In October 2023, we issued a Corporate Alert for clients ("New Laws Will Require Certain Companies to Disclose Formerly Anonymous 'Beneficial Owners'") pertaining to the Corporate Transparency Act ("CTA"), a new federal law that took effect as of January 1, 2024.1

On March 1, 2024, the U.S. District Court for the Northern District of Alabama, Northeastern Division, issued a memorandum opinion concluding that the CTA is unconstitutional, at least as applicable to the plaintiffs in that case (the National Small Business Association and one of its individual members), and temporarily enjoined the U.S. Treasury Department from enforcing the CTA's beneficial ownership reporting requirements against the plaintiffs in that case.2 It is unclear at this time whether and to what extent this decision will apply to other parties and what the ramifications of this case for other parties will be. We anticipate that the U.S. government will appeal the Alabama District Court's decision and seek a stay while the appeal is pending.

On a related point, while there can be no assurance regarding the fallout from this decision, it would appear, at least at this time, that it will not directly impact reporting requirements under the NY Act or the laws of other states which have enacted similar beneficial ownership disclosure laws. We will continue to monitor this issue and provide updates if and when there are developments that impact the CTA's beneficial ownership reporting requirements, but in the meantime, we are generally advising "Reporting Companies" (as defined below) formed or registered in 2024 to comply with the CTA's reporting requirements until the impact of the Alabama District Court's decision becomes clearer. With respect to Reporting Companies formed or registered prior to 2024, we recommend a deferral of reporting under the CTA until late 2024 when, hopefully, the impact of the Alabama District Court's decision will be clearer.

With that backdrop, and especially for those Reporting Companies formed or registered in 2024, we want to remind our clients about the application and operation of the CTA's beneficial ownership reporting requirements. We are assisting a number of clients with CTA compliance matters and, subject to the above discussion regarding the recent Alabama District Court decision, we urge our clients to take appropriate steps to comply with the CTA's requirements.

Registration Requirements

The CTA requires many corporations, limited liability companies, limited partnerships, statutory trusts and other entities created or registered to do business in the United States to register with, and disclose information regarding certain of their beneficial owners to, the U.S. Treasury Department's Financial Crimes Enforcement Network ("FinCEN").

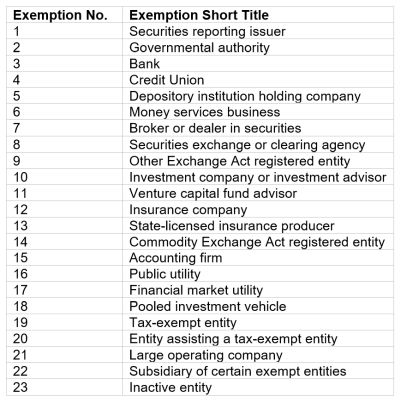

Any corporation, limited liability company, limited partnership, statutory trust or other entity created or registered to do business in the United States that does not qualify for one of the 23 exemptions listed below (a "Reporting Company") is required to file a beneficial ownership information report (a "BOI Report") with FinCEN disclosing certain information about the Reporting Company and each of its beneficial owners. For this purpose, a Reporting Company's beneficial owners include each individual who directly or indirectly exercises substantial control3 over such Reporting Company or owns or controls 25% or more of its ownership interests. BOI Reports are submitted via e-filing through the FinCEN CTA Website. Failure to timely file a BOI Report may result in penalties of up to ten thousand dollars ($10,000) to individuals associated with the filing, as well as senior officers of the entity, and imprisonment for up to two (2) years.

Deadlines

The timing of a Reporting Company's formation or registration will determine the required timing of its initial BOI Report. Thus, Reporting Companies formed or registered before January 1, 2024, must file an initial BOI Report by January 1, 2025. Reporting Companies formed or registered on or after January 1, 2024 and before January 1, 2025 must file an initial BOI Report within 90 days after their formation or registration, and Reporting Companies formed or registered on or after January 1, 2025 must file an initial BOI Report within 30 days after their formation or registration.4

Exemptions

The CTA exempts certain entities from its BOI Report obligations. For example, companies that are publicly traded, subject to certain regulatory regimes or otherwise already reporting information to a governmental agency, as well as charities and nonprofits, are exempted. Also exempt are entities that (1) employ more than twenty (20) employees, (2) filed in the previous year a tax return reporting more than $5,000,000 in gross receipts or sales, and (3) have an operating presence at a physical office within the United States. The following is a complete list of the types of entities that are exempt from BOI Report obligations under the CTA, assuming they satisfy the eligibility requirements for such exemption:

Conclusion

All business entities should carefully consider whether they are subject to the CTA's BOI Report requirements and, if so, the due date for filing their BOI Report. They also should analyze which, if any, of their owners meet the definition of a "beneficial owner" for purposes of the BOI Report requirements and should gather the information needed to timely complete their filing. We are prepared to advise our clients with respect to the CTA's BOI Report requirements, but each Reporting Company will be responsible for actually completing its required filing on the FinCEN CTA Website. There may be independent third-party service providers who are prepared to actually submit BOI Reports on the FinCEN CTA Website on behalf of clients, but we are not currently in a position to recommend any such provider.

Footnotes

1. Our October 2023 Corporate Alert also summarized the then-pending New York LLC Transparency Act (the "NY Act"), which was subsequently signed into law in December 2023 by New York Governor Hochul. The NY Act imposes similar disclosure and filing requirements as the CTA, but applies only to limited liability companies ("LLCs") formed or registered to do business in New York State. All such LLCs formed or registered to do business in New York on or before December 21, 2024 must file the required beneficial ownership information (or the statement of exemption) no later than January 1, 2025. With respect to LLCs formed or registered to do business in New York after December 21, 2024, the required beneficial ownership information must be submitted at the same time as formation or registration. For additional information pertaining to the NY Act, please see our October 2023 Corporate Alert.

2. Nat'l Small Bus. United v. Yellen, No. 5:22-cv-01448-LCB (N.D. Ala. 2022).

3. Under the CTA, an individual exercises "substantial control" over a Reporting Company if the individual (A) serves as a senior officer of the company, (B) has authority to appoint or remove any senior officer or a majority of the company's board of directors, or (C) directs, determines or has substantial influence on decisions made by the company. Individuals can exercise substantial control directly or indirectly through board representation, ownership, rights associated with financing arrangements or control over intermediary entities that separately or collectively exercise substantial control. Some examples of indirect ownership or control include: (i) joint ownership with one or more persons, (ii) ownership through another individual acting as a nominee, intermediary, custodian or agent, and (iii) ownership through ownership or control of one or more intermediary entities that separately or collectively own or control ownership interests of the Reporting Company.

4. For such Reporting Companies, their initial BOI Report also must include certain information regarding the persons who actually formed or registered such entities.

Share This Page

This alert provides general coverage of its subject area. We provide it with the understanding that Frankfurt Kurnit Klein & Selz is not engaged herein in rendering legal advice, and shall not be liable for any damages resulting from any error, inaccuracy, or omission. Our attorneys practice law only in jurisdictions in which they are properly authorized to do so. We do not seek to represent clients in other jurisdictions.