The results of the Bureau of Ocean Energy Management's (BOEM's) recent auction of the Gulf of Mexico (Gulf) lease areas sharply depart from recent auctions and may signal uncertainty about current prospects for offshore wind in the Gulf. When compared to BOEM's 2022 auction for the New York Bight lease areas, the Gulf auction fell flat. Looking ahead to other markets, BOEM has achieved significant milestones in its evaluation of offshore wind opportunities off the coasts of Oregon and the mid-Atlantic states of Delaware, Maryland, and Virginia. Auctions for these lease areas are anticipated in to be held by August of 2024, respectively, and are likely to produce lease prices that reflect neither of these extremes for reasons discussed in this Client Alert.

GULF OF MEXICO

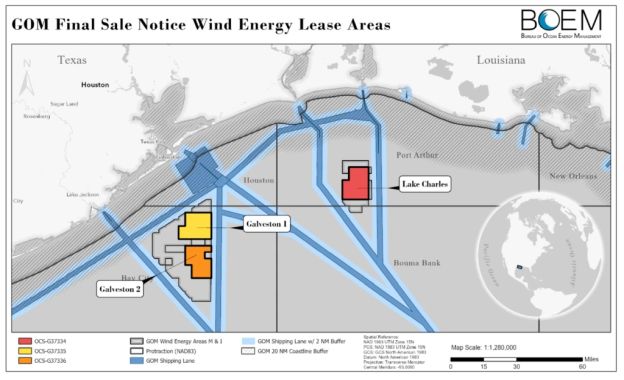

On 29 August 2023, BOEM held the first ever auction for three wind energy lease areas in federal waters of the Gulf of Mexico. The lease areas, totaling 301,746 acres, are located approximately 30 to 40 miles off the coast of Texas and Louisiana.

Source: Bureau of Ocean Energy Management

Although BOEM qualified 15 bidders to participate in the Gulf auction, only two participated. The auction closed after two rounds, lasting about an hour. Neither bidder submitted a bid for the two lease areas off the coast of Galveston, Texas. RWE Offshore US Gulf, LLC (RWE) submitted the winning bid for the 102,480-acre area offshore of Lake Charles, Louisiana.

Like the Carolina Long Bay auction, BOEM utilized a multiple-factor auction format for the Gulf auction. The multiple factor auction format allows a bidder to submit a bid that is a combination of bidding credits and cash. As part of the award, RWE earned bidding credits equal to 20% of its cash bid for committing to supporting workforce training and also developing a domestic offshore wind supply chain that will support investment in workforce training and the domestic supply chain. In addition, RWE earned a credit equal to 10% of its cash bid for contributing to a fisheries compensatory mitigation fund established to mitigate potential damages to fisheries in the Gulf.

RWE will be required to engage with tribes, ocean users, and local communities that may be affected by the offshore wind development on the lease area and related activities, and to submit regular reports to BOEM regarding such engagement.

The strikingly low interest in the Gulf lease areas appears to reflect risk assessments highlighting the lack of certainty surrounding offshore wind in the region. At US $5.6 million, the Louisiana lease area price is about US $55 per acre. The auction results contrast sharply with the New York Bight auction outcome, where prices averaged just shy of US $10,000 per acre. The considerable interest in the New York Bight lease areas reflected the strong support of New York and New Jersey for offshore wind, with those states' development targets of 9 gigawatts (GW) and 7.5 GW (since increased to 11 GW), respectively. Both of those states also had offtake constructs that were established and understood, providing a clear path to market.

In the case of the Gulf auction, only Louisiana has an offshore wind target of 5 GW by 2035. Texas, despite its heavy development of onshore wind and close ties to offshore development economy in the Gulf, has announced no such goals. In the most recent Texas legislative session, bills were proposed to more heavily regulate renewable energy projects and, while these did not pass, they were seen by many as a signal of the sort of support offshore wind projects might receive from the Lone Star State.

Other considerations may have impacted decisions to bid on the Gulf lease areas. It is possible that relatively lower electricity prices in the region could be perceived to lower offtake prices that buyers are willing to pay, thereby elevating economic risk for developers. On the other hand, other siting opportunities are available that could lower interconnection costs. Louisiana has signaled that siting of offshore wind in close-to-shore state waters is an option. The state is currently in talks with two developers for offshore wind in state waters, reducing the necessity for all of its 5 GW goal to come from federal lease areas.

