Explore the latest amendments in the Bulgarian Corporate Income Tax Act, including the introduction of an additional tax for multinational and large national enterprise groups, effective from January 1, 2024. Learn about the global minimum taxation rules, types of additional taxes, calculation procedures, and the European Directive's influence.

Global Minimum Taxation

The key feature of these amendments is the implementation of a global minimum level of taxation. Here are the details:

- Applicability: The global minimum tax applies to both multinational and large national enterprise groups.

- Turnover Threshold: To fall within the scope of this taxation, a group must have a turnover of at least €750,000,000 according to consolidated financial statements for at least two of the last four tax periods.

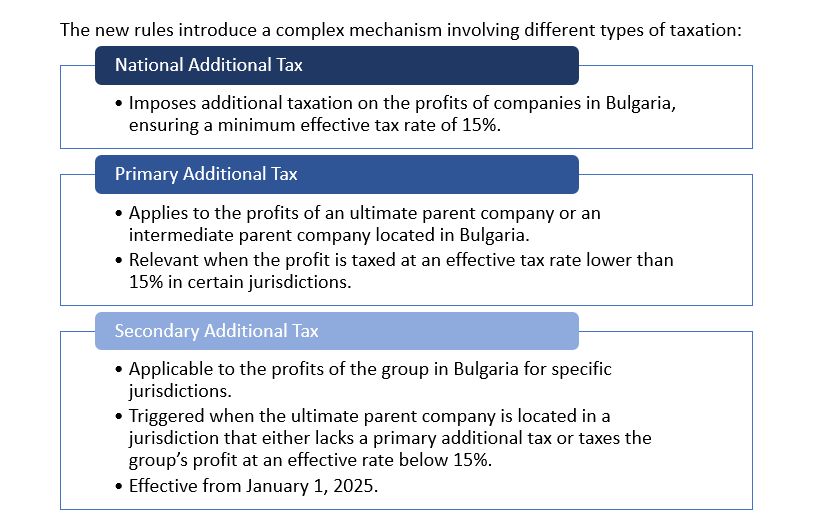

Types of Additional Taxation

Calculation, Declaration, and Payment

- The Corporate Income Tax Act outlines the procedure for calculating, declaring, and paying corporate tax.

- Entities subject to the additional tax must submit an informative declaration for each separate jurisdiction.

- Payment to the National Revenue Agency (NRA) for the national additional tax, primary, and secondary additional tax is due within 15 months after the tax period (18 months for the initial tax period falling under minimum taxation).

Tax Base and Amount

- The amended CITA defines the tax base and payable taxes.

- Calculations involve adjusted included taxes and allowable profit or loss.

- Based on this, the effective tax rate for a specific jurisdiction is determined.

- If the effective rate is below 15%, a corresponding additional tax is levied.

European Directive Influence

These amendments align with the European Directive (EU) 2022/2523, which aims to establish a global minimum level of taxation for multinational enterprise groups and large-scale domestic groups within the Union.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.