In this article, we explore the landmark decision in Pepsi Inc v Commissioner of Taxation [2023] FCA 1490 and its implications for the characterisation of royalties for multinational enterprises.

Summary

- The Federal Court in Pepsi Inc v Commissioner of Taxation [2023] FCA 1490 found in favour of the Commissioner, holding that 'embedded royalties' arose under exclusive bottling agreements, notwithstanding that they did not expressly provide for payments in respect of the right to use PepsiCo group's intangible assets. Multinational enterprises should therefore re-examine any 'royalty-free' related party arrangements to determine if these reflect the substance of the arrangement.

- The case demonstrates the ability for Australia's diverted profits tax (DPT) anti-avoidance measure to apply as a backstop measure, which if applied would be levied at a rate of 40 percent of the 'tax benefit' i.e., the entire royalty amount (versus the five percent treaty royalty withholding tax (RWT) rate that ultimately applied).

- The Commissioner's victory in the case bolsters the Australian Taxation Office's (ATO) continued activity on intangibles. The recent release of Practical Compliance Guideline PCG 2024/1 relating to the migration of intangibles and the updated draft Taxation Ruling TR 2024/D1 relating to royalties in respect of software and intellectual property rights indicates that the ATO's focus on intangibles is wide-ranging and is not limited to distributors.

Introduction

In a recent landmark decision1, Moshinsky J of the Federal Court of Australia ruled that a portion of payments made under exclusive bottling agreements made by Schweppes Australia Pty Ltd (SAPL), an Australian company owned by Asahi Breweries, was subject to royalty withholding tax (RWT) to the extent that they related to use of PepsiCo group's intangible assets held by its US-based companies. These assets included trademarks, formulas, recipes and know-how essential for producing and marketing Pepsi, Mountain Dew and Gatorade products.

In the alternative, if RWT did not apply, then the diverted profits tax (DPT) could have applied. The DPT is an anti-avoidance measure that applies to significant global entities, designed to prevent the diversion of profits offshore through arrangements involving related parties.

The case has important implications for the characterisation of royalties for multinational enterprises, and is the first time a court has applied the DPT since it first came into effect on 1 July 2017.

Background

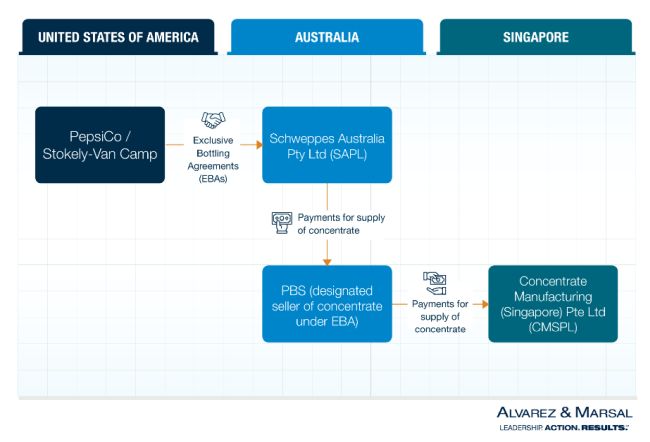

The case revolves around Exclusive Bottling Agreements (EBAs) entered into by PepsiCo, Inc (PepsiCo) as owner of the Pepsi and Mountain Dew brands and Stokely-Van Camp, Inc (SVC) as owner of the Gatorade brand with Schweppes Australia Pty Ltd (SAPL), an Australian company owned by Asahi Breweries, as "Bottler". There was also a separate Concentrate Distribution Agreement (CDA) between an Australian PepsiCo group entity and a Singaporean PepsiCo group entity:

- Under the EBAs, PepsiCo and SVC sold, or procured a related entity to sell, concentrate to SAPL to produce beverages for Australian retail sale. Included in this arrangement were the rights for SAPL to use the trademarks and intellectual property (IP) in Australia. There was no express payment for the IP rights included in the payment for the concentrate and therefore no payments in respect of royalties. Under the EBAs, PepsiCo Beverage Singapore Pty Ltd (PBS), an Australian PepsiCo group entity, was designated as the seller of the concentrate.

- Under the CDA, Concentrate Manufacturing (Singapore) Pte Ltd (CMSPL) a Singaporean member of the PepsiCo group produced concentrate according to a formula provided by PepsiCo and SVC. CMSPL supplied the concentrate to PBS. PBS then supplied concentrate to SAPL. The money received by PBS from SAPL was then passed across to CMSPL less a small margin.