It is likely that the comparatively low cost of the lease may afford RWE additional flexibility as it develops the lease. Leaseholders in the Gulf of Mexico will be able to take advantage of the many advantages that the region does offer including the established vessel support and port infrastructure, existing trained workforce and potential hydrogen project opportunities.

BOEM may plan a second lease auction in the Gulf of Mexico at a future date after reassessing competitive interest in the area. In a statement following the auction, BOEM's spokesperson indicated that BOEM looks forward to holding more offshore wind sales in the future.

OREGON DRAFT WIND ENERGY AREAS

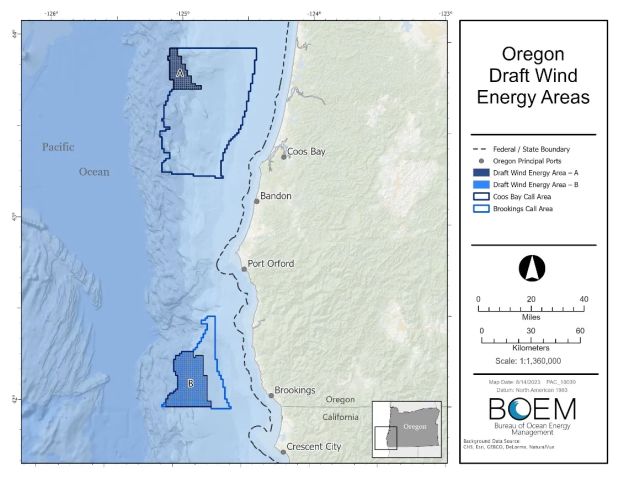

On 15 August 2023, BOEM announced the identification of two draft wind energy areas off the coast of Oregon. The draft wind energy areas are within the Oregon call areas that BOEM identified in early 2022, and would tap up to 2.6 GW of the region's wind energy potential, covering approximately 219,568 acres. The first potential lease area sits 18 miles from shore at Oregon's border with California. The second area lies farther north, 32 miles from the coastline at Coos Bay.

Source: Bureau of Ocean Energy Management

According to BOEM, Oregon has "major opportunities for offshore wind deployment" and the identified areas are an "opportunity to accelerate US leadership in floating technologies" due to the deep waters off the state's coast.1

BOEM has opened a 60-day public review and comment period, and will accept comments on the draft wind energy areas until 16 October 2023.2 BOEM will also hold public meetings and host an Oregon intergovernmental renewable energy task force meeting to outline data and information used to inform the draft wind energy areas and to present next steps in the energy planning process. Public input will be considered before the agency designates one or more final wind energy areas off the coast of Oregon.

Once the designation is made, BOEM will announce for public comment its intent to prepare an environmental assessment in compliance with the National Environmental Policy Act, to consider the potential impacts of wind energy-related leasing, site assessment, and site characterization activities. BOEM will then undertake the environmental assessment, issuing a draft for public comment. Once the environmental assessment is final, and assuming no adverse impacts, one or more lease areas will be designated for auction.

The competitive interest in these call areas will benefit from California's year-old target of 25 GWs of offshore wind energy by 2045, but will be tempered by transmission challenges in the area, an issue that was highlighted ahead of the Humboldt lease area sale in December of 2022. Still, if California is to realize its offshore energy goals, these lease areas and more will be needed. The Pacific Northwest National Labs is in the process of finalizing a transmission study that has examined three scenarios for connecting offshore wind in the region, from a radial model to a multi-terminal networked offshore system. The final study is expected to be released later in September or early October. Like port and supply chain investments, what policy makers ultimately choose to do with such studies will set the stage for the feasibility of large offshore wind in the area.

