In the Ankura Healthcare Real Estate Strategy group, we keep tabs on a wide variety of economic indicators to inform our clients' upcoming strategic endeavors. Here are the ones we are watching in 2024 with our projections of where they are headed over the coming months. While oversimplified and multifactorial, we explain why we believe these accurately predict future trends.

Labor: Normalizing to Pre-Pandemic Rates

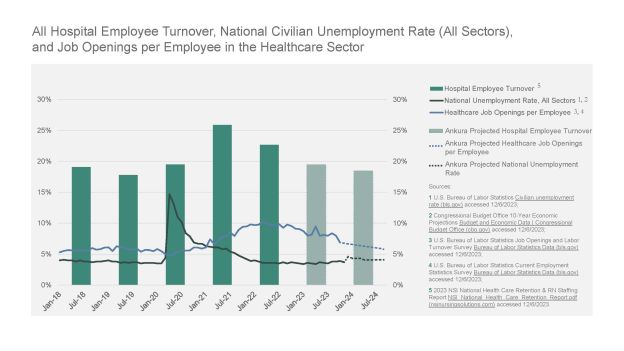

Turnover will return to pre-pandemic rates, but healthcare organizations will continue to need competitive recruitment and retention strategies to maintain adequate staffing.

We project unemployment and turnover will return to pre-pandemic levels based on a cooling labor market, marked by increasing unemployment rates and declining healthcare job openings. This will drive worker retention and reduce voluntary turnover rates among employees.

Unionization: Membership Will Continue To Decline

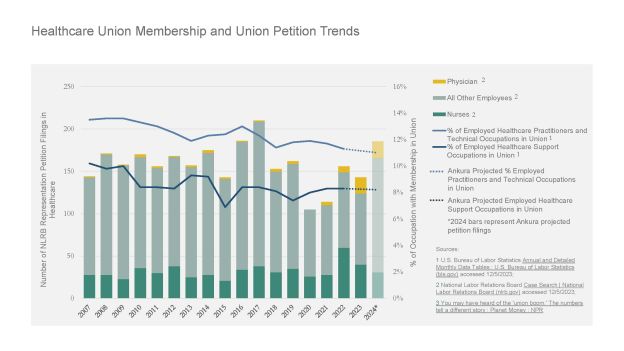

Mirroring national trends, membership in unions will continue a slow but steady decline among healthcare workers. However, the distribution of represented workers will continue to shift, with physician union membership increasing as physician employment continues to rise.

Major barriers to union development, including labor law, globalization, reduction in traditionally unionized industries, and lower participation in social organizations, mean that we project union membership will continue to decline in 2024. Physician union participation will be a notable exception to unionization declines as a growing proportion of physicians transition from independent practice to employment.

Financial Performance: Slow But Steady

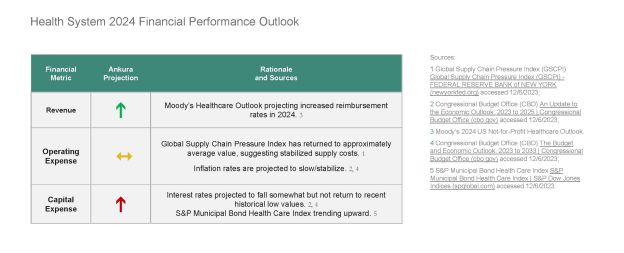

Most hospitals will begin to stabilize financially, with continued risk to smaller hospitals and those that have had less favorable rate negotiations with payers.

Financial Performance: Outlook Revisions Will Begin To Balance Out In 2024 As More Systems Stabilize

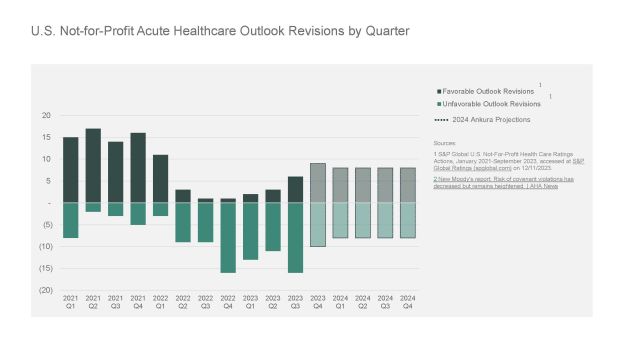

Unfavorable outlook revisions are far outpacing favorable outlook revisions in 2023, reflecting continued cost pressures and weakening balance sheets. These trends are also mirrored in the rate of credit downgrades versus upgrades among hospitals. Ratings actions highlight continued covenant challenges hospitals will face through 2024. As of November 2023, Moody's reported 21 providers they rate that violated at least one financial covenant since January 2022, with most receiving waivers or reaching forbearance agreements/amendments with lenders.

