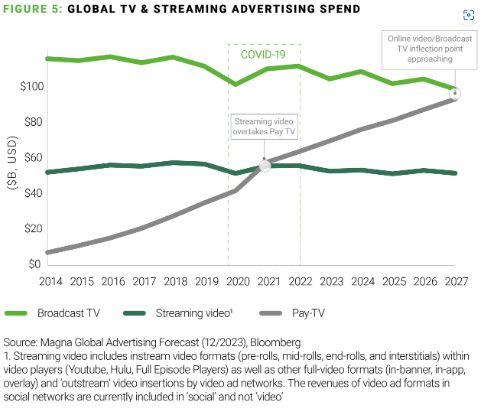

In the2024 AlixPartners Media & Entertainment Industry Predictions Reportpublished in November, we forecasted that the advertising-supported video on demand (AVOD) market would grow 2-3 times larger over the next five years. Advertising budget reallocation from traditional media to digital platforms and viewers' expanding preference for streaming services over traditional TV channels are at the heart of this AVOD growth.

In this article, we delve deeper into the dynamics of this

advertising market by addressing two fundamental questions. First,

why are streamers increasingly focusing on advertising revenue?

Second, which factors influence a streamer's ability to

maximize advertising revenue?

Why streamers are prioritizing advertising

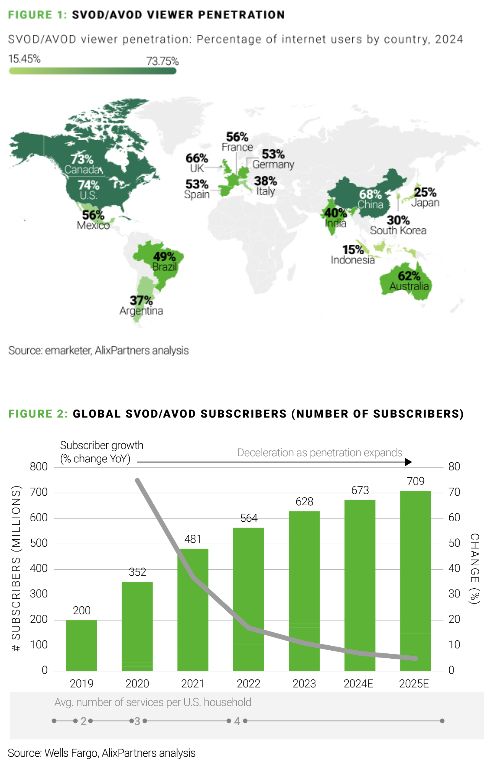

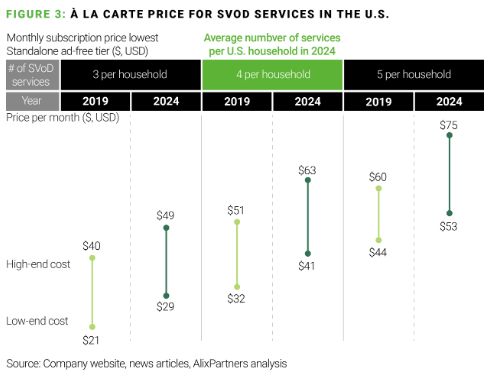

Streaming services are approaching a critical saturation point with a slowdown in net-new subscribers. Over the last 15 years, the proliferation and diversification of streamed content has been tremendous, as long-standing content owners prioritized streaming over traditional channels and newer incumbents (such as Netflix) funded investments in original film and TV series. In the United States, over 70% of individuals are now subscribed or have access to at least one streaming service. This high level of market saturation makes it increasingly difficult for streamers to identify and attract new or untapped subscribers.

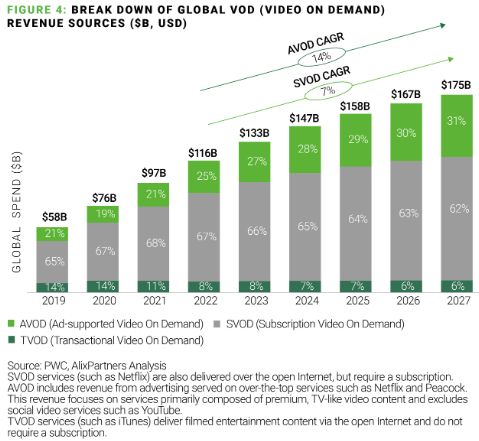

With streaming penetration levels at all-time highs in major markets, only niche segments will see significant future user growth. To sustain the revenue growth that investors expect, streamers must therefore concentrate on increasing the value per user, either by increasing subscription prices or monetizing ads. Most major streamers have already increased subscription prices—Netflix, for example,raised the price of its premium plan from $20.99 to $23.99 in October, its fifth increase since 2016. Streamers have also cracked down on password sharing. This leaves advertising as the primary vector for streaming revenue growth.