MID-ATLANTIC FINAL WIND ENERGY AREAS

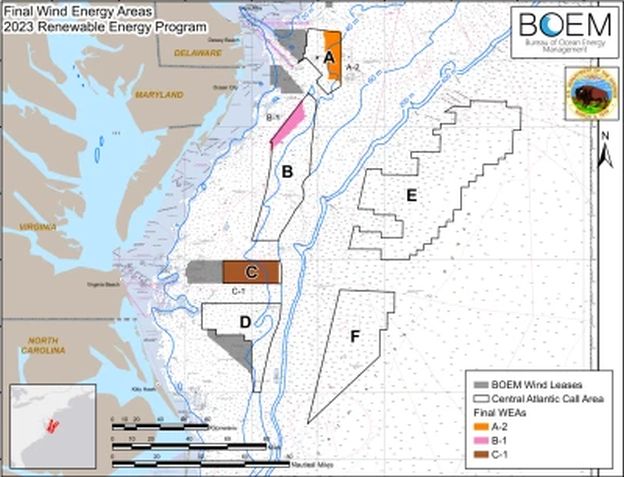

On 31 July 2023, BOEM announced its final selection of three wind energy areas offshore of Delaware, Maryland, and Virginia. The three areas cover approximately 356,550 acres of the 3.9 million acres originally proposed for public comment, and potentially support between 4 GW and 8 GW of energy production.3 The first wind energy area is 101,767 acres and is located 26 nautical miles (nm) from Delaware Bay. The second wind energy area is 78,285 acres and about 23.5 nm offshore Ocean City, Maryland. The third wind energy area is 176,506 acres and located about 35 nm from the mouth of the Chesapeake Bay, offshore Virginia. The three areas were selected from eight draft wind energy areas stretching from the coasts of North Carolina to Delaware.

Source: Bureau of Ocean Energy Management

On 1 August 2023, BOEM published for public comment its notice of intent to prepare an environmental assessment of potential impacts from wind energy-related leasing in the mid-Atlantic wind energy areas.4 The comment period closed on 31 August 2023. As for next steps, BOEM will prepare its draft environmental review and will solicit comments on that draft.

The support of mid-Atlantic states is likely to differentiate these potential future auctions, with Maryland recently passing an 8.5 GW offshore wind target into law. Moreover, while Delaware stands out among its neighbors for not having established an offshore wind GW target, it has signaled support for the resource. Delaware recently enacted legislation that requires the state to study the transmission impacts of offshore wind development, to work with neighboring states and regional grid operator, PJM Interconnection, L.L.C., on the issue, and to further report to the governor and legislature on a process for procuring offshore wind power.

CONCLUSION

BOEM's lease results to-date track the combination of factors that reduce risk and increase certainty for developers. The "policy infrastructure" of clear state procurement goals and clarity around states' offtake regimes seen in the northeastern United States have created the most favorable conditions to-date, although development has been challenged by inflation and increasing costs of borrowing over the past year. But those challenges have resulted in policy modifications from supportive states, such as proposals to include inflation adjustments in future contracts. Even technically challenging wind development opportunities, as seen off the coast of California with its deep water but with the leading state target of 25 GW, has resulted in stronger auction results than were seen in the Gulf. California's goals will likely result in similarly strong market signals for potential leases off of Oregon, especially if identified transmission upgrades move forward. Similarly the mid-Atlantic states have signaled strong state support combined with fixed-bottom wind sites. In contrast, developers are more cautious in areas that may have high technical feasibility but that have not signaled strong support for wind development in federal waters at the level needed to reassure that a path to market will exist.

Footnotes

1 .Press Release, BOEM Identifies Draft Wind Energy Areas Offshore Oregon for Public Review and Comment, (Aug. 15, 2023), available at https://www.boem.gov/newsroom/press-releases/boem-identifies-draft-wind-energy-areas-offshore-oregon-public-review-and (last visited Sept. 1, 2023).

2. BOEM, Oregon Activities, available at https://www.boem.gov/renewable-energy/state-activities/Oregon (last visited Sept. 1, 2023).

3 .Press Release, BOEM Finalizes Wind Energy Areas in the Central Atlantic (July 31, 2023), available at https://www.boem.gov/newsroom/press-releases/boem-finalizes-wind-energy-areas-central-atlantic (last visited Sept. 1, 2023).

4 .Notice of Intent to Prepare an Environmental Assessment for Commercial Wind Lease Issuance and Site Assessment Activities on the Atlantic Outer Continental Shelf Offshore Delaware, Maryland, and Virginia, 88Fed. Reg. 50,170 (Aug. 1, 2023).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.