Over the past two years, the macroeconomic climate and short-term disruptions like high inflation and rising interest rates have increased the pressure on private equity (PE) portfolio companies (portcos) and their investors, PE funds.

With inflation not yet tamed, continued uncertainty around interest rates will continue to strain PE-owned technology companies' returns. The ongoing effects of the high cost of borrowing, drop in portco valuations, and ongoing spread in bid versus ask, make it increasingly difficult for PE investors to achieve their value creation goals within the time frames they originally told investors.

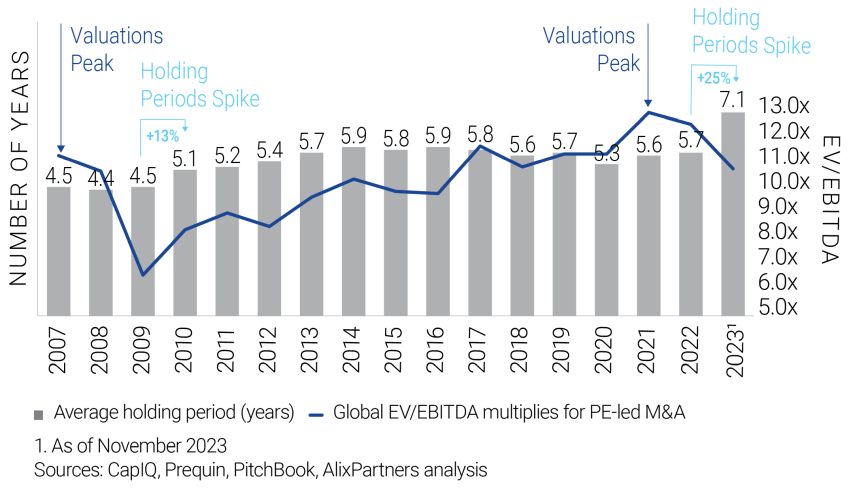

As valuations have fallen relative to previous years, holding times for PE buyout funds have spiked

Buyout multiples for PE-led M&A have declined from record highs of ~13x EV/EBITDA in 2021 to less than ~11x EV/EBITDA during 2023, according to PitchBook. Additionally, lower multiples and an unfavorable exit environment drove the average holding period upward by more than 25% year over year—from 5.7 years during 2022 to 7.1 years in 2023—the longest that holding periods have been in more than two decades and the biggest year-over-year increase since 2009 (figure 1).

Figure 1: HOLDING PERIODS LONGEST IN TWO

DECADES

Average Buyout Holding Period of US and Canadian PE Buyout

Funds, 2007–23

For PE investors, technology portcos represent one of the most impacted sectors when it comes to longer holding periods due to high volatility and the capital-intensive, multifaceted fuel-for-growth investment required to scale operations. The situation has forced PE firms to focus on generating operational leverage by growing both portco revenue and EBITDA. It is critical that tech portcos expand enterprise value when compensating for longer hold periods and lower exit multiples.

PE funds must pivot their tech portcos toward profitability rather than growing for growth's sake

Starting in the fourth quarter of 2023, AlixPartners began to hear that many PE sponsors wanted to guide their management teams through a refinement of their 2024 planning and orient them toward enhancing profitability and efficiency so that growth would derive from fitness, not just from investments. Management teams that are under pressure from their sponsors to create sustainable value rather than unsustainable growth welcome such a performance-first approach, which enables a company to identify immediate—and significant—value creation opportunities while keeping investment lean.

To make this work, it is critical to keep the big picture in view and create a value plan that protects the ability to position the portco for exit as soon as market conditions improve. Recognizing the natural tension between long-term strategies of innovation and PE firms' focus on returns, the portco must strike that balance.

How to drive value in tech portcos while navigating extended hold periods

Finding alignment requires PE investors and tech portcos to identify and pull levers that result in significant impact quickly while also maximizing value over longer periods of time regardless of where we are in the economic cycle. Even though there may be strategic opportunities for further M&A and rollups in an environment of lower multiples, our experience also tells us that many levers can be employed immediately to free up resources and enhance value.

What's needed are both a plan and a playbook that help companies take advantage of operational excellence for both top-line and bottom-line growth. That means identifying areas of underperformance that can be fixed swiftly. But it also means understanding a company's current performance compared with that of its peers to establish stretch goals for efficiency and identify exemplary practices in innovation and transformation, such as modernizing digital infrastructure and optimizing cloud usage for performance and innovation as well as cost.

A similar top-line and bottom-line perspective can improve product strategy and R&D. We urge clients to focus on optimizing product profitability and to then use that knowledge to guide R&D resource allocation. Perhaps the most critical question for tech portcos searching for value creation is how to achieve a balance between existing products and innovations. Achieving that balance ensures that resources are aligned against the most-profitable product lines and growth sectors rather than being spent on long-term bets with uncertain returns.

Each of these approaches can be made stronger and done faster thanks to innovations in artificial intelligence. AI can improve automation. It can reveal patterns in customer behavior that can improve pricing, share of wallet, and customer retention. It can help identify supply chain risk and opportunities to cut procurement costs. Through the real-life application of AI tools and enhancements, we've found further productivity gains that lead to further flexibility and allow for further resource reallocation—initiatives that help tech companies become leaner and more efficient without sacrificing growth potential.

By implementing these strategies, PE firms can become confident that they are mitigating the effects of extended hold periods while enhancing the value of their technology portfolio companies as they await improved market conditions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.