. It is a good type of business to start with, if one wishes to test out their product in the market before advancing into complex form of business. Another advantage of this is the no requirement of formal registration with any of the laws. The downsides of this form of business is the amount of responsibility and liability that falls upon the sole proprietor. Good for those persons who do not have enough capital to start a full-blown company.

- Private Limited Company: A Private Limited Company (Pvt Ltd.) is an association of not less than or more than two people and set number of members with limited liability. In this type of business the Assets and Liabilities of the owner/promotor/director of the company is not similar to the assets and liabilities of the Company. This basically means, the director of the company is not directly responsible for the liabilities of the company. The most sort after form of business when it comes to start-ups, it offers the right amount of security and space for innovation. Since they have slightly higher compliances it helps keep the start-up within the purview of the law. It also allows for foreign investment and transfer of shares within the company which helps start-up grow. Funding for the a private limited company can also collected from external sources which makes it suitable for those who wish to take loans, or just have the means to further the innovation or idea and not the process. The drawbacks are various tax filings that a Pvt Ltd is supposed to undertake but with introduction of GST that has also been relaxed and the amount of capital that would be required to set up the start-up and maintain it (salaries, fixed costs etc.).

- Limited Liability Partnership (LLP): A fairly new development in the Indian business sector, an LLP combines features of a partnership and Limited Liability Company. It offers flexibility and the cost of maintenance of an LLP is far lower than that of Private Limited Company. As far as risks and compliances are concerned this form of business is much better since there is less of both. Partners here have limited liability as per the amount of contribution they have agreed to in the partnership. The drawback in such a business is that FDI requires prior approval of Reserve bank of India (RBI) and transfer of ownership/partnership requires the consent of all partners.

- Partnership Firm: A minimum of 2 persons are required for starting a partnership type start-up. It is easy to form and does not require registration (depends on the State the start-up is being started in). Such type of business is good when you wish to have risk security and share the responsibility of the company with a group of persons. The resources are available on contribution basis and hence the burden of funding is not just on one person. The drawback of such a business is that the liability of the company falls upon the partners. This means that the liabilities and assets of the owners of the business is the same as that of the company and the partners will be directly responsible for any mishaps since the company is not a separate legal entity.

So while partnerships and sole proprietorships are easy to start they do not have liability protection and stability.

The important thing to keep in mind while selecting the form of business for your start-up is to look at your capital, short term and long term goals of the company, and the purpose of the start-up. It would not be beneficial to have a sole proprietorship when your innovation or product has a larger market need and your start-up should have been a private limited company nor is it feasible to have a Limited Liability partnership when you do not have stable partners willing to commit to the cause and you do not have enough capital to fund your project alone.

Furthermore, it is important to register all your companies properly according to the set guidelines. After which you would also benefit from drawing up a founder's agreement clearing up duties and aims of the partners/directors and the company. It also helps give credibility to your company since the agreement provides a look of surety to the world. Following registration of your start up according one of the forms of businesses, it is important to register your Start up with the government to avail government provided benefits.

A Quick reference chart to navigate which business type is suitable for your start-up:-

|

Sole proprietorship |

Private Limited Company |

Limited Liability partnership |

Partnership Firm |

|

|

Registration |

No registration is mandated by law. Good for very small scale start-ups, home-grown businesses led by single person. |

Needs to be registered under Companies act, 2013. |

Needs to be registered under Limited Liability Partnership Act, 2008 |

Registration is Optional. But in such cases, it should be done regardless. |

|

Legal Status |

Promoter/owner personally Responsible for all liabilities. |

Separate entity. Promoter is not responsible for the Liabilities of such company directly. |

Separate entity. Promoter is not responsible for the Liabilities of such company directly. |

Promoter/owner personally Responsible for all liabilities. |

|

Taxation |

Taxed as individual on the basis of the proprietor's income. |

Private Limited Company profits are taxed as per the slabs provided under Income Tax Act, 1961 plus surcharge and cess as applicable |

