Singapore Tax Treatment of Gains From Sale of Foreign Assets

This article provides an overview of the tax treatment of gains from sale or disposal of foreign assets in Singapore and its implications for multinational corporations and the investment fund industry.

What (is it)

Under the newly enacted Section 10L of the Singapore Income Tax Act (SITA), gains arising from the sale or disposal of foreign assets on or after 1 January 2024 which are received in Singapore by an entity of a relevant group will be taxable in Singapore in certain circumstances. This is a significant shift from the previous regime where capital gains from the sale of foreign assets that are capital in nature were not taxable in Singapore.

Specifically, foreign-sourced disposal gains which are received in Singapore will be subject to tax if an entity does not have adequate economic substance in Singapore or if the gains are from the disposal of a foreign Intellectual Property Right (IPR). Examples of foreign assets include immovable property outside Singapore, equity and debt securities registered in a foreign exchange, intercompany loans where the creditor is resident outside Singapore, and IPRs where the owner is resident outside Singapore.

In the sections below, we will examine the why, where, who and how of this new legislation as well as share the relevant considerations for multinational corporations and funds.

Why (was it introduced)

Section 10L was enacted to align the treatment of gains from the sale of foreign assets to the European Union Code of Conduct Group's guidance, which was updated in December 2022 to address international tax avoidance risks. The change is in line with the Singapore government's focus on anchoring substantive economic activities in Singapore.

Where (does it apply)

The gains on disposal of foreign assets are taxable only upon receipt of gains in Singapore. The gains are regarded as received in Singapore if the gains are:

- remitted to or transmitted or brought into Singapore; or

- applied in or toward satisfaction of any debt incurred in respect of a trade or business carried on in Singapore; or

- applied to the purchase of any movable property which is brought into Singapore.

Who (does it apply to)

Section 10L will apply to entities of relevant groups.

A group is a relevant group if the entities of the group are not all incorporated, registered or established in Singapore; or if any entity of the group has a place of business outside Singapore. The definition of a relevant group means that a group with only Singapore entities and operates only in Singapore will not fall under Section 10L.

The Inland Revenue Authority of Singapore (IRAS) has clarified that foreign entities that are not operating in or from Singapore will not be within the scope of Section 10L even if the income is brought into Singapore.

How (does it work)

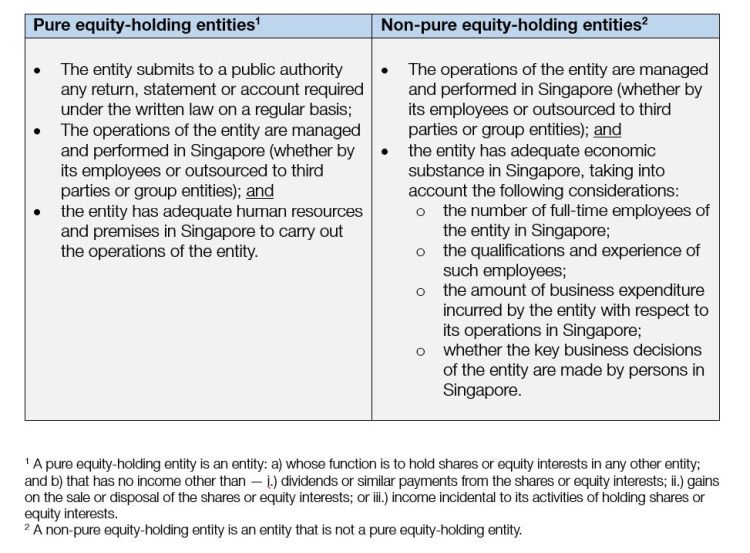

For the analysis of "adequate economic substance," in-scope entities are classified into two groups – pure equity-holding entities and non-pure equity-holding entities. The conditions that must be satisfied to meet the "economic substance" requirement are appended in the table below.

It is worth noting that the above conditions are to be applied in the basis period in which the sale or disposal occurs and not in the basis period in which the disposal gains are remitted into Singapore.

In the event the gains are taxable under Section 10L, it should be noted that the IRAS may adjust the gains to be taxed in Singapore should the sale or disposal be transacted at a price less than the open-market price for the foreign asset.

Our thoughts and planning considerations for multinational corporations and funds

It is important to note that Section 10L starts with "Despite anything in the Act", which means that Section 10L overrides any other provisions under the SITA, including the specific tax exemption provisions such as the safe harbor rule under Section 13W (exemption of gains or profits from disposal of ordinary shares). Having said that, certain incentivized companies are specifically excluded from the scope of Section 10L, e.g., companies incentivized under the Development and Expansion Incentive, the Financial Sector Incentive and the Global Trader Programme.

Funds and family offices should take note that incentives under Sections 13D, 13O and 13U are not specifically excluded from the Section 10L scope; hence, gains arising from disposal of foreign assets under management may now become taxable in Singapore if the fund entities do not have adequate economic substance. The fund industry is likely one of the industries most impacted by this new legislation. Without specific guidance on the application of Section 10L to the fund industry from IRAS, industry players may face multiple challenges, such as: determining the level of monitoring of Singapore-based fund managers granted a discretionary mandate to meet the economic substance requirement, ensuring sufficient documentation of the monitoring mechanism, and putting in place sufficient additional resources to track gains/losses from disposal of foreign assets and accurately report the relevant information in tax returns. Funds should review their existing management structure and ensure that the roles of the investment committees are clearly defined and that robust documentation such as a properly drafted investment management agreement is put in place.

For groups with intercompany loans, covered assets include loans from related companies outside Singapore, which means that any debt forgiveness may potentially result in Section 10L implications. It should be noted that during cleanup of intercompany balances and legal entity rationalization exercises of multinational corporations, Section 10L should be considered.

In analyzing the implications of Section 10L, it is crucial to determine whether an entity has adequate economic substance in Singapore. However, as of now no specific guidance has been provided by the IRAS on the minimum threshold for quantifiable factors such as number of employees and amount of business expenditure in Singapore. In view of the uncertainty in treatment, companies may consider making an application for an advance ruling to the IRAS to obtain certainty on the adequacy of economic substance when a proposed sale or disposal of foreign assets is expected to occur. The advance ruling on the adequacy of economic substance can be valid for up to five years of assessment, including the year of assessment of the proposed sale.

We would be pleased to speak to you if you would like to understand the implications of Section 10L on your business transactions. Feel free to reach out to us.

Originally published June 25, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.