Learn about the requirement for a local Tax Number for foreign residents in Greece, essential for key commercial activities. This article will help you understand the process of appointing a tax representative and their duties, the option to decline this requirement, and how it differs from the VAT Code Tax Representative.

Requirement for a Local Tax Number

Foreign residents in Greece often encounter the necessity of obtaining a local Tax Number, a pivotal requirement for engaging in commercial activity or real estate transactions or purchase of a car or opening of a bank account within the country's jurisdiction.

Appointing of a Tax Representative

Foreign tax residents, either individuals or legal persons/entities, may issue a Greek Tax Number by appointing a tax representative according to art.8 of the Tax Procedure Code. In light of both, the increased investing interest and the ongoing digitalization of the public administration, the Greek government has recently updated the tax representative related legal provisions with the circular Α.1069/03.05.2024.

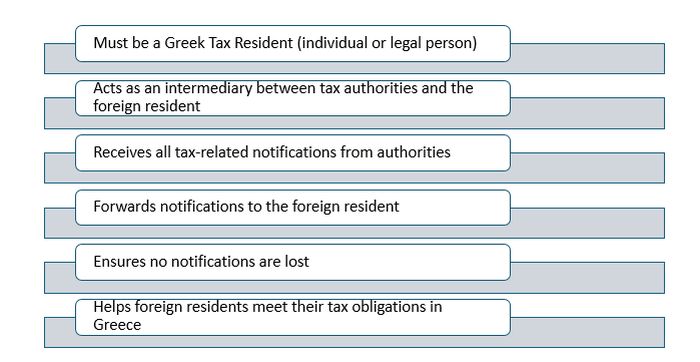

Duties of a Tax Representative

A tax representative shall be Greek Tax Resident (individual or legal person) and acts, as a liaison between the tax authorities and the foreign resident. They receive all the tax related notifications and oversee forwarding them to the individual or entity that they represent. Their role is to ensure that no notification will be lost and that the foreign residents will be supported in fulfilling their obligations towards the Greek state (see the essentials below).

Option to Decline a Tax Representative

According to the same circular, as of 09.09.2024, the foreign tax residents can also make use of their right not to appoint a tax representative. The tax representative prerequisite can be disregarded, if the foreign resident officially declares that they accept the receipt of all notifications directly to their contact details from the Greek tax authorities. However, given that all the related communication (notification, acts and documents) will be in Greek and referring to Greek law and obligations, a foreigner would find this opportunity quite tricky to navigate. In the existing legal framework, the tax representative's role is of high importance.

Distinction from VAT Code Tax Representative

Last but not least, our readers should be informed about that the role of the above Tax Representative differs from the role of the Tax Representative provided for by the VAT Code and no 1113/13 Ministerial Circular which regulates "the Procedure for issuing a VAT number and submitting periodic VAT returns for the payment of tax by taxable persons established in another Member State of the European Union and entails greater responsibilities for the tax representative thereof.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.