The semiconductor industry is attracting more interest than ever from global investors. But disruption has taken center stage in this rapidly evolving landscape, surpassing traditional economic cycles as the primary challenge for financing. Balancing high risk and high reward is essential to place strategic investments that ensure protection in the case of an economic downturn.

These were among the key themes covered at the International Semiconductor Executive Summit held May 14-15 in Taiwan, which brought together leaders from across the semiconductor value chain for compelling discussion on important current trends and projections for the industry. As part of the program, Michael Mo, AlixPartners Partner and Managing Director, led a session on disruptions across the semiconductor value chain.

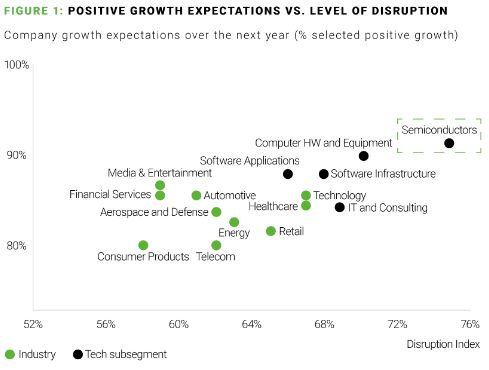

As part of the firm's annual Disruption Index, AlixPartners surveys 3,100 cross-industry CEOs and senior executives worldwide to delve into the root causes of disruption. With this data and analysis, we then detail what companies can do to not only mitigate its effects but also harness its opportunities.

For the semiconductor industry, disruptions center around three major themes: consumer demand for end-user products, technological innovation, and supply chain rebalancing.

Consumer demand for end-user products

Trends in end-user products, ranging from artificial intelligence (AI) to autonomous driving, are propelling semiconductor demand and evolution. The proliferation of AI applications necessitates advanced semiconductors capable of handling complex computations and large data sets. Autonomous vehicles, which rely on an array of sensors and processing units, similarly push the boundaries of semiconductor technology. Additionally, as consumers continuously seek smarter devices across all categories—from smartphones to home appliances—the demand for more advanced and efficient semiconductors only intensifies. This growing consumer expectation for intelligent devices propels the semiconductor industry forward, compelling manufacturers to innovate at an unprecedented pace.

Technological innovation

The next generation of extreme ultraviolet (EUV) tools, particularly high numerical aperture (High NA) EUV lithography, represents a significant leap in technological innovation within the semiconductor industry. These advanced tools, developed by industry leader ASML, increase processing power while reducing the physical space and weight of semiconductor components. This technological advancement enables the new end-user products described above, helping push the global semiconductor market from its current valuation of $600 billion to an anticipated $1 trillion by 2030.

ASML's current technological edge, established through years of research and development, is expected to extend well into the next decade, ensuring its position at the forefront of semiconductor innovation. The ability to pack more power into smaller chips not only meets current demands but also sets the stage for future breakthroughs.

Supply chain rebalancing

Geopolitical conflicts have necessitated a significant rebalancing of the global semiconductor supply chain. Government actions are reshaping the landscape, particularly between the Western and Eastern hemispheres. In 2022, the United States took decisive steps by investing $52 billion in subsidies for domestic semiconductor fabrication plants. This move, coupled with imposing export restrictions on advanced technology to China, aims to bolster domestic production capabilities and reduce reliance on Eastern manufacturing hubs. Furthermore, within the Eastern hemisphere, there is a noticeable shift as countries seek to diversify their supply chains away from heavy dependence on Taiwan and China. This strategic rebalancing is driven by the need to mitigate geopolitical risks and ensure a more resilient and secure supply chain for the future.

At least nine companies have set up or expanded operations in Japan over the past two years, such as TSMC and eMemory Technology. We believe that the semiconductor value chain can capitalize on long-term opportunities through enhanced cooperation. With geopolitical tensions becoming the norm, companies must leverage the economic frameworks of the U.S. and APAC countries to invest in these regions. This approach allows companies to benefit from incentives and subsidies while lessening operational risks related to talent, water, and electricity.

To implement a strategic, practical manufacturing footprint at this critical point for the semiconductor industry, companies must focus on:

- Projecting future-state scenarios to understand labor productivity and wage costs.

- Assessing the impact of location on proximity to the supply chain and customers.

- Ensuring government support to bolster commitments.

Disruptions may pervade, but the semiconductor industry isn't slowing down any time soon. Proactive companies have an opportunity to thrive in this investment-heavy space in years to come if they can meet consumer needs, boost their technology, and navigate geopolitical supply chain challenges. As we learned in Taiwan, those that take the right risks will receive worthy rewards.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.