This edition of the Automotive Industry Spotlight will focus on the next four years of planned new model launches for automakers globally and the upstream impact on suppliers.

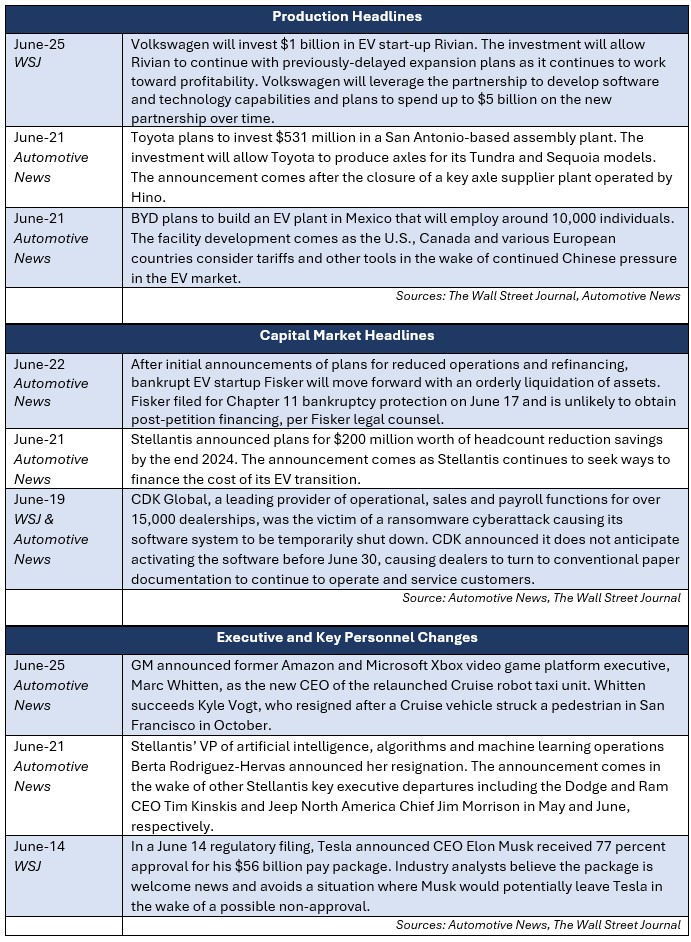

In industry news, a cyberattack on CDK Global affected over 15,000 dealerships utilizing the company's software services, causing significant operational and sale-related delays. Volkswagen announced a $1 billion investment in EV start-up Rivian, with plans for up to $5 billion of spend to develop a software development partnership. EV-manufacturer Fisker filed for Chapter 11 bankruptcy and is heading toward liquidation as the company failed to secure adequate debtor-in-possession financing.

In regulatory news, the Canadian government has taken the first step to align with other U.S. trade allies in assessing tariffs on EVs from China. Ford and Toyota recalled over 500,000 and 145,000 vehicles, respectively. Ford's total recalls this year top 3.6 million vehicles, per the National Highway Traffic Administration (NHTSA).

Industry Focus — Revisiting the Mid-Term Product Pipeline

Tumult in EV demand, public policy and cost profiles this year has had a significant impact on the outlook for new models in the next four years for automakers globally. Significant pullbacks in EV growth have led to unprecedented changes in the roadmap for new models, with Detroit's Big Three specifically pushing out the launches of new EV models.

While strategies between the Big Three have shown significant differences in prior years, there is some 'smoothing' among automakers moving closer toward a comparable industry average for development pipelines for alternative powertrains. While hybrid models have come back into the near-term picture for the Big Three, EV models have been pushed to later years in the pipeline, signaling a hesitancy by automakers to go all-in on EVs until consumer sentiment can match production targets. With this pushback comes further uncertainty down the automotive value chain for suppliers, who have placed significant financial bets on an EV-driven future only to have volume targets pushed out further on the horizon.

Detroit Big Three Strategies Meeting in the 'Industry Middle'

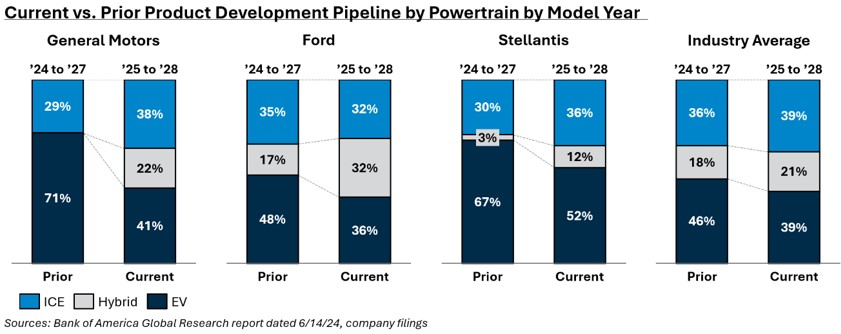

Current new product roadmaps for GM, Ford and Stellantis, covering model years 2025 to 2028, look vastly different than roadmaps for model years 2024 to 2027 this time last year and generally follow more similar tracks [ 1].

While each automaker has made multi-billion-dollar investments into an EV-focused future, near-term focuses have moved back toward relying on internal combustion engine (ICE) vehicles for their demand runways and profitability. Hybrid models have also made an aggressive comeback into new vehicle plans for the Big Three, moving closer toward the global industry average:

Notably, GM's hedge on a majority EV strategy has taken a significant step back. Hybrid versions of the automaker's popular — and hugely profitable — Silverado, Suburban/Tahoe and Yukon will launch by 2028. The company's EV strategy remains focused on delivering both a high number of low-volume models, specifically through the Cadillac brand, and EV models of its high value nameplates.

