With the gazetting of the Finance (No. 2) Act 2023 on 29.12.2023, capital gains tax ("CGT") was introduced into the Malaysian tax regime. In this alert, we summarise the essential elements and information relating to this new tax.

A. Overview of CGT

- The insertion of Section 4(aa) into the Income Tax Act 1967 ("ITA") created a new class of income upon which tax is chargeable i.e., income in respect of "gains or profits from the disposal of a capital asset" ("Capital Gains").

- "Capital asset" is widely defined under Section 2 of the ITA, i.e., "movable or immovable property including any rights or interests thereof".

- However, paragraph 38(1), Schedule 6 of the ITA exempts gains or profits from the disposal of capital assets situated in Malaysia ("Malaysian Capital Assets") from income tax, except where they arise from:a. The disposal of shares of a company incorporated in Malaysia not listed on the stock exchange ("Unlisted Malaysian shares"); and b. The disposal of shares in a foreign-controlled company deriving value from Malaysian real property ("Shares of Foreign-Controlled Company deriving value from Malaysian Real Property").

- In respect of CGT arising from disposal of Unlisted Malaysian Shares, an exemption has been given pursuant to the Income Tax (Exemption) (No. 7) Order 2023 ("PU (A) 410/2023"). This exemption applies to the disposal of Unlisted Malaysian Shares made between 1.1.2024 to 29.2.2024.

B. Scope of CGT

- Chargeable Persons for CGT.

CGT appears to be chargeable on companies, limited liability partnerships ("LLPs"), trust bodies, and co-operative societies that receive gains or profits from the disposal of capital assets on or after 1.1.2024.

- Capital Assets

As explained above, 'capital asset' is widely defined under the ITA. However, by virtue of the exemption in paragraph 38, Schedule 6 of the ITA, the scope of CGT is restricted to:

a. Disposal of any capital asset situated outside Malaysia ("Foreign Capital Assets") (not limited to only shares), where the gains are received in Malaysia1.

b. Disposal of Unlisted Malaysian Shares.

c. Disposal of Shares of Foreign-Controlled Company deriving value from Malaysian Real Property.

- Deriving Value from Malaysian Real Property

Section 15C of the ITA envisages three scenarios in which a Foreign Company can be said to be deriving value from Malaysian Real Property, thus rendering the disposal of shares in that Foreign Company chargeable to CGT.

a.Scenario 1: Where more than 75% of the value of the Foreign Company's total tangible assets consist of Malaysian Real Property.

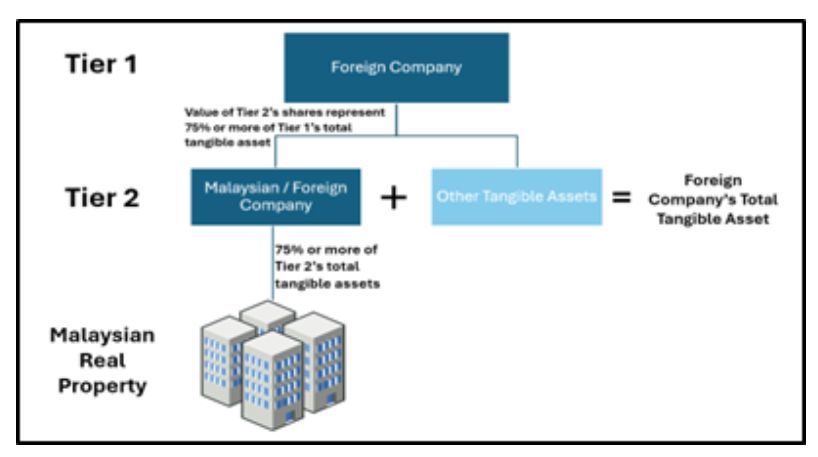

b.Scenario 2: Where there are two layers of ownership (i.e., Foreign Company ("Tier 1 Company") holds shares of another controlled company ("Tier 2 Company"), and the Tier 2 company in turn holds Malaysian Real Property, the disposal of shares in the Tier 1 Company will be subjected to CGT if:

i. More than 75% of the value of the Tier 2 Company's total tangible assets consists of Malaysian Real Property; AND

ii. More than 75% of the value of the Tier 1 Company's total tangible assets consists of shares in the Tier 2 Company.