Issues

Royalty withholding tax

The Federal Court held that a portion of the payments made by SAPL to PBS under the EBAs constituted "royalties" for RWT purposes as they represented consideration for the use of or right to use the items set out in the definition of "royalty" in Article 12(4) of the US-Australia double tax agreement (DTA) and subsection 6(1) of the Income Tax Assessment Act 1936 (Cth) (ITAA 1936).

Whilst PBS was not a party to the EBAs, Moshinsky J found that payments made by SAPL to PBS were intrinsically tied to the license of PepsiCo and SVC's trademarks and IP. Hence, without PepsiCo's and SVC's trademarks and IP, SAPL would not have been able to produce and sell the beverages under relevant brands.

Secondly, Moshinsky J found that those royalties were in fact income derived by, and paid to, PepsiCo and SVC for the purposes of paragraphs 128B(2B)(a) and 128B(2B)(b)(i) of the ITAA 1936 and amounts to which they were beneficially entitled for the purposes of Article 12 of the US-Australia DTA. As PBS was nominated as the seller of the concentrate under the EBAs, this was in effect a 'direction to pay' PBS rather than PepsiCo and SVC. As such, the payments made by SAPL were income derived by and paid to PepsiCo and SVC as they were applied as they directed.

Accordingly, PepsiCo and SVC were liable to pay RWT at the rate of five percent on those royalties.

In determining the apportionment of the payments made by SAPL which related to royalties, the judge accepted the Commissioner's expert evidence, adopting a royalty rate of 5.88 percent of SAPL's net revenue from sales of the relevant products (subject to an adjustment) based on the expert's review of comparable agreements.

Diverted Profits Tax

Moshinsky J held that if the RWT provisions did not apply, the DPT provisions would apply.

The relevant 'tax benefit' was found on the first of the Commissioner's two alternative counterfactuals, that is, in the absence of the relevant scheme, the agreements might reasonably have been expected to encompass all of the property and rights provided by the PepsiCo or SVS and not for concentrate only, with the effect that RWT would have been payable on some portion of the payments.

Moshinsky J concluded that one of the principal purposes of each of PepsiCo or SVC in entering into or carrying out the scheme was to obtain a tax benefit by avoiding Australian RWT and to reduce US tax on income. Particularly relevant to this finding was the disconnect between the form and substance of the EBAs, the form of which provided that the payments made by SAPL were for the concentrate alone, whilst their substance indicated that the payments were in fact made for both the concentrate and the license of the trademarks and IP.

A&M's key takeaways

Although the decision is still being appealed, the case bolsters the ATO's continued focus on intangibles. The ATO's Practical Compliance Guideline PCG 2024/1 in relation to the migration of intangibles follows hot on the heels of this case and, similarly, the updated draft Taxation Ruling TR 2024/D1 on software and intellectual property rights shows just how broad the focus of the ATO is on royalties beyond just distribution agreements.

The finding that a royalty was paid to PepsiCo and SVS under the EBAs is significant as, prima facie, the payments made by SAPL were to an Australian entity (PBS). The case serves as a reminder that the substance of the arrangement will be scrutinised by courts and that careful legal drafting can only go so far.

Disappointingly, there is still limited guidance on how taxpayers should apportion royalties, especially in light of where there are multiple products or services bundled in the relevant payments. This has been a challenge for taxpayers since the Commissioner expressed its concerns on 'embedded royalties' in Taxpayer Alert TA 2018/2. In this case, an expert witness was used to quantify the royalty based on comparable agreements in a benchmarking exercise. This analysis was not particularly helpful as a broad methodology to be applied and is fraught with challenge to implement when dealing with hard-to-value intangibles, such as was the case here.

Whilst the PepsiCo case is seen as the first DPT case in Australia, there was not much that was addressed or analysed specifically in relation to the 'principal purpose test' in the DPT versus the 'dominant purpose test' in the general anti-avoidance provision in Part IVA to give meaningful guidance to taxpayers. However, the case serves as a warning that courts are not unwilling to apply the DPT, which would have in effect resulted in a 40 percent tax rate (versus the five percent RWT rate that was ultimately applied).

The key takeaways are that multinational enterprises operating in Australia should review their arrangements in both form and substance and will need to have regard to the DPT. Transfer pricing is also an important consideration and should be appropriately documented.

Footnote

1. Pepsi Inc v Commissioner of Taxation [2023] FCA 1490

Originally published by 02 April, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.