Consumers—frustrated and overwhelmed by streaming fragmentation and the rising cost of subscription services—increasingly tolerate ad tiers. They are willing to downgrade their viewing experience for an ad-supported model that offers content at a reduced price.

In the early days of streaming, players sought to attract cord-cutters and cord-nevers with low-priced monthly subscriptions to their direct-to-consumer (DTC) platforms. From 2014-2019, consumers were happy to pay an average of $8-10 for one or two premium streaming services; the flexibility to cancel anytime was a relief relative to the skyrocketing cost of cable and rigid long-term contracts. Nowadays, as streamers focus on growing profits, streaming service costs are nearing higher traditional linear TV costs. As such, we expect that many consumers will relearn to live with advertising in their content.

Streaming is also a bright spot in the world of advertising. AVOD's widespread adoption makes it appealing to advertisers. Streamers are more frequently licensing sports content (e.g. Netflix's 10-year deal with WWE and 3-year deal for Christmas Day NFL games), which are expected to draw lucrative ad dollars. With large segments of the population increasingly unreachable through broadcast and other traditional channels (many Gen Y and Gen Z'ers don't have Pay TV), we expect more and more ad dollars to shift towards AVOD and predict streaming video advertising spend will eclipse broadcast TV advertising spend by 2027. Digital channels such as AVOD also provide rich behavioral data that is challenging to obtain though some traditional channels, and advertisers are willing to pay.

It is clear therefore that advertising will play an increasingly important role in Streamer's revenue mix, and that they must figure out how to ensure its effectiveness. One key metric the ad industry has coalesced around is CPM, or "cost per mille"—the cost an advertiser pays for one thousand views of an ad. CPM is particularly powerful because it directly impacts the profitability of both streamers and advertisers. For streamers, maximizing CPM means earning more for each finite advertising slot.

How streamers can maximize advertising revenue & CPM

Supply and demand are the ultimate factors that drive the CPM a streamer can command. Higher-quality advertising inventory generally leads to higher CPMs, though there are exceptions. Netflix's astronomically high CPM when it first launched ads, for example, was driven by market hype more than quality of inventory; it has since come down.

In our experience, there are five major areas streamers should consider to maximize CPMs:

- Ad format:Ad format matters,and while there is no silver bullet, the most sophisticated streamers continuously experiment with various formats to determine which are most effective for their audiences. These include short-form vs. long-form content, ad length, pre-roll, mid-roll, or end-roll ad placements, skippable vs. non-skippable ads, customer thumbnails, end screens, and clickable links.

- Viewer intent:Viewers in a shopping mindset are much more likely to interact with advertisements than viewers in an entertainment mindset. Some platforms, like Instagram, blend video streaming with shopping activities Others, such as Netflix, are used primarily for entertainment and relaxation. The more streamers can utilize content to put viewers in a "shopper" mindset, the more advertisers will pay for their eyeballs.

- Meta data:Richer meta data leads to more effective ad deployments. Advertisers are willing to pay for increased transparency into the audience demographics to which their ads are exposed. To improve meta data quality, streamers can collect data directly from viewers, indirectly observe viewer habits, and bolster their data collection through third-party sources. Profile splitting and the crack down on password sharing have also improved data, as streamers can more effectively attribute viewing habits to different users.

- Advertising allocation engines:Advertising engines and associated ad stacks can be the "special sauce" that makes or breaks a streamer's advertising efforts. Effective ad stacks enable personalized, localized ads, which are far more attractive to advertisers and therefore boost CPMs. With that said, these stacks are highly complex and expensive to build and maintain. All but the most sophisticated streamers will leverage third-party services, and even platforms with in-house ad stacks will leverage third-party tools within their stacks.

- Advertising sales effectiveness:Old-fashioned sales still play an important role in the AVOD value chain, and streamers that develop strong agency relationships will more effectively sell their programmatic inventory. Likewise, streamers with strong direct advertiser relationships will be able to command a premium for their best slots. It takes time for relative newcomers, like Netflix, to build trust and strong working relationships with both agencies and direct sellers; long-standing content owners, such as Paramount, have had decades to build this muscle. Accelerating sales effectiveness efforts will level the playing field.

Advertising tiers are here to stay—all streamers must consider how advertising fits into their overall monetization strategy. Operating an advertising business is complex, and navigating the journey differs based on the nuances and unique audiences of each business. Regardless, to thrive in advertising, streaming firms must take a hard look at their businesses and make the right investment choices.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.