On the 14th of May, the European Securities and Markets Authority (the ESMA), published new guidelines on the use of ESG and sustainability-related terms in funds' names (the Guidelines). TheGuidelines – which apply to funds marketed in the EU under a passport - are part of the ESMA's broader attempt to tackle greenwashing and to avoid the misleading of investors. In short, Guidelines require funds with ESG and sustainability-related terms in funds' names to operate a specific investment policy. If a fund manager cannot comply, it either needs to amend the name of the fund or change the investment policy of the fund.

Guidelines

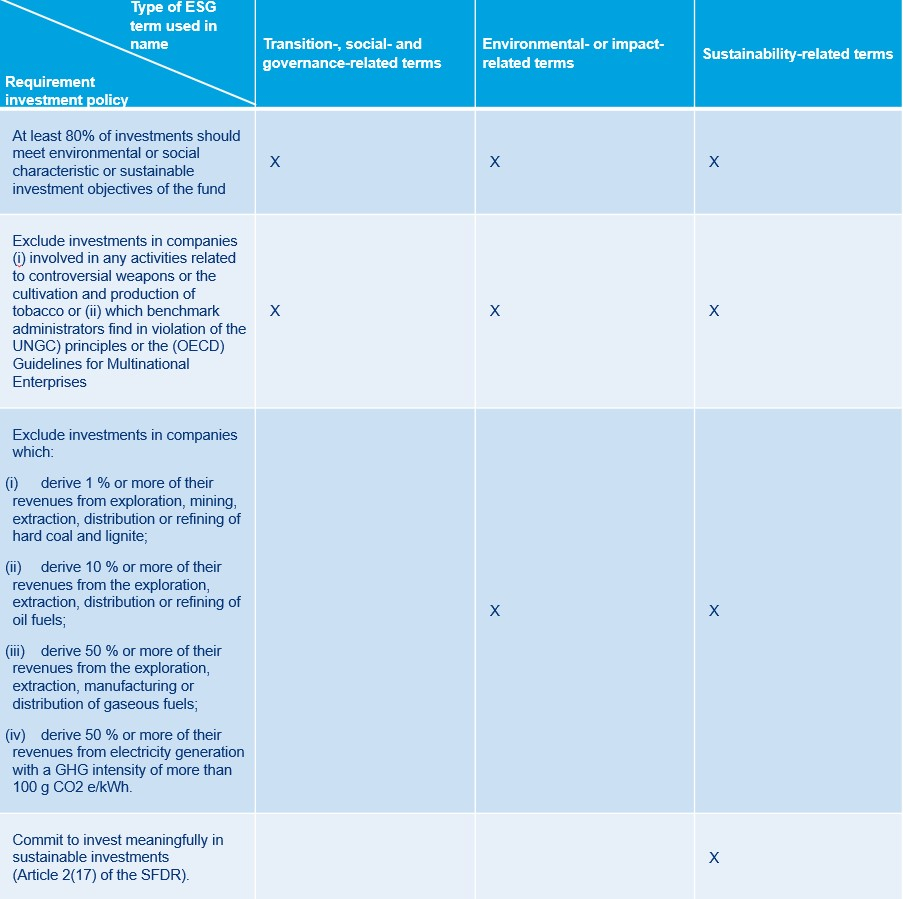

If a fund marketed under an EU passport (such as an AIF marketed by a licensed AIFM or under the EuVECA/EuSEF/ELTIF label, or a UCITS fund) includes ESG or sustainability related terms in its name, it needs to operate an investment policy which complies with certain requirements depending on the type of term used in the fund name, as indicated below:

Next Steps

The Guidelines will become applicable 3 months after the Guidelines are translated into all EU official languages and published on ESMA's website, which is currently still awaited. Managers of any new funds created after such date, are required to comply with the Guidelines immediately. Existing funds shall have a transitional period of 6 months, which gives fund managers of existing funds a total of at least 9 months' to ensure compliance with the requirements laid out in the Guidelines.

To ensure compliance with the Guidelines, fund managers need to make the following assessment: (i) review whether the fund's name includes a "Transition", "Environmental", "Social", "Governance", "Impact" or "Sustainability" – related term (or terms derived therefrom); (ii) if it does, assess if the requirements of the Guidelines are met; and (iii) if they are not met, take steps to ensure compliance with the Guidelines (taking into consideration that this likely requires changes to the fund documentation and the SFDR disclosures). We are happy to assist with this assessment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.