In today's globalised economy, businesses commonly operate in multiple States and engage with international creditors. Consequently, financial difficulties faced by a business often transcend national borders. Hence, insolvency proceedings opened in a State will frequently have cross-border implications.

Several questions arise when a debtor's insolvency has or may have cross-border implications, namely:

- Jurisdiction: which courts will have jurisdiction to open and administer the insolvency proceedings?

- Applicable law: Which law governs the insolvency proceedings?

- Creditors' rights: How can the rights of creditors established in other States be preserved?

- Asset treatment: What happens to assets located abroad?

The European Union has proactively addressed these questions through its Insolvency Regulation1. This Regulation applies to insolvency proceedings (reorganisation and liquidation procedures specified in Annex A of the Regulation) opened in a Member State that may have effects in at least one other Member State.

When the insolvency proceedings are opened in a third-party State or when they are opened in a Member State and have effects in at least one third-party State, the private international law of the concerned States will apply.

In this fifth and last episode, we will briefly outline the rules applicable to insolvency proceedings with cross-border implications within the EU and outside the EU, considering both creditors' and debtors' perspectives.

CROSS-BORDER INSOLVENCY PROCEEDINGS WITHIN THE EU

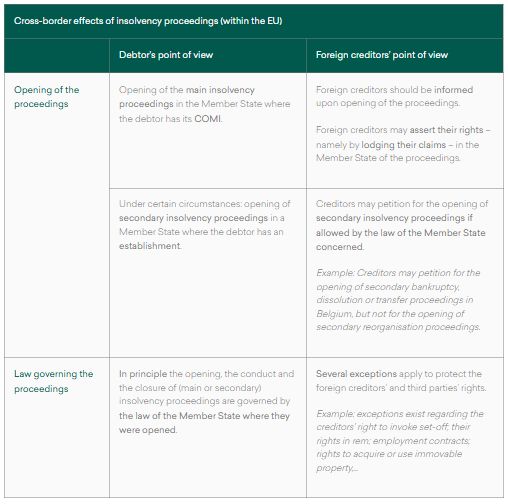

The Insolvency Regulation lays down common principles to address the main issues stemming from a situation of insolvency with cross-border implications within the EU. The Insolvency Regulation's principles are summarised below.

Opening of the insolvency proceedings (jurisdiction)

a. Main insolvency proceedings

The Member State where the debtor's center of main interest ("COMI") is located has jurisdiction for opening the main insolvency proceedings relating to this debtor. A debtor's COMI is the place where it conducts the administration of its interests on a regular basis and which is ascertainable by third parties. The debtor's COMI is presumed to be the place of its registered office (for legal entities) or its principal place of business (for natural persons).

The main insolvency proceedings opened in one Member State receive automatic recognition across all EU Member States. Accordingly, the insolvency practitioner appointed in that Member State will in principle be empowered to exercise his powers throughout the EU, without the need for an enforcement procedure.

b. Secondary insolvency proceedings

If the debtor has one or several establishments in Member States other than where its COMI is located, secondary insolvency proceedings may, under certain conditions, be initiated in each Member State of establishment. The effects of such secondary proceedings only impact assets located within the territory of the Member State where they are opened.

Once such secondary proceedings are opened, the practitioner appointed in the main proceedings no longer has authority over the assets located in that Member State.

The local creditors' right to petition for the opening of secondary insolvency proceedings in their own Member State depends on the insolvency law of that Member State.

Creditors' information and rights

The automatic recognition of insolvency proceedings opened in a EU Member State implies that foreign creditors located within the EU are directly impacted by insolvency proceedings opened in another Member State.

Upon opening of the (main or secondary) insolvency proceedings, the court or the appointed insolvency practitioner must inform all known foreign creditors. Foreign creditors are entitled to assert their rights, namely by lodging claims in accordance with the law of the State in which the proceedings are opened, without having to be represented by a professional. The Insolvency Regulation also establishes a standard form for lodging of claims.

It is relevant to note, in this regard, that under Belgian law, foreign creditors not represented by a lawyer are not compelled to lodge their claims through the Central Solvency Register ("RegSol"). They may either use RegSol or send their declaration of claim by registered mail to the insolvency practitioner. The declaration may be drafted in English.

Applicable law

The applicable insolvency law is that of the Member State where the main insolvency proceedings are opened (lex fori concursus). This law governs the conditions for the opening of the insolvency proceedings, its conduct, and its closure.

