On 27 March 2024, the Hong Kong Customs and Excise Department made its largest ever gold-smuggling bust — approximately 146kg with an estimated market value of HKD 84 million — at the Hong Kong International Airport. The gold was not smuggled as ingots or jewelry with serial numbers as one might expect, but was disguised as parts for air compressors.1 This raises the question: Can forensic practitioners trace the movement of luxury items, such as physical gold, and how are these valuable items controlled?

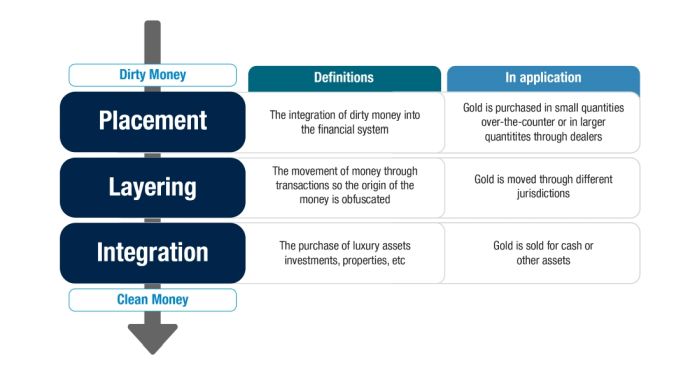

Money laundering is the process of making illegally obtained gains appear "clean," and typically follows a three-stage process — placement, layering and integration. Because of the scrutiny given to bank transactions, criminals may turn to gold or other precious metals when they need to launder money. These valuable and physical items appear to be relatively attractive assets by which to conceal the origins of any illegally obtained money, using this process:

Can we, as forensic investigators, trace the movement of illicit funds through the movement of gold?

The international Financial Action Task Force (FATF) designates dealers in precious metals and precious stones, amongst others, as Designated Non-Financial Business Professionals (DNFBPs) and recommends implementing a risk-based anti-money laundering (AML) approach in these industries. In this light, since 1 April 2023, the Hong Kong Customs and Excise Department has commenced a registration regime for dealers in precious metals and stones, including businesses involved in:

- Trading in (including purchasing and selling), exporting or importing precious metals, precious stones or precious products;

- Manufacturing, refining or carrying out any value-adding work on precious metals, precious stones or precious products;

- Issuing, redeeming or trading in precious-asset-backed-instruments; or

- Acting as an intermediary in any of the above.2

Placement

Essentially, in Hong Kong the use of cash to purchase gold valued above HKD 120,000 in a single transaction or several seemingly linked transactions triggers customer due diligence requirements. The dealer is then obliged to obtain and verify information such as the beneficial owner's identity. Based on the assessed risk, the dealer may also need to understand the customer's source of wealth/funds or other additional information.

On gold bars, generally, details of its owner can be verified through engravings that detail its weight, purity and manufacturer, along with an accompanying certificate of authenticity. If the gold bar is sold by an intermediate dealer and not the manufacturer, the intermediate dealer will be subject to local AML requirements and will likely have records of its customers.

Gold bars can also be embossed with kinegrams or security holograms, which are diffractive optically variable image devices used to prevent counterfeiting, commonly used on banknotes. These security devices provide an additional layer of comfort with regard to the authenticity of a gold bar's declared weight, purity and serial number. This, in turn, provides comfort as to the true identity of the buyer.

Layering and integration

If gold is purchased or sold from or to a non-reputable dealer, or over-the-counter from or to another individual, its subsequent movement may be difficult to track, especially if its serial number, security features and certificate of authenticity have been tampered with. Tracking can be further complicated as large amounts of gold and other precious metals can easily travel between jurisdictions undetected in suitcases or pockets or openly in the form of jewelry.

After moving the gold bars from location to location, criminals may try to liquidate the gold at other dealerships. Reputable dealers will care about the authenticity of the gold, and criminals may find liquidizing gold bars with no serial numbers to be relatively difficult. However, less scrupulous dealers in other countries may take the opportunity to undercut the seller, allowing the criminals to cash out their criminal proceeds as clean money. These third countries may not have effective AML regulations, and less scrupulous dealers will not keep records of their buyers and sellers, making the tracking of asset flows very difficult.

Alternatively, as in the Hong Kong Customs and Excise Department's case, gold can also be easily melted by money launderers and remolded into other items or jewelry to sell. This process necessarily removes the serial numbers, hence hiding the gold's origins, and may allow for easier integration due to the lower absolute value of each item. This jewelry can subsequently be sold to customers directly or to other intermediaries.

Gatekeepers of gold and precious metals

As mentioned above, the FATF and the Hong Kong Customs and Excise Department issue guidelines on how gold dealers, manufacturers and intermediaries should adopt a risk-based approach and implement customer due diligence, ongoing monitoring, screening and staff training processes, as well as file suspicious transaction reports when necessary.

This is not unlike measures that the Hong Kong Monetary Authority requires financial institutions to carry out when dealing with customers. Therefore, as in banking, this puts the emphasis of maintaining a clean industry on its gatekeepers. The attractiveness of gold as both an asset and as a vessel for money laundering not only requires its gatekeepers to remain vigilant, but also protect the market's reputation by understanding its patterns and trends. It is in these stakeholders' interests to engage with the regulators and enforce relevant requirements, to avoid prosecution and pecuniary penalties, to maintain their status as a reputable business, and to prevent criminals from laundering gold.

Footnotes

1. Government of the Hong Kong Special Administrative Region, Press Release, 08 April 2024. https://www.info.gov.hk/gia/general/202404/08/P2024040800425.htm.

2. Government of the Hong Kong Special Administrative Region, Customs and Excise Department, Service and Enforcement Information, 1 April 2023. Supervision of Dealers in Precious Metals and Stones.

Originally Published 2 June 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.