Today, maximizing the use of your limited capital is especially important because:

- margins continue to be squeezed,

- access to capital has become more difficult,

- the cost of capital continues to rise,

- the cost of building projects continues to increase due to stubbornly high inflation, and

- healthcare disruptors have raised the stakes on ambulatory strategy.

Capital investment needs are also increasing as health systems continue to increase their ambulatory footprints, driving them to look for creative ways to execute projects by exploring all the financial levers they can pull. We help model a variety of scenarios and utilize financial metrics such as the payback period, the internal rate of return (IRR), and net present value (NPV) to evaluate and prioritize options, as well as the impact such options have on key financial ratios including debt ratio, long-term debt to capitalization, liquidity, and days cash on hand.

These key financial ratios that rating agencies report on when

evaluating the health of a health system, ultimately impact the

system's credit rating, debt capacity, and cost of

capital.

We would like to illustrate two different capital

management scenarios to show how the insights revealed by the

various financial metrics and analyses informed decisions by

the health system clients of the Ankura Healthcare Real

Estate team.

Scenario 1: New Ambulatory Development Project

As part of a project to develop new ambulatory buildings for a health system, we ran financial projections to compare the return of using their own cash reserves versus debt, or third-party financing. Our analysis showed that by using third-party developer capital, the financial projections produced much better return metrics than if they used their own cash. Even though the cost of 3rd party capital was more expensive, overall, this scenario provided a better NPV, IRR, and a quicker payback for the health systems required investment in the project (i.e., medical equipment, technology systems, and excess tenant improvements).

Scenario 2: Whether to Liquidate a Medical Office Building (MOB) Portfolio to Redeploy the Cash

We frequently conduct system-wide real estate portfolio optimization studies to identify opportunities to consolidate, reduce overhead, improve space utilization, and shed non-core assets based on demographic projections, case volumes, and maximizing HOPD reimbursement.

A large health system was considering monetizing its MOB portfolio to raise cash to address a revenue shortfall. Our analysis revealed that although a sale would slightly decrease operating margins, it would improve their debt capacity and liquidity, providing the health system with additional "dry powder" and debt capacity to redeploy to other uses generating a higher return.

But when we conducted a more detailed "Hold vs. Sell" analysis, we found that by year five after a sale the NPV variance between the investment income realized from the sales proceeds and the increased rent, taxes, and management fees the health system would pay as a tenant began to favor "holding" vs. selling. This was mainly driven by the health system's projected overall portfolio occupancy increasing from approximately 37% to 44% over the next five years due to their strategy to continue employing more physicians.

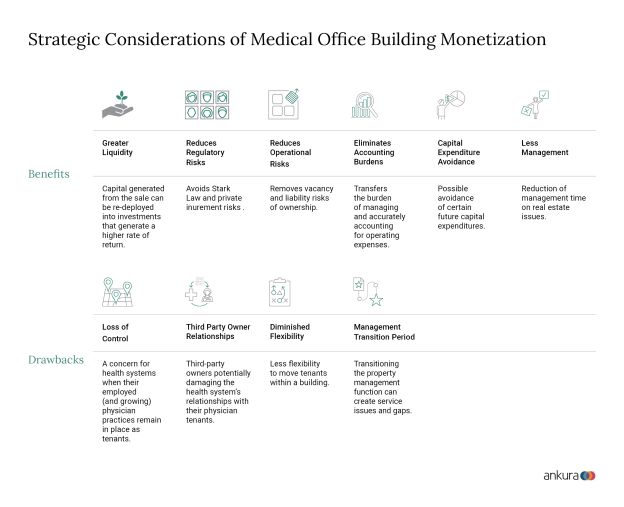

Given this key finding and after deliberating the strategic and financial considerations summarized below, the health system ultimately decided "the juice was not worth the squeeze" for it to monetize its MOB portfolio.

Conclusion

The complexity of the current healthcare real estate market dictates discipline. Financing options that follow the latest trend or obvious historical option may contain more risk than expected. The adage "numbers don't lie" is true but the holistic and contextual understanding of the numbers is paramount in this capital-limited environment. Let us help contribute to the long-term financial health of your organization through a disciplined process that analyzes the full implications of capital management options.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.