For instance, it namely determines:

- Whether and to what extent the insolvent debtor is divested of its powers;

- Which of the debtor's assets are affected by the insolvency proceedings;

- The effects of the insolvency proceedings on ongoing contracts;

- The rules governing the lodging, verification and admission of claims and the distribution of proceeds from the realisation of assets;

- The ranking of claims and the creditors' claims and rights;

- The rules relating to the unenforceability of acts detrimental to the creditors.

In principle, the lex fori concursus also governs actions directly arising from the insolvency proceedings.

However, the Insolvency Regulation provides for several exceptions to these principles, in order to protect foreign creditors' and third parties' rights.

For instance:

- Creditors' right to invoke set-off of their claims against the claims of a debtor" is not affected by the opening of insolvency proceedings, when such set-off is permitted by the law applicable to the insolvent debtor's claim (even if it is not permitted by the lex fori concursus);

- The opening of insolvency proceedings does not affect creditors' or third parties' rights in rem in respect to the debtor's assets located within the territory of another Member State. These rights in rem are governed by the law of the State where the assets concerned are located;

- The effects of the insolvency proceedings on employment contracts are governed by the law applicable to these contracts;

- The effects of insolvency proceedings on contracts conferring the right to acquire or use immovable property are governed by the law of the Member State where this property is located.

Summary

INSOLVENCY PROCEEDINGS OUTSIDE THE EU

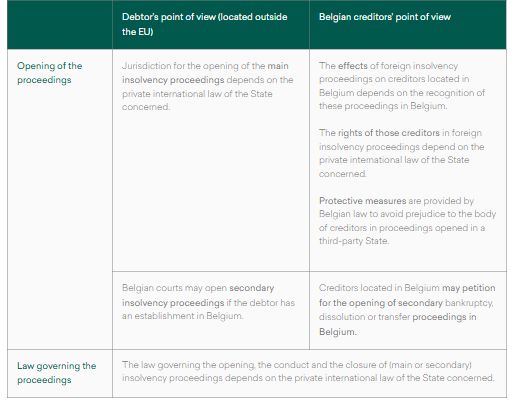

Cross-border insolvency proceedings falling outside the Insolvency Regulation's scope are subject to the private international law of the States concerned.

Following the Brexit, the Insolvency Regulation in particular no longer applies to the United Kingdom. Consequently, the rules of the Belgian Code of Private International Law may apply, especially to insolvency scenarios affecting both Belgium and the United Kingdom.

Opening of the insolvency proceedings (jurisdiction)

a. Main insolvency proceedings

In cross-border situations outside the Insolvency Regulation's scope, Belgian courts have jurisdiction to open insolvency proceedings when the debtor's main establishment or registered office (for legal entities), or its domicile (for natural persons) is located in Belgium.

Insolvency proceedings initiated in third-party States are not automatically recognised and enforceable in Belgium. If recognised, their effects in Belgium will be determined by the lex fori concursus, i.e. the law of the State where these proceedings were opened.

b. Secondary insolvency proceedings

When the Belgian courts lack jurisdiction to open main insolvency proceedings, they may still open secondary insolvency proceedings if the debtor has an establishment in Belgium.

Creditors' information and rights

The effects of foreign insolvency proceedings on creditors located in Belgium may be dependent on whether these insolvency proceedings are recognised in Belgium. The same applies to the effects of insolvency proceedings opened in Belgium on creditors located abroad.

Foreign creditors are, of course, entitled to lodge their claims in insolvency proceedings opened in Belgium. As mentioned above, under Belgian law, foreign creditors not represented by a lawyer are not compelled to lodge their claims through RegSol. They may either use RegSol or send their declaration of claim by registered mail to the insolvency practitioner. The declaration may be drafted in English.

Belgian law also includes some measures protecting the body of creditors in cross-border insolvency proceedings by preventing individual creditors from receiving payments detrimental to the body of creditors:

- When insolvency proceedings are initiated in a third-party State and recognised in Belgium, creditors receiving, after the opening of these proceedings, (partial) indemnification through assets located in Belgium must return the payment they received to the foreign insolvency practitioner, in order for the latter to be able to apply the distribution rules of that State;

- When two concurrent insolvency proceedings are opened, one in Belgium and the other in a third-party State, creditors obtaining (partial) payment of their claim in the foreign insolvency proceedings may only obtain payment in the proceedings opened in Belgium when creditors of the same rank or category have obtained an equivalent payment in the other proceedings.

Applicable law

Belgian law generally applies to insolvency proceedings opened in Belgium and governs the conditions for their opening, their conduct and their closure. The applicable law principles closely resemble those established by the Insolvency Regulation.

Summary

Footnote

1 Regulation (EU) 2015/848 of the European Parliament and of the Council of 20 May 2015 on insolvency proceedings (recast).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.