While many hospitals will see financials stabilize this year, systems that experience new or recurring covenant challenges will experience continued unfavorable outlook revisions in 2024.

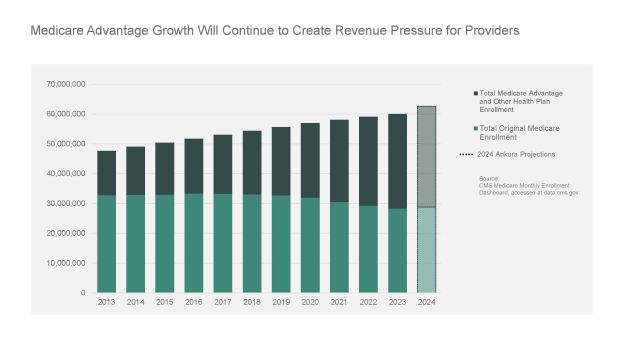

Medicare Advantage: Continued Growth

Medicare Advantage plans leverage denials, burdensome documentation requirements, and care downgrades to effectively lower reimbursement to providers. While providers have begun to push back, the growing population of Medicare Advantage enrollees means that health systems will continue to experience these revenue hurdles in 2024.

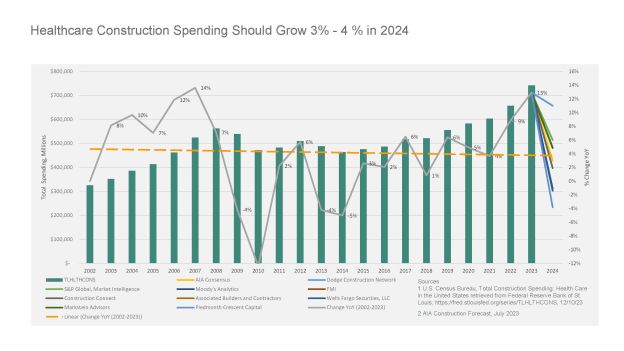

Healthcare Construction Spending Should Grow 3% - 4% In 2024

The historical growth in healthcare construction in the last 6 years has not been seen since the construction boom years leading up to the Great Recession. Nationally, we believe that construction costs for healthcare will grow a modest 3% to 4% in 2024 due to dropping inflation and year-over-year trajectory as the supplies and labor begin to normalize.

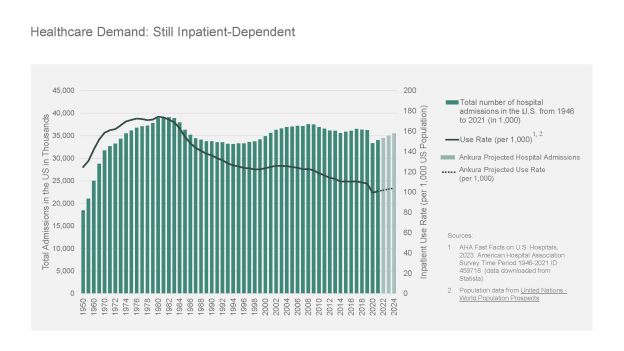

Healthcare Demand: Still Inpatient-Dependent

We predict in 2024 that total inpatient admissions in the U.S. will cusp back over 35,000 and use rates will have a slight uptick to 104 admissions per 1,000 population.

