Prepare for cost hikes; Order ahead

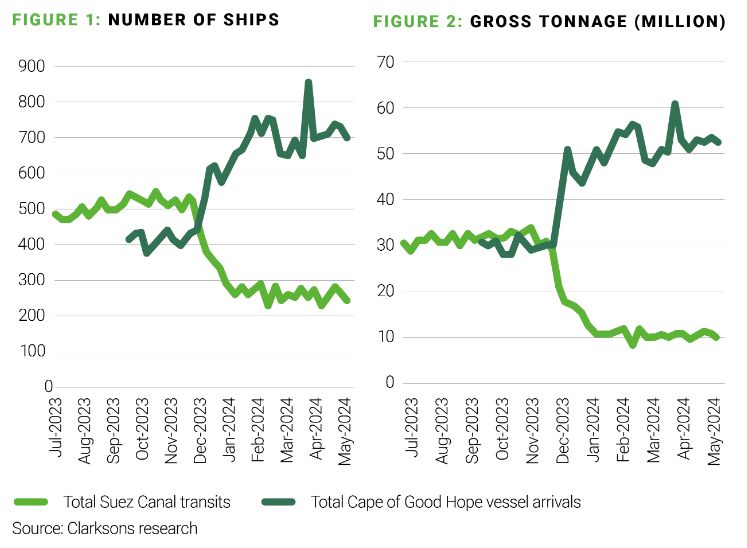

Ship traffic continues to be diverted away from the Suez Canal as geopolitical tension continues to disrupt Red Sea activity, bringing into focus long-term impact of a tense event initially expected to last a short time. With the Suez Canal in turmoil, the Cape of Good Hope remains a viable alternative.

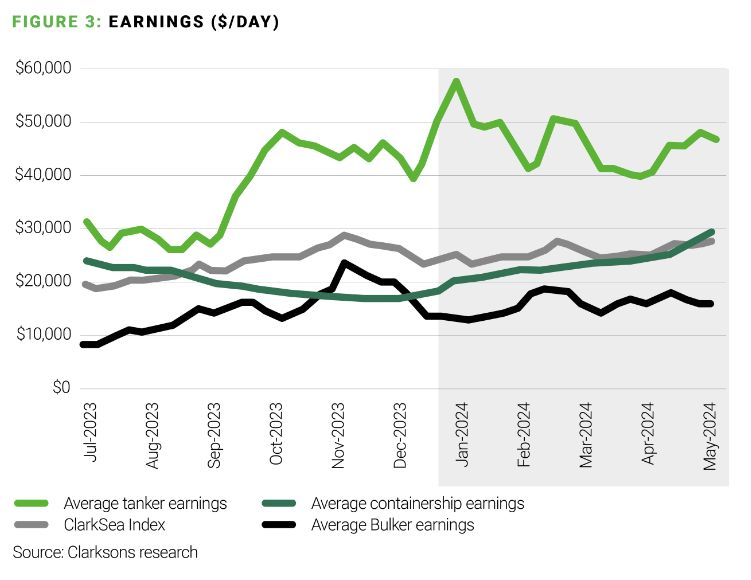

This trend has boosted voyage length and resulted in higher vessel utilization and rates as a trip transiting around the Cape of Good Hope is a longer alternative for many compared to transiting through the Suez Canal. This improved profitability for carriers (providers of service) in the first quarter, but shippers (owners of cargo) should expect choppy seas over the next six months.

Bottlenecks

The operational impact of rerouting vessels has increased. Expect to continue seeing increased bottlenecks in marine transportation. This pressure will also reduce the reliability of the shipping transportation networks, kinking the supply chain.

Insurance

Ships that do transit the Red Sea face the additional burden of significantly increased voyage insurance premiums compared to rates over the same period in 2023. These premiums are likely to remain elevated as long as safety incidents—such as fresh reportsof attacks by Houthi rebels on cargo and container ships continue.

Voyage costs

Those opting to avoid the Red Sea region, meanwhile, aren't insulated from financial pressure. Increased voyage time leads to additional fuel consumption and higher operating costs due to added wear and tear of onboard machinery, usage of spares, and additional costs during the crew sign-on and sign-off process.

Inventory holding costs

Longer vessel sailing times lead to goods sitting on board for longer durations, lifting inventory holding costs and working capital needs during an extended period of elevated interest rates. This primarily affects shippers ordering goods from Asia to be delivered to Europe, which requires approximately two-to-three additional weeks in transit.

Shippers on the Asia bound for North America's West Coast are also expected to be affected. Longer Asia-to-Europe journeys will soak significant amounts of ship capacity, tightening supply for other long-haul lanes and raising rates. Look for the impact to be more apparent as the annual Pacific contracting season wraps up.

More disruption to status quo

The cumulative impact of the above factors could deliver yet another jolt to inflation as costs are passed on to consumers. The supply chain will also be further rattled as risk of delays will jeopardize just-in-time delivery.

We have seen how shipping disruption can affect several key aspects of our daily lives. The pandemic severely distorted market dynamics in the 2020-2022 period and shippers must address the risk of similar delays in 2024. As there is no immediate solution to the Rea Sea shipping disruptions, the impact for shippers is expected to continue at least into 2025. Therefore, shippers must plan ahead for the fourth quarter 2024, (following a strategy employed during the COVID era when ordering earlier for the peak season demand to avoid being stung by items being unavailable when needed most).

While we will not see as significant a repeat of pandemic-related global shortages, businesses and consumers will be on the alert particularly when forced to pay more than initially budgeted during the remainder of the year due to Red Sea shipping disruptions.

Contingency planning

We've recommended four components for every shipper's contingency plan. As the Suez Canal crisis continues, the points are worth revisiting:

- Create systemic alternatives: Routing variants along trade lane corridors should be established within ERP and TMS systems, allowing a quick and seamless switch to viable alternatives amid disruption.

- Establish visibility: Simple, available methods to track international shipments leads to accessible, reliable data for decision making.

- Prioritize freight: Shippers need a system that allows them to seize alternate options without spending time driving alignment among cross-functional stakeholders. In addition, early planning is required on the potential need to maintain additional inventory prior to peak season.

- Build and leverage relationships: Continuing to invest in shipper/carrier relationships could pay dividends if capacity constraints force providers to allocate freight.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.