The recently enacted Tax Cuts and Jobs Acts (the "Tax Reform Act") made significant changes to the Internal Revenue Code. Although there was a lot of press coverage about potential changes that could significantly impact employer-provided retirement, welfare, and fringe benefits, the reality is that most of the changes did not make it into the final version of the law and, as a result, tax reform did not make any sweeping changes in this area. Notwithstanding that this was much ado about (almost) nothing, nearly all employers, including public, private, and non-profit, need to know and become familiar with what has changed in the new rules and where the status quo remains the same for employer-provided retirement, welfare, and fringe benefits.

The Tax Reform Act made significant changes to public company executive compensation, which will be covered in an upcoming webinar on January 16 ( register here). The Tax Reform Act also made significant changes for tax-exempt employers and their employees, which will be covered in an upcoming webinar on January 17 ( register here).

Provisions Related to Retirement Plans Effective January 1, 2018

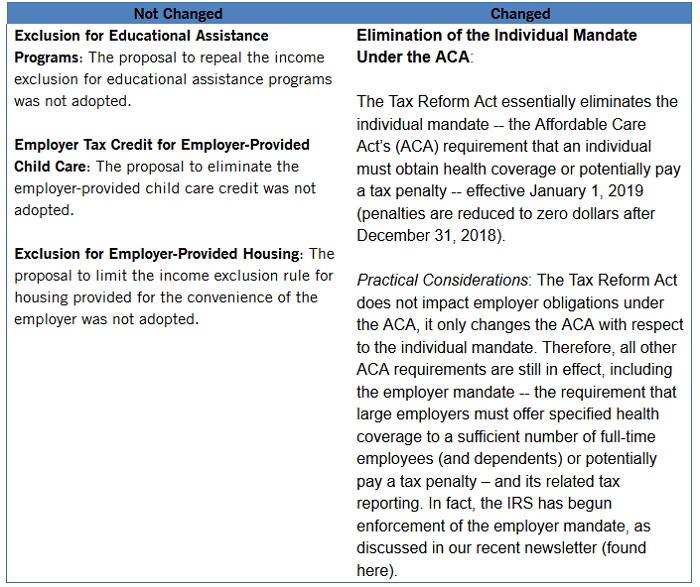

Provisions Related to Health and Welfare Benefits Effective January 1, 2019

Provisions Related to Fringe Benefits Effective January 1, 2018

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.