SECURE 2.0 significantly changed the legal and administrative compliance landscape for retirement plans. Foley recently hosted a webinar where Leigh Riley, Kathleen Bardunias, and Kelsey O'Gorman discussed key provisions of SECURE 2.0 that will impact your 401(k) and pension plans. They provided insights and suggestions for administering your company-sponsored retirement plans in light of these new rules and related best practices. Here are some of the key takeaways from the discussion:

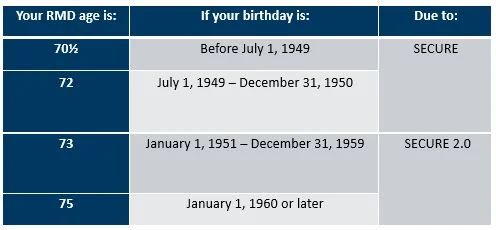

- The original SECURE Act passed in 2019 increased the required

minimum distribution (RMD) age from 70.5 to 72. SECURE 2.0 again

increases the RMD age to 73 or 75 for some participants. New RMD

ages are set forth in the chart below.

- The original SECURE Act added a requirement that part-time employees must be permitted to make elective deferrals starting in 2024 if the employee had 500 hours of service for three consecutive years on or after January 1, 2021. SECURE 2.0 changes the requirement to 500 hours of service for only two consecutive years beginning in 2025 (with service counting for this purpose beginning January 1, 2023).

- SECURE 2.0 added several new optional plan design changes, such as student loan matching contributions and new in-service distribution options, many of which could be added to a plan as early as January 1, 2024, but we are not seeing significant interest in any of these options from plan sponsors, at least for the 2024 plan year.

- Plan amendments for SECURE 2.0 changes are generally due December 31, 2025. However, you may need to amend your plan sooner if (1) the plan terminates, (2) the plan merges into another plan, or (3) your plan vendor requires a formal amendment to implement a design change that you want to be effective before December 31, 2025.

- SECURE 2.0 further expanded the IRS' correction program for retirement plans—the Employee Plans Compliance Resolution System (EPCRS)—including new rules about the recoupment of overpayments from plan participants, expanding the self-correction program, and establishing favorable rules for auto-enroll plans.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.