Consistent across the Big Three is a more balanced model year pipeline that more closely resembles the global industry average. Consistent across nearly all automakers globally is the shift out of mid-term EV development and into ICE as a means of funding longer term EV development.

The EV Horizon Creeps Further Away... but Remains the Stated Long-Term Goal

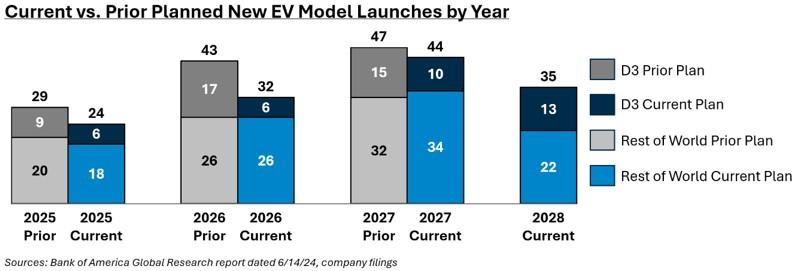

While automakers across the board have re-balanced their plans for new models by power train to give more weight to ICE and hybrid models, new EV models have consistently been either put on hold or pushed into out years of new model year forecasts. On a like-for-like basis, the total number of new EV models that global automakers project to launch for model years 2025 to 2027 has trimmed significantly, with 2026 taking a majority of the hit for both the Big Three and the rest of the world.

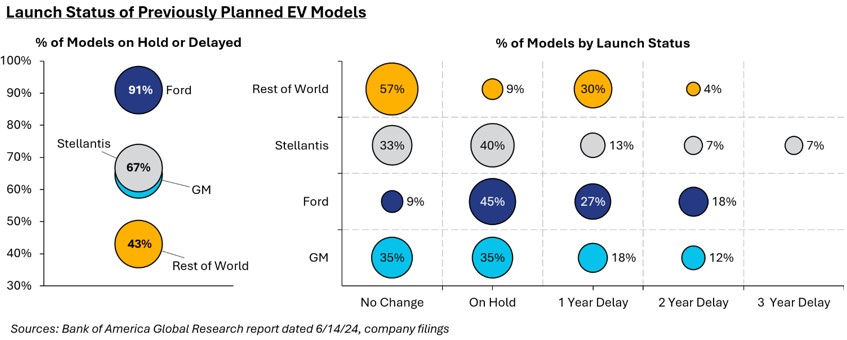

EV model launch delays are tracking closely with automakers' announcements of delays in planned capital investments into EV development. With consumer demand for EVs continuing to slow and a three-year outlook that remains uncertain, a significant portion of models have been placed on hold or pushed out by at least one calendar year.

The Upstream Impact of Uncertain Plans

The effect on suppliers of this magnitude of change in automakers' plans remains unclear, but the significant investments many suppliers, particularly tier 1, have made to support an EV-focused transition will likely see their returns delayed alongside the launch of new EV models.

Suppliers with the closest ties to Detroit's Big Three will be subjected to the most volatility based on the changes made in the last 12 months for new model launches planned — particularly those heavily weighted toward Ford's EV business, which put 91 percent of previously-planned new models on hold or on delay [ 1]. However, the evolving nature of new products with autonomous capabilities and broader software updates presents significant new product opportunities for suppliers as well.

Continued focus by original equipment manufacturers (OEMs) on ICE vehicles and a reinvigorated interest in hybrids should lead to continued profitability support for suppliers who have made considerable investments in supporting dual-track programs despite EV-focused programs being delayed or having their ramp-up periods extended.

Source:

[1]. Bank of America Global Research report dated

6/14/24.

Additional June insights are included below.

Industry Update

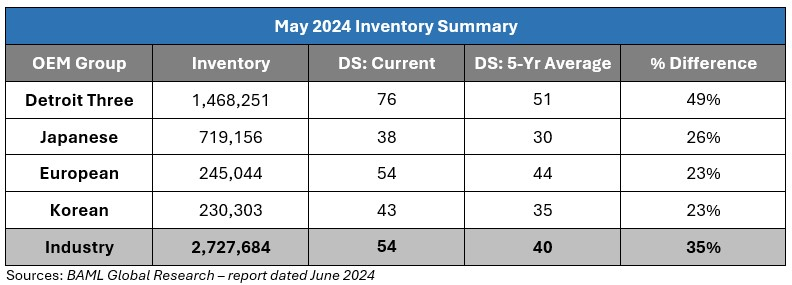

April inventory levels ended at 2.73 million units, an 8,000-unit decrease from April. Days' supply closed at 54, approximately 35 percent above the five-year average. Inventory at Japanese OEMs had the largest decrease, with a 27,000-unit decrease in inventory, partially offset by a 16,000 unit increase by Stellantis, one of the Detroit Big Three.

Regulatory Landscape

Canada aligns with U.S. restrictions on China EV imports: Canadian finance minister Chrystia Freeland announced a consultation period to assess the impact of Chinese EV imports, the first step in administering tariffs on the vehicles. The announcement comes as the Canadian government has received pressure from the Biden Administration, trade allies and Canadian manufacturers to take a harsher stance on Chinese manufacturers.

Ford recalls 500,000 F-150s due to powertrain issues: Ford is recalling over 500,000 2014 Ford F-150s due to an issue that causes the vehicles to unintentionally downshift, causing loss of control for drivers. Per the NHTSA, Ford has generated 30 U.S. recalls affecting over 3.6 million vehicles in 2024 alone1.

Toyota to recall 145,000 2024 Grand Highlanders and Lexus TXs: Toyota announced it will recall 145,000 2024 Grand Highlanders and Lexus TXs due to faulty side curtain airbags 1. The reason for the defect is not currently known, causing a stop sale to be issued on June 20th. The vehicles were manufactured in Princeton, Indiana.

Footnote

1. Automotive News

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.