Introduction

Starting in the 1980s, companies began offshoring elements of their supply chains to low-cost countries in the Asia-Pacific (APAC) region. For decades, this trend was a reliable and certain low-cost option. However, while cheaper labor/materials are often a cost-benefit of the offshoring model to APAC, companies also incur additional logistics and inventory management costs and limit their ability to respond to market changes due to long travel times. Today's hyper-globalized supply chain paradigm is shifting, given increasing labor, transportation and logistic costs as well as trade barriers, global instability, and supply chain disruptions in inputs and conditions has shifted the paradigm of offshoring.

This article will:

- Highlight the benefits of nearshoring to Latin America (LATAM), specifically to Mexico, for those companies producing physical goods in Asia with a customer footprint in the U.S.

- Propose a model that organizations can follow to implement this transformation to maximize and realize the value of an improved supply chain.

Traditional Offshore Value Chain Challenges

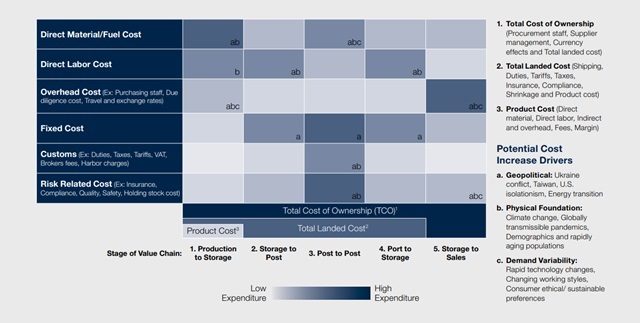

The traditional offshore value chain model in Asia has been a predominant strategy for many global companies seeking cost advantages through outsourcing and offshoring. However, in recent years, the world has seen a change, with more significant disruptions happening more often. Global events like trade disputes, intellectual property and data security concerns, natural disasters, wars, pandemics and changes in countries' economies have destabilized global supply chains. Disruptions have led to shortages and increased costs in inputs, from labor to raw materials across semiconductors, fertilizer, food and beyond (See Fig. 1). Challenges to the value chain are expected to grow in frequency and without warning — signaling exigency to develop resilience in the supply chain. As companies look to modernize their supply chain practices and become more agile and responsive — particularly between North America (NORAM) and Asia — to an everchanging consumer demand, the costs associated with managing these processes will continue to increase.

To minimize the challenges and risks, businesses are exploring ways to bolster the resilience of their supply chains. This may entail relocating or sourcing a portion of production closer to their key customers. For those organizations that serve the U.S. market, this means looking at North and Central America.

Fig. 1 - Traditional Offshore Value Chain Framework

III. Nearshoring to Mexico

In evaluating the current risk environment for companies with a global supply chain footprint, especially between Asia and NORAM, nearshoring production elements to North or Central America, especially Mexico, can be a cost- and value-focused hedge to mitigate risk for companies with a global supply chain footprint, especially between Asia and NORAM.

The value of nearshoring manufacturing, sourcing and operations to Mexico stems not only from its proximity to the U.S. market but also from a host of environmental factors in Mexico's business and economic environment — and aligns to the four groups of Cost and Liquidity Advantages, Process and Organizational Advantages, Growth and Strategic Advantages, and Sustainability and Resiliency Advantages.

Additionally, critical specific advantages around labor and logistics costs, supply chain agility, taxation/trade agreements with the U.S. and improved greenhouse gas emissions stand out as primary focal points for the benefits of nearshoring to Mexico.

Nearshoring production elements to North or Central America, especially Mexico, can be a cost- and value-focused hedge to mitigate risk for companies with a global supply chain footprint, especially between Asia and NORAM.

Nearshoring is not new for Mexico but, more recently, it has

been the transformation of the talent and the technology ecosystem

that has been the most important and disruptive competitive

advantage compared to Asia. Mexico has become a driver of

innovation and not only a supplier of basic, second-tier or

labor-intensive products.

Below are some of the key benefits of nearshoring to Mexico.

| Key Benefits of Nearshoring to Mexico | |

|---|---|

| Cost and Liquidity Advantages |

|

| Process and Organizational Advantages |

|

| Growth and Strategic Advantages |

|

| Sustainability and Resiliency Advantages |

|

Footnote

1. Shipping a container from Asia to the U.S. can be at least two times more expensive than shipping from Mexico to the U.S., according to an internal analysis/research from Optilogic.

2. Delivery lead times between China and the U.S. vary from 20 to 40 days, whereas transportation from Mexico typically takes one to nine days.

3. The following thesis from the MIT Center for Transportation and Logistics evaluates the benefits of shorter lead times and higher frequency of shipments – thesis

4. By reducing both lead time duration and variability, companies can optimize inventory levels, mitigate the risk of stockouts and adapt faster to changing demand patterns.

5. Mexico has 13 free trade agreements with 50 countries, including the USMCA. Additional incentive programs with the U.S., such as the Inflation Reduction Act (IRA) and the CHIPS Act, reduce duties and provide tax incentives for companies producing goods exported from Mexico and for consumers buying products made in Mexico

6. Mexico's corporate income tax is 30 percent. Still, incentives for manufacturers, such as the Maquiladora program, lower the tax burden by removing duty taxes on imported raw materials/machinery under the condition that all finished goods will be exported out of Mexico.

7. According to Statista, the hourly wage for manufacturing workers in China increased from $5.78 in 2019 to $6.50 in 2020, a growth rate of over 12 percent. Meanwhile, Mexico experienced a much smaller increase from $4.66 to $4.82, or 3 percent, over the same period.

8. Mexico has a young labor force, with 42 percent of the population between 20 and 49 years old. In addition, Mexico graduates more engineers each year than almost any other country – Statista.

9. Based on an internal assessment, relocating supply chains from Asia to Mexico can reduce emissions from freight transportation and business travel by more than 80 percent.

Originally published 09 April 2024

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.