In February 2021, ReNew Power - one of India's leading renewable energy companies - announced an impending public listing on the US NASDAQ. In a typical scenario, the company would have taken the traditional initial public offering (IPO) route; however, ReNew Power opted to merge itself with RMG Acquisition Corporation II, a NASDAQ-listed special purpose acquisition company (SPAC). In doing so, it embraced a booming trend which has taken global capital markets by storm, particularly in recent years.

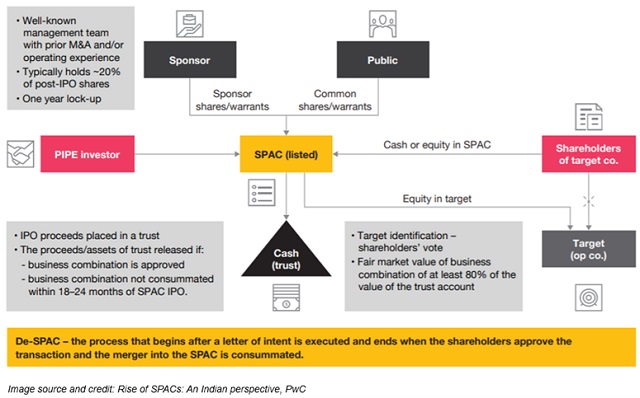

SPACs, often called "blank-cheque companies", are shell corporations that raise capital via IPOs to acquire unlisted firms (target companies) and list them publicly. Once the acquisition is complete, the target company merges with the SPAC and becomes the surviving publicly-listed entity. SPACs are founded by seasoned investors/professionals

(sponsors) who have expertise in specific industries/sectors. IPO proceeds are placed in an escrow account till a target is identified within a fixed time frame which is typically 18-24 months. Failure to identify a target within the stipulated time results in liquidation of the SPAC and refund of money, along with interest, to investors.

Although deals involving SPACs have seen a spectacular rise globally, they are yet to gain popularity in India. In 2020, there were 248 SPAC IPO deals worth $83 billion globally. The growth is expected to be exponentially higher in 2021: as of 16 May 2021, 318 SPACs had already raised $102 billion through IPOs. In comparison, India has seen less than a handful of deals till date, all involving US-listed SPACs:

- Merger of Videocon d2h with Silver Eagle Acquisition Corp (NASDAQ listing) [Completed in 2015]. In 2018, Videocon d2h voluntarily delisted from NASDAQ after finalizing an amalgamation with DISH TV

- Merger of Yatra India with Terrapin 3 Acquisition Corp (NASDAQ listing) [Completed in 2016]

- Merger of ReNew Power with RMG Acquisition Corporation II; to be listed on NASDAQ [Announced in 2021]

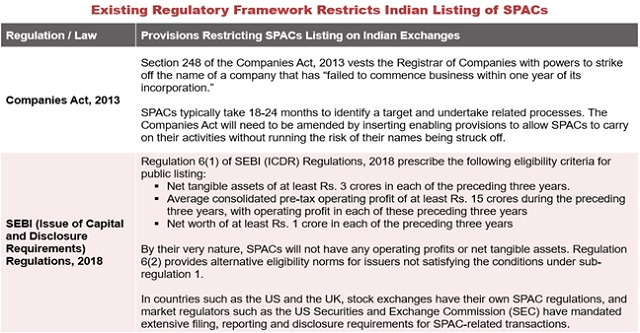

India's current regulatory environment is not supportive of the SPAC framework. Existing laws severely restrict the ability of SPACs to list on Indian stock exchanges, thereby denying a large pool of unlisted companies - including start-ups - the option to become publicly-listed entities after being acquired by special-purpose vehicles.

Besides the restrictions mentioned, issuers also need to fulfil inbound and outbound merger compliances and foreign exchange norms under the Foreign Exchange Management (Cross Border Merger) Regulations, 2018, the Foreign Exchange Management (Transfer or issue of any Foreign Security) Regulations, 2004, and the Liberalized Remittance Scheme of the Reserve Bank of India (RBI). Another key restriction will present itself in the form of existing taxation norms, especially those related to capital gains, transfer of Indian capital assets, and anti-abuse provisions under sections 56(2)(viia) and 56(2)(viib).

