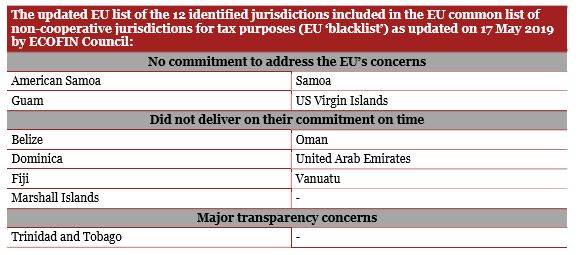

On 17 May 2019, the ECOFIN Council updated the EU list of third country 'non-c0operative jurisdictions in tax matters' (commonly referred to as the EU 'blacklist') and also updated the EU list of third country 'co-operative jurisdictions subject to the successful delivery of their commitments' (commonly referred to as the EU 'greylist').

For background, please refer to our prior Tax Update Newsletters N-17-2017, N-4-2018, N-11-2018, N-19-2018, N-5-2019.

The updated EU 'blacklist' and EU 'greylist' will be effective as from their date of publication in the Official Journal of the European Union.

As a result of the latest update:

- Aruba is no longer listed in either list due to the successful delivery of its commitments.

- Barbados and Bermuda have been moved from the EU 'blacklist' to the EU 'greylist'.

For your ease of reference, the latest revised lists are set out below:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.