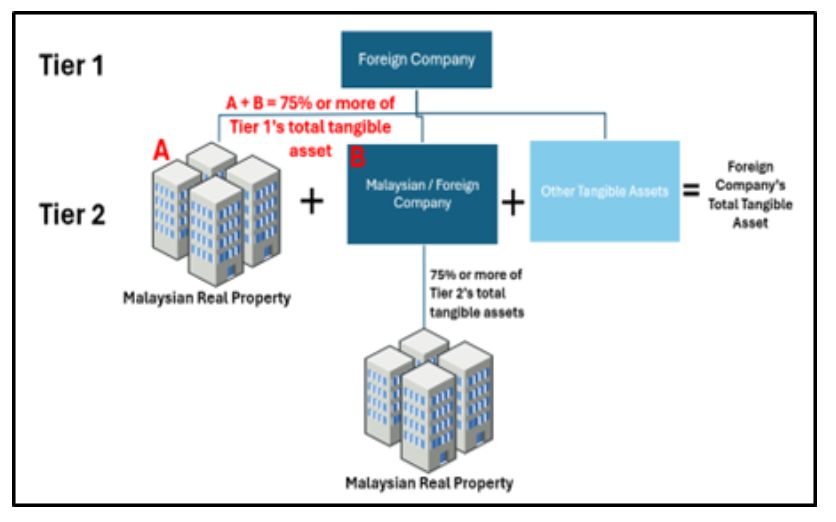

c.Scenario 3: Where Scenario 2 above applies, but in addition, the Tier 1 Company also holds Malaysian Real Property directly, CGT will apply to the disposal of shares in the Tier 1 Company if:

More than 75% of the value of the Tier 1 Company's Total Tangible Assets consists of:

i. The value of Tier 2 Company's shares;AND

ii. Malaysian Real Property held directly by Tier 1 Company.

- Disposal

Disposal has been defined to mean to sell, convey, transfer, assign, settle, or alienate whether by agreement or by force of law and includes a reduction of share capital and purchase by a company of its own shares2.

- Shares

This has been defined to include any and all of the following3:

a. Stock and shares in a company.

b. Loan stock and debentures issued by a company or any other corporate body incorporated in Malaysia.

c. A member's interest in a company not limited by shares, whether or not it has a share capital.

d. Any option or other right in, over, or relating to shares as defined in paragraphs (a) to (c).

C. Effective Date

- Capital Gains from Disposal of Malaysian Capital Assets–3.2024 onwards

By virtue of PU(A) 410/2023, CGT will only be payable on disposals of Unlisted Malaysian Sharesfrom 1.3.2024 onwards. The exemption in PU(A) 410/2023 does not apply to:

(a) Disposal of Shares of Foreign-Controlled Company deriving value from Malaysian Real Property; or

(b) The requirement to file returns by disposers.

- Capital Gains from Disposal of Foreign Capital Assets and Received in Malaysia.

The effective date remainson 1.1.2024.

- >The Inland Revenue Board's ("IRB") Position: Guide Notes for the Capital Gains Tax Return Form (CGTRF) Filing Programme4.

The IRB has stated that the exemption will also apply to the Disposal of Shares of Foreign-Controlled Company deriving value from Malaysian Real Property and the requirement to file returns by disposers in the period between 1.1.2024 till 29.2.2024. It is hoped that this will be legislated in the form of supplementary exemption orders to avoid uncertainty as to the obligations and liabilities of taxpayers.