Inpatient admissions continue to decline from their 80s peak as technology improves and care shifts to the ambulatory setting. While COVID-19 drove the dip in admissions in 2020 and set the trajectory for alternative care models like tele-ICU and "hospital at home," we anticipate a slight uptick in overall admissions associated with:

- Aging population

- Rise in obesity & co-morbidities

- Downstream impact of care delays during COVID-19

- Rise in behavioral health and lack of preventative and outpatient resources

- Relatively status quo reimbursement structure

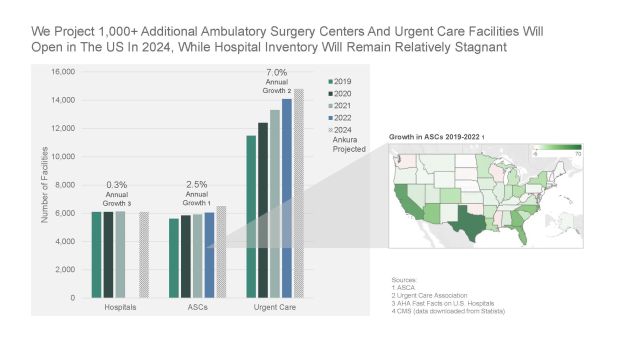

Healthcare Supply: Continues To Follow The Patient

In line with flattening inpatient growth, the number of hospitals across the U.S. has remained relatively flat. We anticipate continued investment in tertiary/quaternary facilities but a decline in the number of critical access and rural community hospitals. Growth in urgent care centers and ambulatory surgery centers will continue with the largest growth expected in the southeast, Texas, California, and those states with anticipated policy changes around CON and the CMS AHEAD model.

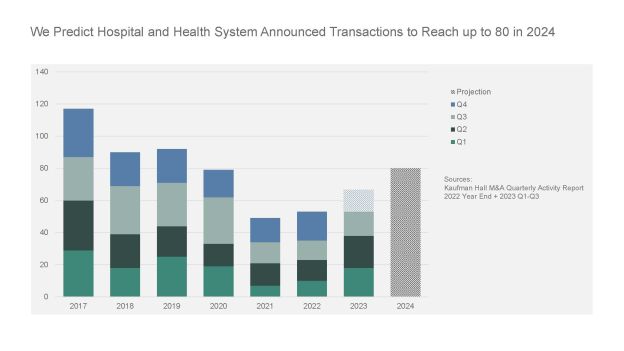

M&A: Increasing But Not The Same Deals

Hospital and Health System Merger & Acquisitions (M&A) are up in 2023 from pandemic lows. We've seen increases in cross-market mergers (two health systems operating in different geographic markets) and anticipate continued growth across markets into 2024. Regulators have begun revisiting dated guidelines and we expect new rulings to roll out in the next year that further scrutinize proposed transactions, especially within the same markets. While regulations, the global economy, and interest rate changes will impact the M&A outlook in 2024, we anticipate continued hospital consolidation as growing systems look for value-based partners and capacity pop-off valves.

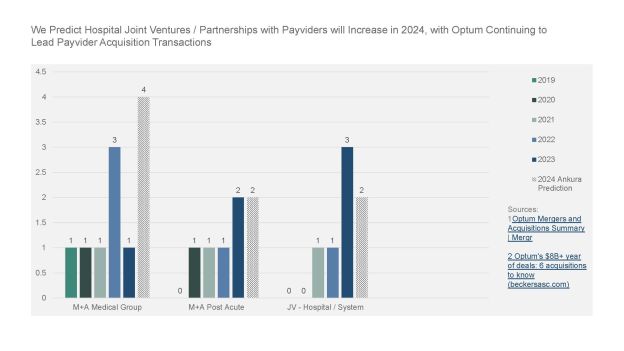

Payviders: All About Control And Scale

We predict hospital joint ventures/partnerships with payviders will increase in 2024, with Optum continuing to lead payvider acquisition transactions. Continued M&A activity will drive more provider employment and capture of home care services as payviders look to control pre and post-acute activities and reduce costs.

Conclusion

We anticipate decisions and trends in 2024 to be highly driven by the almighty dollar (or the lack thereof) with increased competition via technology adoption. We will continue to see strides towards value-based care, but with labor shortages, rising expenses, and increases in Medicare Advantage (MA) plans, we anticipate continued investment in high-acuity, high-dollar services. Payviders, private equity, and academic medical centers will continue to amass scale to leverage financial negotiating power to drive increased margins. However, governmental payers are still dominant, and with a looming November election, pressure will mount to continue to reduce costs and increase access and outcomes for all.

The Ankura Healthcare Real Estate Strategy group helps healthcare providers manage costs and risks to ensure that their investments realize their financial value to the organization today and decades into the future. We are an experienced team of professionals who create targeted solutions using strategic imperatives and data justification. Our investment scenarios include operational metrics to cultivate leadership consensus around future performance targets and financial viability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.