LLP profits are taxed as per the slabs provided under Income Tax Act, 1961 plus surcharge and cess as applicable |

Partnership profits are taxed as per the slabs provided under Income Tax Act, 1961 plus surcharge and cess as applicable |

|

Foreign ownership |

Foreigners not allowed to own sole proprietorships in India. |

Under Automatic route, FDI in Pvt Ltd is allowed without prior approval of RBI. (Subject to conditions, please check for latest policy.) |

Foreigners can invest in LLP without prior approval of RBI. (Subject to conditions, please check the latest policy.) |

Foreigners not allowed to be part of partnerships. |

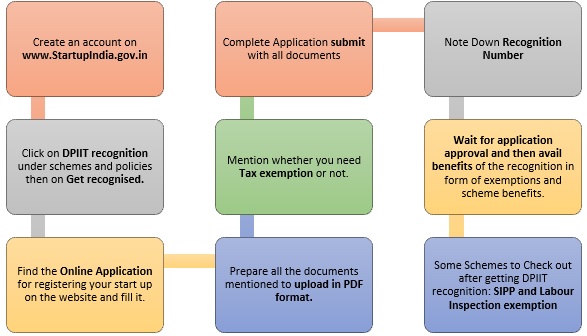

Registration as a Start-up

After the registration of your start-up company, It is important to register your start up with the government to avail tax and other benefits offered by government schemes. For registering yourself as a start up in India, you must meet the criteria set out in the latest government policy already mentioned above as per the GSR 127(E) and then follow these steps:

Step 1: Creating an Account and Registering.

The government has made the process extremely convenient and all of it is doable online. Go on to www. StartupIndia.gov.in and create/register yourself for an account. After doing so, Reach for the schemes and Policies tab and click on DPIIT recognition.

Check the criteria to confirm if you meet all requirements to be legally recognised as a start-up and proceed to fill out the application.

Step 2: Documents required.

In order to judge your start-up as worthy of the DPIIT Recognition, the website asks you to upload a number of documents to check your credibility. These documents all must be in PDF format and authentic. Any forgery or falsification of documents if found upon inspection will call for a hefty fine of 25,000 rupees.

List of documents required:

- Incorporation/Registration certificate of your company: after registering your company under respective act as per company type, you would have received a certificate. Use that certificate you fulfil this criteria.

- A Letter of Funding if any of not less than 20% in equity, by an Incubation Fund, Private Equity Fund, Angel Fund, Accelerator, Private Equity Fund, registered with SEBI that endorses the innovative nature of business.

- A letter of Recommendation: This is to check the worthiness of

your innovation. You can bring any of the following recommendation

letters.

- A recommendation letter from an Incubator known in a post-graduate college in India, in a format approved by the DIPP. This is regarding the innovative nature of the business; OR

- A recommendation letter from an incubator that the Government of India funds as part of any specified scheme to promote innovation; OR

- A letter from any of the Incubators, recognized by the Government of India, in DIPP format. A recommendation later by the Central or any State Government of India; OR

- A patent filed and published in the Journal of Indian Patent office in areas affiliated with the nature of the business being promoted, if any. This can also be used as a letter of recommendation in certain cases.

- Proof of Concept: This could be a prototype of the product or service, website or a sample video that verifies the usefulness and uniqueness of the product for which start-up is established.

- Awards or Certificates if any.

- PAN Number: In case of a sole proprietorship, individual Pan Number would work and in case, your start up is a company of more than one persons than the Company Pan Number would be required and very essential for all transactions and availing tax benefits.

Once you have collected all the required documents in the PDF format, you can complete the DIPP recognition form and wait for confirmation after submission. The Next step is to apply for tax exemption after you have achieved DPIIT recognition for your start-up.

Availing Tax Exemption

The government has provided various Tax benefits for start-ups and Micro enterprises. After getting DPIIT Recognition, you may apply for Tax exemption. There are two types of exemptions that the start-up India scheme provides. To view the official notice, click here.