D. Calculations & CGT Rates

- CGT Rates (a) On disposal of Malaysian Capital Assets

acquiredbefore 1.1.2024. At the option of the

disposer, either: i. 10% of the adjusted income; or

ii. 2% of the gross proceeds of the disposal. (b) Malaysian Capital Assets acquiredafter 1.1.2024– 10% of the adjusted income. (c) Foreign Capital Assets – at theprevailing income tax rateof the disposer (generally at 24% corporate income tax rate if the disposer is a Malaysian company,) - Calculation of capital gains [Adjusted income / loss] (pursuant to Section 65E of the ITA) (a) The gains or profits will be ascertained separately for each disposal of assets and treated as a separate source of gains or profits from the disposal of capital asset for that year of assessment ("YA")5.(b) The adjusted income of a company, LLP, trust body, or co-operative society from a source consisting of gains or profits from the disposal of a capital asset will be calculated as follows6:

| Consideration value for the disposal of the capital asset at the time of disposal. |

Nett Disposal Consideration Value |

|

Minus |

|

| · Expenditure incurred on the capital asset

after its acquisition to enhance or preserve the value of the

capital asset, which is reflected in the state or nature of the

capital asset at the time of disposal.

· Expenditure incurred on the capital asset after its acquisition to establish, preserve, or defend its title or right over the capital asset. · Incidental costs of making the disposal. |

|

|

Minus |

|

| Consideration value for the acquisition of the capital asset together with any incidental costs7. |

Nett Acquisition Consideration Value |

|

Minus |

|

| · Compensation for damage or injury to the

capital asset or for the destruction or dissipation or depreciation

or risk of depreciation to the capital asset.

· Sums received under a policy of insurance for damage or injury to or loss, destruction, or depreciation of the capital asset. · Sums forfeited as a deposit made in connection with an intended transfer of the capital asset. |

|

|

Equals |

|

|

Adjusted Income If the Nett Disposal Consideration Value exceeds the Nett Acquisition Consideration Value. |

OR |

|

Adjusted Loss If the Nett Disposal Consideration Value is less than the Nett Acquisition Consideration Value. |

|

The above calculation would not apply if the disposer has elected to charged 2% of the gross proceeds of the disposal.

(c) Any adjusted loss is allowed to be carried forward and claimed as a deduction to reduce the disposer's adjusted income for subsequent disposals of capital assets8for a period of ten consecutive YAs9.

- >Date of Disposal (& Acquisition10) (pursuant to section 65F ITA) (a) Where no approval is required from the Government or the State Government

|

Is there a Written Agreement? |

||

| Yes |

No |

|

|

Date of Disposal |

Date of Written Agreement. | Date of completion of disposal i.e.,

· Date on which ownership is transferred by the disposer; or · Date on which whole or the consideration in money or money's worth for the transfer has been received by the disposer. |

(b) Where approval is required from the Government or the State Government ("Government Approval")

|

Is the Government Approval Conditional? |

||

|

Yes |

No |

|

|

Date of Disposal |

Date on which the last of the conditions are satisfied. | Date of obtaining the Government Approval. |

- Consideration Deemed at Market Value11

The consideration for the acquisition or disposal of a capital asset shall be deemed to be equal to the market value of the capital asset at the time of the disposal where:

(a) The transaction is not by way a bargain made at arm's length, and in particular where it is acquired or disposed of by way of gift12.

(b) The transaction is made at wholly or partly for a consideration that cannot be valued13.

(c) The acquisition by the acquiror was made as trustee for the creditors of any person in full or part satisfaction of any debt due from that person14.

(d) The disposal was made by the disposer as trustee for the creditors of any person to the creditors in full or part satisfaction of any debt due to the creditors15.

(e) The acquisition or disposal was made in a transaction for the transfer of a business for a lump sum consideration16.

(f) The disposer and the acquirer are "connected persons"17.

(g) Where the capital asset is taken into the trading stock of the company, LLP, trust body, or co-operative society, and there is a deemed disposal of the capital asset on the date the capital asset is taken into the trading stock18.

F. CGT vs RPGT

RPGT will no longer apply on the disposal of real property company shares by companies, LLPs, trust bodies, or co-operative societies19.

