Climate as a financial risk factor to an organization has dominated the recent marketplace discussion of environmental, social and governance (ESG) topics. At its core, ESG is an enterprise-wide financial value proposition whose focus has been accelerated by institutional investors; voluntary standard setters like Sustainability Accounting Standards Board (SASB), GRI (formerly, Global Reporting Initiative) and Task Force for Climate-Related Disclosures (TCFD); and international and domestic regulators. With voluntary disclosure, the consistent theme in the ESG space has been the lack of consistent, comparable and reliable information across the spectrum of ESG topics - from climate to human capital - to assess an organization's management of ESG risks and opportunities.

Staying true to the Biden administration's focus on climate as a threat to U.S. financial stability, on March 21, 2022, the SEC took the first step toward a sea change in its approach to climate disclosures when it described its proposed amendments, "The Enhancement and Standardization of Climate-Related Disclosures" (Proposed Rule), to Regulations S-K and S-X in an open meeting. Paying heed to the institutional investor community at large and its consistent calls for disclosure on how organizations are assessing, strategizing, and managing climate-related risks to their business, the SEC seeks to make climate a material issue for all public companies - both domestic and foreign - to provide comprehensive disclosures of these risks in their annual reports filed with the SEC.

The Proposed Rule defines "climate-related risks" as "the actual or potential negative impacts of climate-related conditions and events on a registrant's consolidated financial statements, business operations, or value chains, as a whole." Discussed in more detail below, the most significant element of the disclosures is a new materiality standard with respect to disclosing Scope 1 and 2 emissions. All organizations will have to provide their Scope 1 and 2 emissions, with eventual assurances required for certain organizations.

Historically, the SEC has taken a principles based approach to disclosure—giving discretion to issuers in determining what is material to their business when shaping their SEC disclosures, specifically, in the annual report on Form 10-K and the proxy statements. But, with the unrelenting and growing focus on ESG matters in the past few years, climate change has taken center stage.

If finalized as expected this year, large accelerated filers will need to be prepared to make the Scope 1 and 2 emissions disclosures beginning with the 2023 Form 10-K filed in 2024 (assuming a calendar year fiscal year). Compliance with the Scope 3 emissions disclosures would be required the following year. Whereas many organizations, led by the technology sector, have been disclosing some or all of the data that would be required by the Proposed Rule for some time, other organizations may be left scrambling to meet their disclosure obligations. Organizations that will potentially be most disrupted are likely those that have not identified climate as a material risk to their business strategies, created the internal infrastructure to manage the risk and opportunity, or assessed the necessary internal and external expertise to evaluate the data necessary to meet disclosure requirements and developed the internal reporting on climate change.

The Proposed Rule

The SEC reporting framework follows a structure of both qualitative and quantitative disclosures and draws upon the TCFD and GHG Protocols. They are intended to provide issuers with a consistent and standardized disclosure structure with the expectation to:

- give investors the opportunity to make informed decisions as to investment strategies that consider the associated climate-related risks on those investments;

- further empower stakeholders to hold organizations accountable for their potential contributions to climate change, and in some circumstances force organizations to cease or change business practices that may have a negative impact on the environment; and

- allow investors and issuers to compare established metrics against other organizations across a broad platform to evaluate both risks and progress.

Whether the objectives will be met remains to be seen and is a subject of ongoing debate.

Scope 1 and 2 Emissions Disclosure. . . . and maybe Scope 3

The Proposed Rule requires that the organization disclose the direct impact of its operations on climate change through data reflecting its own greenhouse gas emissions, and also data on how much energy the organization itself consumes (e.g., electricity and vehicle use) for the last completed fiscal year. These disclosures are referred to as "Scope 1" and "Scope 2" emissions, respectively. The methodology, significant impacts and significant assumptions in calculating these emissions will also need to be described.

The prescriptive nature of this disclosure dictates that climate is a material risk factor to any organization regardless of any determination of materiality by senior management. As noted below, attestation by independent parties is required with limited assurances building to reasonable assurances for Scope 1 and 2 emissions.

Disclosure of "Scope 3" emissions is left to the organization to determine based on whether the organization believes that the disclosure would be an important factor to investors, and therefore "material," or if the Scope 3 emissions are included in an emissions reduction target or goal. Scope 3 emissions are the emissions generated within the organization's value chain (both upstream and downstream) and includes suppliers and customers, business travel and company leases. The SEC has proposed that only the largest filers are subject to the more burdensome and complicated "Scope 3" analysis and exempts smaller reporting companies.

Citing consistency with the GHG Protocol approach and to "provide the full magnitude of climate-related risk", aggregate emissions disclosures must exclude use of any purchased or generated offsets.

While Scope 1 and 2 emissions are defined as relating to operations within the control of the registrant, Scope 3 emissions requires significant reliance on the availability and accuracy of data from third parties. A holistic understanding of an organization's carbon footprint would necessarily need to include Scope 3, and therefore, disclosure would be appropriate on its face. But, an organization's value chain - particularly past tier 1 - can span many jurisdictions, including those jurisdictions without any substantial environmental regulations or guardrails.

In other ESG due diligence contexts, such as assessing the impacts of company operations on human rights, the ability to know - with confidence and accuracy - is initially dependent on how well an organization can trace its supply chain beyond tier 1. Inclusion of this data in an SEC filing with such a heightened risk of liability can be concerning for many organizations, and can be particularly acute in certain industries, like manufacturing. By omitting any requirement for verification or assurance over Scope 3 emissions and providing a safe harbor unless the Scope 3 disclosure is a "Fraudulent Statement" that is "made without a reasonable basis or not in good faith," the SEC appears to acknowledge that the Scope 3 data carries an inherent sense of uncertainty.

