The annual AlixPartners Disruption Index (ADI) is a barometer of the amount of influence volatile business conditions have on executives, and a litmus test for their ability to respond. The study, now in its fifth year, gathers fresh intel from more than 3,000 senior executives worldwide, delivering both a comprehensive macro story and sector-by-sector findings.

As part of that, the ADI delivers important insights for executives in and connected to the auto industry. The 2024 study finds that while some disruptive forces related to the auto industry have moderated, it's hardly time to take hands off the wheel. The 300 executives surveyed at automakers, suppliers, dealer groups, aftermarket companies, and shared-mobility firms report more disruption overall than peers in many other industries, including the aerospace, consumer products, media, and financial industries.

Importantly, a substantial number of automotive executives expect "significant" disruption in the year ahead.

Planning and prioritization are proven ways to successfully weather disruption, and even to capitalize on it. When it comes to the auto industry, however, there is clearly a lot of work to be done.

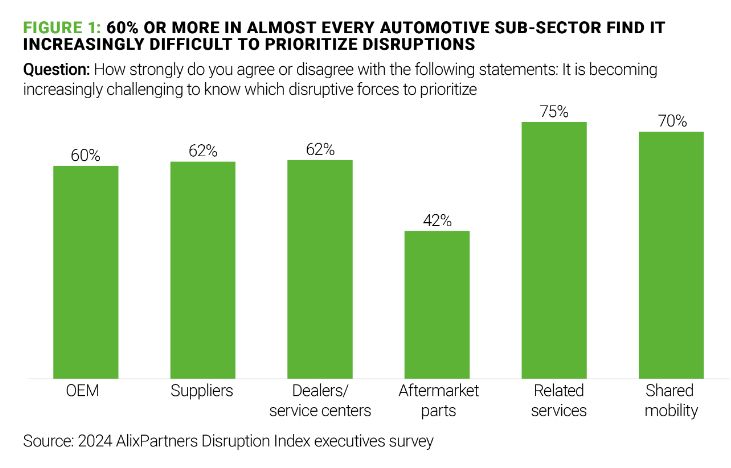

More than 60% of auto executives in all but one sub-sector (aftermarket) say it's increasingly difficult to know which disruptive forces to prioritize (Fig 1). What's causing the confusion?

Response readiness

Levels of concern fluctuate by topic and region of the world. For instance, North America-based executives report greater levels of concern around inflation, interest rates, and aging populations; those in Europe, meanwhile, see protectionism, tariffs, and deglobalization as a bigger threat. China- and Japan-based executives are more alarmed than peers by the threat environmental concerns and regulatory developments pose.

Meanwhile, concerns about job security are present regardless of where the executive is based. A quarter of automotive respondents internationally say they are worried about losing their positions.

This year's ADI also looked at several other issues important to auto executives, including two focus areas that continue to consume an enormous amount of time, resources, and thought:

Supply chain: While no longer hamstrung by chip shortages or pandemic-era shockwaves, supply chain disruption is still present. Nearly four in ten auto executives say this part of the business is actually more challenging than 12 months ago.

This is an evolving challenge, however. When asked what concerns them most when thinking about near-term changes to the supply chain, twice as many executives (41%) cite keeping up with demand than those citing "supply availability."

Seizing tech potential, raising ROI: Europe-and China/Japan-based executives in our new ADI are more bullish than North American counterparts when it comes to software-defined vehicles (SDV), electrification, and autonomous-vehicle technologies. Across the board, executives see a near-term opportunity for their companies on several tech fronts, including SDVs, AI, and automation.

However, tech strides are not yet delivering big returns. While auto executives say they are spending more on these priorities than last year, 86% of them say their ROI on that spending is just 10% or less.

Turning disruption into success

AlixPartners has identified several steps to win in these disruptive times in auto:

Short-term actions

Strengthen your cash position: Maximize cash by tuning up your financial warning systems, and understand costs and revenue at a detailed level to improve reaction time.

Go digital: Reorient your business to become "digital-first," aligning people, processes, tools, and KPIs to support today's consumers and production.

Expect and embrace disruption: Disruption presents unpredictable risks, but also unexpected opportunities. Set up a strategic foundation that includes a high degree of flexibility.

Long-term actions

Strengthen your supply chain:Nearshoring and reshoring can minimize potential disruptions, including those caused by geopolitical issues.

Prioritize operational superiority:Consider basing business plans on EP (economic profit), which considers the full cost of what it takes to get a return.

Reduce and retire debt:This is especially crucial in higher-interest-rate markets.

Look for "smart M&A" opportunities:The auto industry continues to transform and, in the years ahead, will be radically different than it is today. Don't be left behind.

Overall, the auto industry is going through more disruption than it likely has at any period in its more than 100-year existence. From the truly historic transition from internal combustion to electrification (which itself has become a roller coaster of late!) to the promise—and elusiveness—of SDVs and beyond, the industry really hasn't seen anything like what's to come.

The winners will be those who take action now to turn the challenges ahead into opportunities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.