In March 2021, the International Financial Services Centres Authority (IFSCA) - a unified regulatory body overseeing the establishment of International Financial Service Centres (IFSCs) in India - issued a consultation paper which provides a draft framework for listing SPACs on recognized stock exchanges in IFSCs only. It provides for the following salient features:

- Minimum offer size of $50 million or any other amount as may be specified by the IFSCA from time to time

- Sponsor shall hold at least 20 percent of the post issue, paid-up capital of the SPAC

- Minimum application size in a SPAC IPO shall be $250,000

- Minimum subscription to be received will be at least 50 percent of the offer size

- Timeline for acquisition will be three years from the date of listing, extendable up to one year

While this is indeed a step forward, the proposal suffers from limitations. Currently, India has only one IFSC - the Gujarat International Finance Tec-City (GIFT City). Restricting the listing of SPACs to IFSCs will significantly deter the pace of activity. Moreover, target companies can be acquired only by Indian SPACs. In its current form, the proposal lacks a concrete framework for SPAC transactions to be undertaken in a meaningful way. The global market environment for SPACs calls for a far more accelerated pace of developing the SPAC framework in India, which in turn necessitates amendments to the existing regulatory requirement comprising restrictive rules.

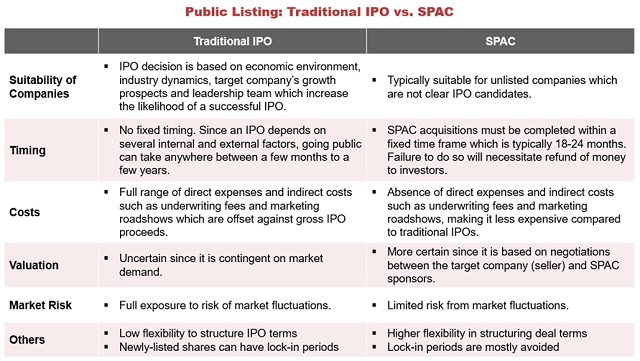

All funding alternatives to IPOs have their share of pros and cons, and SPACs are no exception. Given that India has a robust start-up ecosystem, significant potential is waiting to be unlocked. That can only happen when an enabling environment is created for both domestic and international SPACs to invest in Indian entities.

Recent research published by Credit Suisse estimates that India has 100 "highly valued and as-yet-unlisted companies" unicorns (companies with a valuation greater than $1 billion) with a combined market capitalization of US$240 billion. These unlisted companies present significant opportunities for capital inflows if the regulatory environment permits a higher level of direct alternative financing options from international institutions, particularly foreign investments by SPACs. So far, Asian markets have not received sufficient attention from foreign SPACs, and it is only a matter of time before that happens. India should be ready to take advantage of this pent-up investor demand.

There is no denying the fact that SPACs present certain downsides. A SPAC does not conduct any business operations but instead relies on the credibility of its sponsors; this amplifies the risk and uncertainty for investors. In the last few years, investors have lost money by placing bets on SPACs and target companies which were later found to be fraudulent. In order to meet the stipulated timeline, SPACs may end up shortlisting an undeserving target or overpaying for a target. Some also argue that compared to IPOs, the due diligence process involving SPACs is less stringent, leaving room for loopholes and manipulation.

As is the case with many such transactions, retail investors bear the brunt. However, these and other downsides have led to course correction by taking measures such as bringing on board accomplished sponsors, eliminating the concept of founder stock, and reduction in underwriting costs. If the Indian government and market regulators decide to go down the SPAC route, they can adopt best practices from countries such as the UK and US where capital to the tune of billions of dollars has been raised through SPACs.

The uncertainties brought about by the coronavirus pandemic have seen companies struggling to raise capital via traditional IPOs. SPACs have emerged as preferred vehicles for companies looking to go public in an environment where getting access to more traditional forms of capital is proving difficult. Such a mechanism offers a compelling opportunity for Indian firms to make forays into global financial markets through overseas listings. Conversely, Indian SPACs can acquire targets with attractive valuations and strong business models. In either case, a supportive regulatory environment is necessary to give wings to the dreams of Indian companies, especially start-ups and those promoted by first-generation entrepreneurs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.