The Proposed Rule provides a definition for a "fraudulent statement" that is substantially consistent with the anti-fraud provisions under Sections 11 and 12 of the Securities Act and Section 10(b) and 18 of the Exchange Act.

The SEC is also not blind to other potential concerns that may be raised. In her statement, Commissioner Allison Lee raised a number of questions surrounding Scope 3 in an effort to solicit comments. These questions were:

- Whether the release contains sufficient specificity regarding how companies should undertake their analysis and whether companies should be required to provide the basis for any determination that their Scope 3 emissions are not material.

- Whether it would be more prudent to phase in an assurance requirement over time for Scope 3 emissions disclosures.

- Whether the safe harbor from liability for statements within an SEC filing be conditioned upon the use of specific methodologies such as the Partnership for Carbon Accounting Financials (PCAF) Standard if the registrant is a financial institution and the GHG Protocol Scope 3 Accounting and Reporting Standard for other registrants.

Other Qualitative Disclosures

Although Scope 1 and 2, and for some filers Scope 3, disclosures are mandatory, there are other qualitative disclosures that may be required if material. A non-exhaustive list of other specific disclosures include:

- A description of the oversight and governance of climate-related risks by the organization's board and management;

- Identification of any climate-related risks that have had or are likely to have a material impact on an organization's business and consolidated financial statements, over the short-, medium and the long-term;

- Identification of how any climate-related risks have affected, or are likely to affect the organization's strategy, business model and outlook;

- The role of carbon offsets or renewable energy credits or certificates in any strategy;

- Any transition plan adopted by the organization as part of any climate-related risk management strategy, and a description of any relevant metrics and targets used to identify and manage any physical and transition risks; and

- Any publicly announced climate-related targets or goals.

On this last item, disclosure would include the scope of the activities and emissions that are included in the goal (along with any interim goals), and the timeline by which the goal is to be achieved. In addition, disclosure needs to address the process by which each goal will be accomplished, associated updates as to progress made towards reaching the goals; and certain information about the use of carbon offsets or renewable energy certificates, including the amount of carbon reduction represented by the offsets, if they are used to reach the goals.

Implementation Schedule

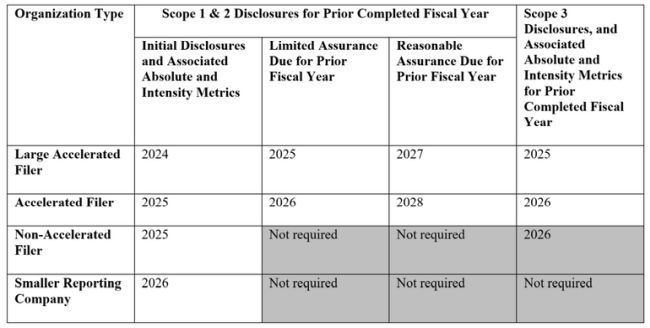

As noted above, assuming the Proposed Rule is approved by December 31, 2022, the first Proposed Rule disclosures will be required in filings made as early as 2024 for the 2023 fiscal year (assuming the calendar year), as set forth in the following table.

The comment period for the Proposed Rule ends on the later of (i) 30 days from publication in the Federal Register, or (ii) May 20, 2022.

Takeaways and Looking Forward

- Climate is Material for All - An ESG strategy must be tailored to an organization's purpose, mission and values taking into account a variety of stakeholders' perspectives. Naturally, some stakeholders' views will be stronger than others, but the strategy should be one that the organization - between the board of directors and management - determine is appropriate for its business and the long-term performance. While climate is viewed as a topic that cuts across all industries in some way, the disclosure rules dictate its materiality for an organization. As a result, organizations will necessarily need to prioritize climate as both a board and management topic and, to the extent necessary, accelerate any focus and efforts on creating the internal controls, processes and organization needed to support compliance with the Proposed Rule.

- Benchmarking - Reporting on ESG topics is a delicate balance between meeting the expectations of stakeholders and management's view of what is material to the business. ESG reporting also risks being a check the box exercise. The Proposed Rule dictates the disclosure of emissions. It necessarily begs the question of how this information will be used to truly assess financial risk and to assess its impact on mitigating climate risks in the absence of benchmarking. In some respects, it is analogous to the request for EEO-1 data by institutional investors. The request is rooted in having comparable and consistent information, yet the data itself doesn't always represent the full diversity of the organization. In addition, the data on its own is not reflective of an organization's progress.

- Expected Legal Challenges - Legal challenges to the Scope 3 emissions disclosures are expected on the grounds that the SEC may have exceeded its authority. We will have to stay tuned on this one.

- Climate Metrics in Incentive Compensation Plans - There is an increased focus by investors and the raters and rankers (e.g., MSCI) on whether organizations are using incentive plans as a way to advance progress on achievement of any ESG related goals. Climate and other environmental goals are appealing metrics in ESG plans given that they can, seemingly, be measured in a quantitative manner. For organizations that look at the disclosure framework proposed by the SEC as a roadmap for developing or refining a climate strategy, we expect that incentive plans as a vehicle to advance the strategy will be increasingly utilized to demonstrate progress.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.