1. Tax exemption under section 80 IAC of Income Tax Act.

Section 80 IAC of ITA mentions that an eligible start-up is allowed a deduction of an amount equal to 100 percent profits and gains for any three consecutive years out of five years beginning from the year of incorporation of the start-up.

Requirements:

- If the business is incorporated as a Limited Liability Partnership (LLP) or a Company.

- If the total turnover of the business does not exceed INR 20 Crores in any of the prior years beginning on or after the 1st of April, 2016 and ending on the 31st of March, 2021.

- The Start-up should have been incorporated on or after 1st April 2016.

This would mean that sole proprietorships and partnership firms are not eligible for exemption under this scheme.

It should be noted that the requirement of the turnover not exceeding INR 25 Crores would apply to seven previous years commencing from the date of incorporation. Further, turnover should not exceed the prescribed limit of INR 25 Crores for the year for which the start-up claims the 100 per cent deduction.

As per the Income Tax Act, for computing deduction under this section, the gains and profits of the eligible business shall be computed as if such businesses are the only source of income of the assessee during the relevant previous years.

The deduction shall be allowed only if a chartered accountant has audited the accounts of the start-up for the relevant previous year and the assessee furnishes the audit report in the form that is prescribed, and duly signed and verified by such an accountant along with his return of income.

The form to apply for the tax exemption is available on the Start-up India website. For more details about what the application entails, you can visit here.

2. Tax exemption under section 56 of Income Tax Act. (Angel Tax)

Angel tax was tax levied on capital raised by start-ups from private individuals and organisations to fund their endeavour. First step is to check yourself as eligible for start-up status, then acquire DPIIT recognition and apply for this tax. Specifics to get this tax exemption are:

The aggregate amount of its paid-up share capital and share premium of the start-up after issue or proposed issue of shares does not exceed INR 25 crores.

Further in the calculation of threshold of INR 25 crores, the amount of paid-up share capital and share premium in respect of shares issued to any of the following persons will not be included: A Non-resident or A Venture Capital Company or A Venture Capital Fund. The condition however is that, the start-up should not invest, within 7 years from the end of the latest financial year in which the shares are issued at a premium, in any of the following:

Building or land for the purpose (other than own use or as stock in trade or for the purpose of renting) or For advancing loans (other than where the lending of money is the substantial part of the business of the start-up) or Capital contribution to any other entity or Shares and securities or Motor Vehicle, aircraft, yacht, or any other mode of transport, the actual cost of which exceeds INR 10 Lakhs (other than that held by the start-up for the purpose of plying, hiring, leasing, or as stock-in-trade, in the ordinary course of business or Jewellery (other than that held by the start-up as stock in the ordinary course of business)or Archaeological collections & Artefacts etc.

Lastly, start-up should not give out loans and advances nor make capital contributions to other entities.

You can find the form for availing Angel Tax exemption on the Start-up India Website.

SIPP Scheme

As a start-up it is important to protect your ideas and innovations. Besides, it is also important to protect the identity that you are trying to create through brand name, logo or any other symbol. In order to protect young entrepreneurs and their ideas, the government launched scheme for facilitating start-ups intellectual property protection which seeks to facilitate protection of patents, trademarks and innovation designs in order to encourage and promotes creativity amongst start-ups.

The Aim of this scheme is to promote awareness and adoption of Intellectual property laws. Provisions of the Scheme includes:

- Providing high-qualification IPR professionals for filing and prosecution of IPR violations and protection of start-ups for free and the professionals are paid nominal fees by government itself. However fees for patent/trademark/design filing application must be undertaken by the start-up itself.

- There is an 80% reduction in cost of filing patents. For patent and design applications under the category of Start-up, The start-ups are only required to pay official fee for filing the application and no professional charges. The government will bear all facilitating charges.

- There is a 50% rebate available for Trademark filings.

