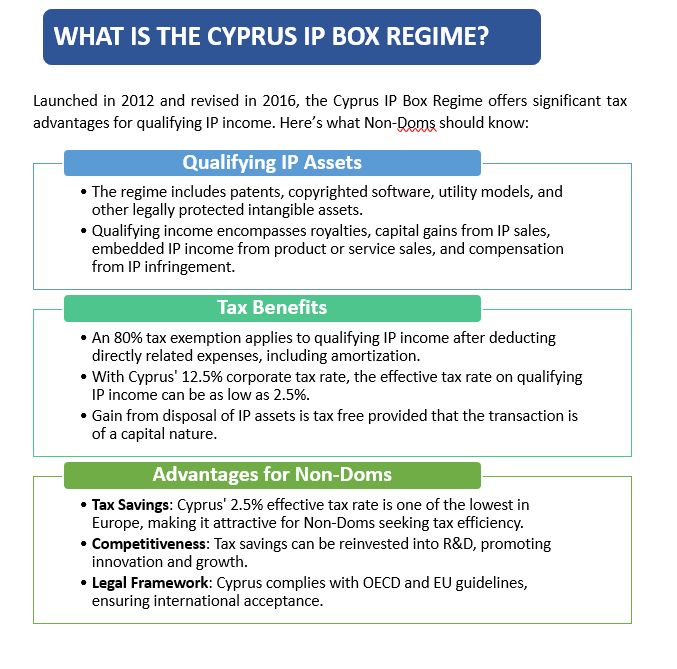

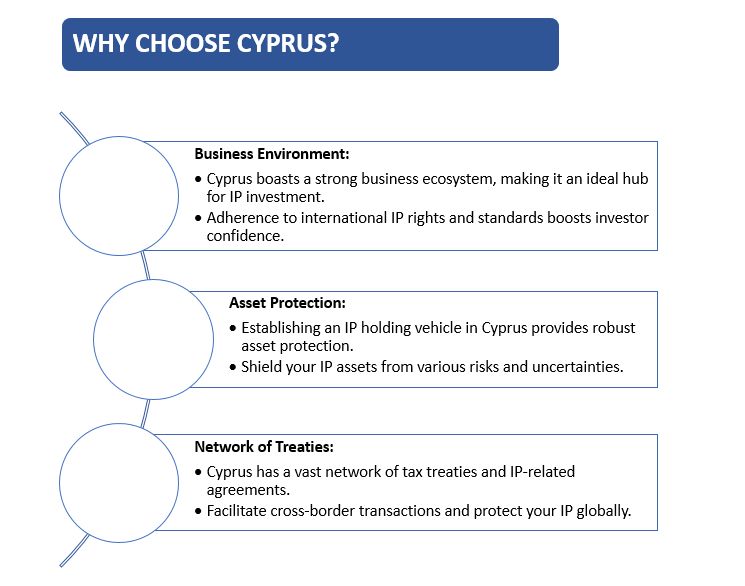

Discover why savvy investors are turning to Cyprus for intellectual property investments amidst the UK's upcoming Non-Dom rule changes with Eurofast tax experts. As the UK prepares to implement new rules affecting Non-Doms in 2025, insightful investors are seeking alternative jurisdictions for their intellectual property (IP) investments. Cyprus stands out as an appealing option with its attractive IP Box Regime, which promotes innovation, safeguards assets, and reduces tax liabilities.

To wind up, as the UK's tax landscape changes, Non-Doms should consider Cyprus as a strategic location for IP investment. The IP Box Regime, coupled with Cyprus' business-friendly environment, legal framework, and tax benefits, makes the island a compelling choice for forward-thinking investors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.