On 14 May 2024, the European Securities and Markets Authority (ESMA) released its final report on the guidelines on funds' names using ESG or sustainability-related terms (the "Guidelines"), which also include a minimum investment threshold and qualifying criteria for different categories of ESG- and sustainability-related terms. The purpose of these Guidelines is to ensure that fund names using ESG- or sustainability-related terms are fair, clear and straightforward.

Background

As part of its efforts to combat greenwashing, in November 2022, the ESMA launched a public consultation on guidelines on funds' names using ESG or sustainability-related terms. The feedback received was used to create the final provisions in the Guidelines, as described below.

Scope

The Guidelines apply to:

- UCITS management companies and UCITS that have not designated a UCITS management company

- Alternative Investment Fund (AIF) Managers and internally managed AIFs, EuVECAs and EuSEFs

- MMF managers

The requirements apply to both open- and closed-ended funds.

Key information and expectations

Categories of terms

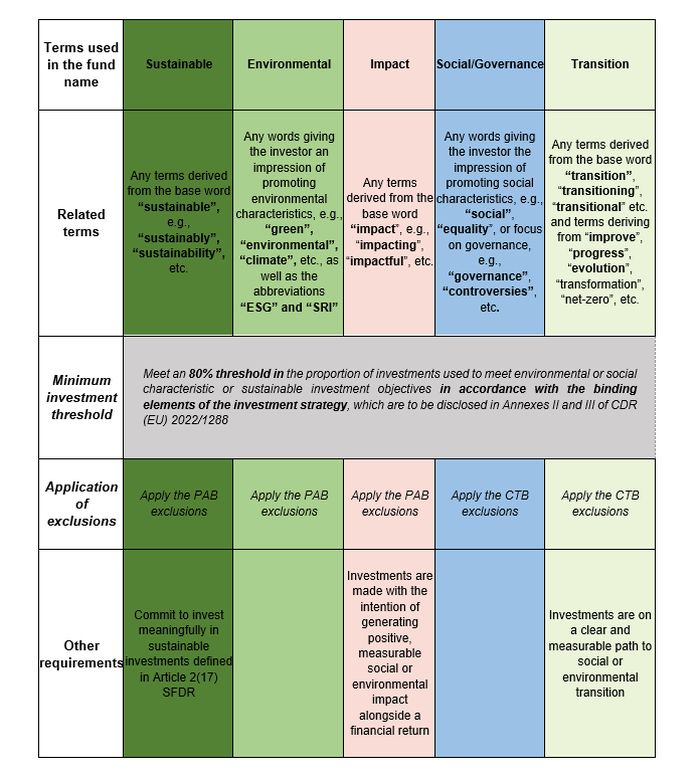

The ESMA distinguishes different categories of ESG- and sustainability-related terms:

- "Environmental"-related terms mean any words giving the investor the impression of promoting environmental characteristics, e.g. "green", "environmental", "climate", etc. These terms may also include the abbreviations "ESG" and "SRI".

- "Sustainability"-related terms mean any terms derived from the base word "sustainable", e.g. "sustainably", "sustainability", etc.

- "Impact"-related terms mean any terms derived from the base word "impact", e.g. "impacting", "impactful", etc.

- "Transition"-related terms encompass any terms derived from the base word "transition", e.g. "transitioning", "transitional" etc. and terms deriving from "improve", "progress", "evolution", "transformation", "net-zero", etc.

- "Social"-related terms mean any words giving the investor an impression of promoting social characteristics, e.g. "social", "equality", etc.

- "Governance"-related terms mean any words giving the investor the impression of a focus on governance, e.g. "governance", "controversies", etc.

Minimum investment threshold

All funds using ESG- or sustainability-related terms should meet an 80% minimum threshold in the proportion of investments used to meet environmental or social characteristics or sustainable investment objectives in accordance with the binding elements of the product investment strategy, as disclosed in the SFDR pre-contractual template (Annexes II and III of CDR (EU) 2022/1288).

Application of exclusions

- Funds using the terms "Sustainable", "Environmental" and "Impact" in their names should apply the Paris-aligned Benchmark (PAB) exclusions contained in Article 12(1)(a) to (g) of CDR (EU) 2020/1818.

- Funds using the terms "Social", "Governance" and "Transition" in their names should apply the Climate Transition Benchmark (CTB) exclusions referred to in Article 1 of CDR (EU) 2020/1818.

Other requirements

In addition to the requirements outlined above, the following categories of ESG-related terms should comply with the below elements:

- Funds using "Sustainable"-related terms should commit to investing meaningfully in sustainable investments referred to in Article 2(17) of the SFDR.

- Funds using the term "Transition" should ensure that investments are on a clear and measurable path to social or environmental transition.

- Fund names with the term "Impact" should ensure that investments are made with the intention of generating positive and measurable social or environmental impact alongside a financial return.

When a fund name combines several ESG-related terms, the Guideline requirements should apply cumulatively with the exception of terms used with "Transition" where only the CTB exclusions apply, as well as the requirement to have a clear and measurable path to social or environmental transition.

Summary of the requirements

Supervisory expectations:

The ESMA expects compliance with the above requirements for the duration of the fund. Any temporary deviation from the minimum investment threshold and exclusionary criteria should be treated as a passive breach and corrected in the best interest of investors, provided that the deviation is not deliberate.

In addition, according to the Guidelines, national competent authorities should investigate, as part of their supervisory duty, the following circumstances:

- Discrepancies in the quantitative threshold which are not passive breaches.

- Insufficient level of investments to be permitted to use "Transition", "ESG", "Impact" or "Sustainability"-related terms.

- Where the use of "transition", "ESG", "impact" or "sustainability"-related terms in the Fund name would result in investors receiving unfair or unclear information or in the manager's failure to act honestly or fairly, thus misleading investors.

Timeline

These Guidelines will apply three months after the date of the publication on the ESMA's website in all official EU languages.

- New funds will need to comply with the Guidelines from the date of the entry in force.

- Existing funds will have a transition period of six months as of the application date of the Guidelines.

At a later stage, the ESMA, together with the other European Supervisory Authorities (ESAs), will also reflect on the need to widen the scope of these Guidelines to other financial products.

How we can help

Stay one step ahead of the game and get in touch with our experts to help you face the challenges arising from the constantly evolving ESG framework.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.