I. Individuals

1.1 Personal Income Tax

Residents are subject to tax on their worldwide income. Non-residents are taxed on their Albanian-source income only. Income tax is assessed in the tax year on a current year basis. Individuals who have annual income greater than 1,200,000 ALL have the obligation to file a personal income return form. Also, individuals who have a second job have the obligation to file personal income return form even though their total annual income might not exceed the amount ALL 1,200,000.

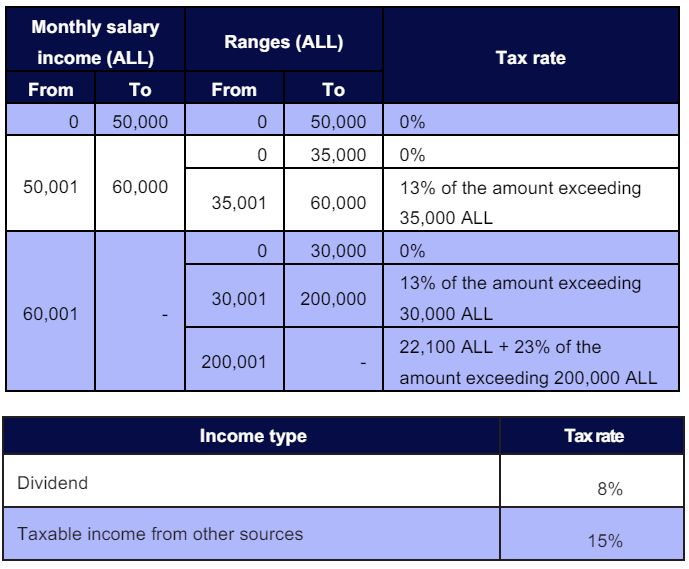

1.1.1 Tax Rates

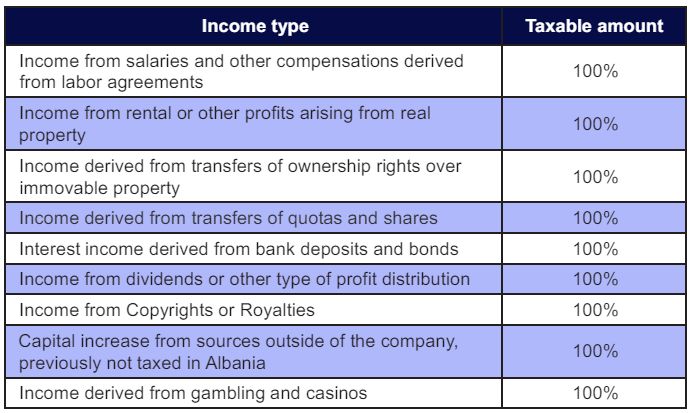

1.1.2 Taxable Incomes

![]()

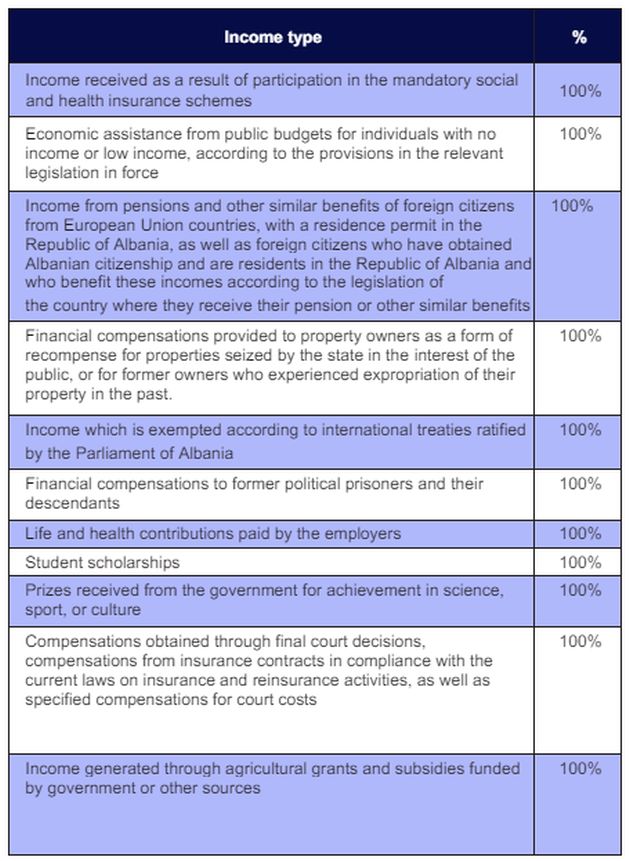

1.1.3 Exempt Income from personal income tax

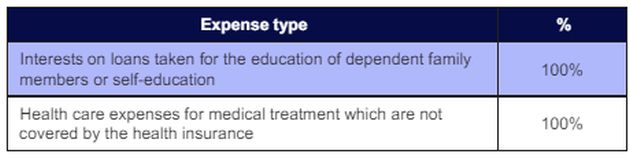

1.1.4 Deductible Expenses

The total of deductible expenses cannot exceed the amount of total taxable income. Deductible expenses are applicable only to resident taxpayers.

1.2 Social Security and Health Insurance Contributions

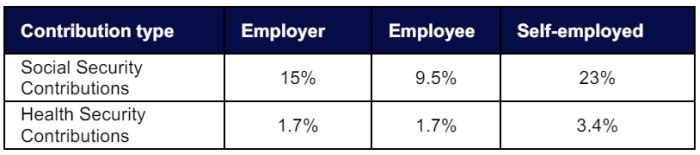

Mandatory social security and health insurance contributions are due on employment, civil and management income. The social security contribution is calculated on a monthly gross salary and ranges from a minimum amount of ALL 40,000 to a maximum amount of ALL 176,416. The health insurance contribution is calculated on a monthly gross salary. Self-employed persons must pay social security contribution calculated on the minimum salary of ALL 40,000 and health insurance contribution on the minimum salary of ALL 80,000. Contribution rates are as follows:

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.