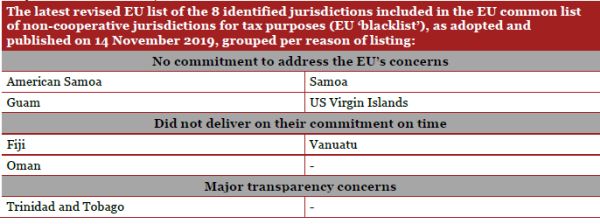

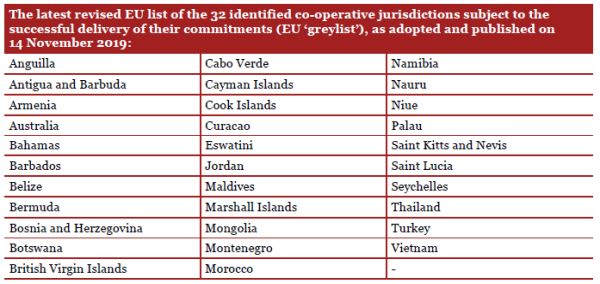

On 14 November 2019 the ECOFIN Council adopted and published a revised EU list of third country 'non-cooperative jurisdictions in tax matters' (commonly ref erred to as the EU ' blacklist') and a revised EU list of third country 'co-operative jurisdictions subject to the successful delivery of their commitments' (commonly referred to as the EU ' greylist').

As a result of the latest revision:

- Belize has been moved from the EU 'blacklist' to the EU 'greylist'.

- North Macedonia has been removed from the EU 'greylist' due to succesfull delivery of its commitments.

The revisions above were preceded by another adoption and publication of a revised EU 'blacklist' and a revised EU 'greylist' by the ECOFIN Council on 17 October 2019. As result of this earlier revision:

- United Arab Emirates are no longer listed due to successful delivery of their commetments.

- Marshall Islands have been moved from the EU 'blacklist' to the EU 'greylist'.

- Albania, Costa Rica, Mauritius, Serbia and Switzerland have been removed from the EU ' greylist' due to succesfull delivery of their commitments.

For background, please refer to our prior Tax Update Newsletters N-17-2017, N-4-2018, N-11-2018, N-19-2018, N-5-2019, N-9-2019, N-11-2019.

For your ease of reference, the latest revised lists (i.e. after the above revisions) are set out below:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.