- Start-ups can apply for fast tracking of their patent applications by filling request for expedited examination which mandates the controller to issue an FIR with 105 days when the expedition request is accepted. Granting of patent is expedited and the time taken is reduced to a year or so compared to a normal of 5 to 7 years.

It might seem easy to ignore the IPR issues when starting a start-up but in the longer run it would only be beneficial for your endeavour to be quick with IPR related issues relevant to your business and also making use of the government schemes provided to ease the burden of functioning.

Self-Certification and exemption from Labour inspection

In order to catalyse the generation of employment opportunities by Start-ups, the government has issued a new scheme where start-ups can self-certify themselves in the field of Labour laws and Environmental Laws.

If start-ups manage to furnish a self-declaration of their compliance with 9 labour laws in the first year from the date of incorporation, no inspection under the law wherever applicable will be held. The labour laws covered under this are:

Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act,1996

The Inter-State Migrant Workmen (Regulation of Employment & Conditions of Service) Act, 1979

The Payment of Gratuity Act, 1972

The Contract Labour (Regulation and Abolition) Act, 1970

The Employees' Provident Funds and Miscellaneous Provisions Act, 1952

The Employees' State Insurance Act, 1948

The Industrial Disputes Act,1947

The Trade Unions Act,1926

The Industrial Employment (Standing Orders),1946

From the second year onwards, up to 5 years from the setting up of the units, such start-ups are required to furnish self-certified returns and would be inspected only when credible and verifiable complaint of violation is filed in writing and approval has been obtained from the higher authorities

The advisory to State Governments is not to exempt the Start-ups from the ambit of compliance of these Labour Laws but to provide an administrative mechanism to regulate inspection of the Start-Ups under these labour laws, so that Start-ups are encouraged to be self-disciplined and adhere to the rule of law.

Similar is also the case for environment law compliances which can be found on Start-upIndia.gov.in.

Conclusion

Start-ups are the future of the market and innovation. It is important in a country like ours where the demographic is young minds who have the ability to create, to have the right kind of support from government. While the government is trying to do their part by providing multiple schemes, it is imperative to keep in mind that the growth of a start-up is in the hands of the owner and how they conduct their business. By complying with the law, they create stable and risk free foundations from themselves that allow their innovation to flourish. It also makes the government more trusting of new businesses and recognise their contribution to the economy. This guide briefly touched upon laws and rules that can guide start-ups, but there is always room for more information according to one's own needs. The idea is to always research legal and other requirements when starting a start-up given its relative nascent stage in the economy of India.

References

https://www.startupindia.gov.in/content/sih/en/startupgov/self-certification.html

https://taxguru.in/chartered-accountant/startup-business-proprietorship-form-entity.html

https://razorpay.com/blog/legal-basics-that-every-indian-startup-should-know/

https://www.rna-cs.com/guide-for-start-ups/

https://taxguru.in/corporate-law/indian-laws-startup.html

https://ssrana.in/corporate-laws/startups-registration-related-laws/

https://dpiit.gov.in/sites/default/files/lu133.pdf

https://cleartax.in/s/startup-india-tax-exemptions-eligibility

https://ssrana.in/corporate-laws/startups-registration-related-laws/ipr-benefits-startups/

By

Vijay Pal Dalmia, Advocate

Supreme Court of India & Delhi High Court

Email id: vpdalmia@vaishlaw.com

Mobile No.: +91 9810081079

Linkedin: https://www.linkedin.com/in/vpdalmia/

Facebook: https://www.facebook.com/vpdalmia

Twitter: @vpdalmia

© 2020, Vaish Associates Advocates,

All rights reserved

Advocates, 1st & 11th Floors, Mohan Dev Building 13, Tolstoy

Marg New Delhi-110001 (India).

The content of this article is intended to provide a general guide to the subject matter. Specialist professional advice should be sought about your specific circumstances. The views expressed in this article are solely of the authors of this article.