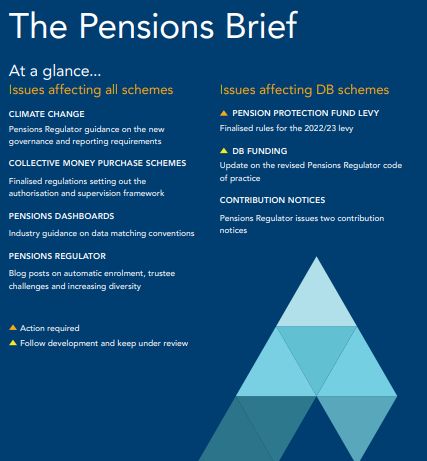

Issues affecting all schemes

Climate change - governance and reporting requirements

The Pensions Regulator has published finalised guidance for trustees on complying with the new climate change-related governance and reporting requirements. The guidance is designed to complement the government's statutory guidance on the requirements. It covers:

- Strategy and scenario analysis.

- Risk management.

- Publishing a climate change report.

In addition, the Regulator has published the finalised appendix to its monetary penalties policy setting out its approach to the penalties that it can impose for breach of the governance and reporting requirements. The Regulator has also responded to its consultation on the draft versions of the guidance and appendix.

The governance and reporting requirements came into force for schemes with £5 billion+ of assets on 1 October 2021 and will come into force for schemes with £1 billion+ of assets on 1 October 2022.

Action

No action required, but trustees of schemes that are subject to the governance and reporting requirements may find the guidance helpful.

Collective money purchase schemes - authorisation and supervision

The government has responded to its consultation on draft regulations setting out the detail of the authorisation and supervision framework for collective money purchase schemes. The framework is similar to the regime that applies to DC master trusts. Schemes will need to satisfy prescribed criteria for authorisation and comply with a range of ongoing obligations once authorised, including submitting annual supervisory returns and notifying the Pensions Regulator of prescribed "triggering" events.

The finalised regulations will come into force on 1 August 2022. To begin with, only single and connected employers will be able to establish collective money purchase schemes. The government will consider how the regime could be extended to include unconnected multi-employer schemes.

The government expects the Regulator to consult on a draft code of practice for collective money purchase schemes in January 2022.

Action

No action required.

Originally published December 2021

To view the full article please click here.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2021. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.