F. Filing Requirements for CGT Returns

- For the disposal of Unlisted Malaysian Shares or Shares of Foreign-Controlled Company deriving value from Malaysian Real Property, the disposer must submit an electronic return within 60 days from the disposal of that asset.20

- Taxpayers are required to submit the return form electronically (e-CKM Form) on the MyTax portal.

- Taxpayers are required to maintain sufficient records and documentation for 7 years on the disposal of the capital asset21.

- Taxpayers are not required to submit a separate estimate of tax payable for a year of assessment for gains or profits from the disposal of capital assets falling within the CGT regime22, and there is no requirement to include such gains or profits within the usual tax estimate form.

G. Other Exemptions relating to CGT

- On 16.1.2024, the Finance Minister II announced that the Government had agreed to exempt unit trusts from CGT (and foreign source income)23. from 1.1.2024 to 31.12.2028. It is hoped that this exemption will be legislated soonest to provide clarity and certainty for unit trusts.

- The Government has indicated in the Budget 2024 Speech that it was considering exemptions for share disposals in connection with Initial Public Offerings approved by Bursa Malaysia, internal group restructuring, and venture capital related investments. No further indications had been given as to the status of these proposed exemptions.

- During the National Tax Seminar for Budget 2024 conducted by the IRB, indications were also given that exemptions would be available for foreign-sourced gains on disposal of capital assets which meets economic substance requirements. Similarly, no further guidance has been given on these proposed exemptions.

However, no legislation had yet been passed to afford exemption to the transactions stated above.

H. Labuan Companies

As the amendments made to the ITA to introduce CGT into the tax regime were not inserted into the Labuan Business Activity Tax Act 1990 ("LBATA"), CGT is not imposed on Labuan companies taxed under the LBATA. However, Labuan companies that have elected to be taxed under the ITA will be caught by the introduction of CGT into the ITA.

I. Double Taxation Agreements ("DTAs")

The Malaysian courts have consistently held that double taxation agreements prevail over the ITA by virtue of Section 132 of the ITA. Since CGT is part of the income tax regime under the ITA, that taxpayers should also be afforded protections against double taxations similar to the ones applied in relation to income tax. However, this would depend on the specific terms of the applicable DTAs.

Footnotes

1. See Section 3 ITA which states that "a tax to be known as income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia orreceived in Malaysia from outside Malaysia.".

2. Section 65C ITA

3. Section 65C ITA

4. https://www.hasil.gov.my/en/forms/cgt-return-form-filing-programme/

5. Section 65E(1) ITA

6. Section 65E(2) ITA

7. S.65E(13) ITA: Incidental costs means fees, commission or remuneration paid for the professional services of any valuer, accountant, agent or legal adviser; costs of transfer (including stamp duty), for acquisitions, costs of advertising to find a seller, for disposals, costs of advertising to find a buyer and costs reasonably incurred in making any valuation or in ascertaining market value.

8. Section 65E(5) ITA

9. Section 65E(6) ITA

10. The date of disposal and acquisition is deemed to coincide by virtue of s. 65F(2) of the ITA.

11. See s. 65E(8) ITA and 65F(6) ITA.

12. Section 65E(8)(a) ITA

13. Section 65E(8)(b) ITA

14. Section 65E(8)(c) ITA

15. Section 65E(8)(c) ITA

16. Section 65E(8)(d) ITA

17. Section 65E(8)(e) and Section 65E(9) ITA

18. Section 65F(6) ITA

19. See Section 2 of the Real Property Gains Tax Act 1976 where "gain" is defined to mean "gainother than gain or profit chargeable with or exempted from income taxunder the income tax law".

20. S. 77A (1B) ITA

21. S. 82A(1) ITA

22. S. 107C(11C) ITA

23. https://www.mof.gov.my/portal/en/news/press-citations/govt-agrees-to-exempt-cgt-and-taxes-on-fsi-on-unit-trusts-minister-of-finance-ii

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.