On October 3, 2022, the Securities and Exchange Commission (SEC) announced that it entered into a $1.26 million settlement with Kim Kardashian over her social media promotion of the EMAX token without disclosing payment she received from token issuer, EthereumMax. The matter provides important lessons for advertisers. Here's a summary of what happened to Ms. Kardashian and what brands and those working on their behalf need to know.

The Promotion.

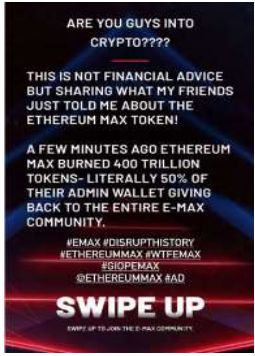

Ms. Kardashian promoted EthereumMax's EMAX token in a 2021 Instagram post to her 225 million followers:

EthereumMax reportedly paid Ms. Kardashian $250,000 for this post.

Legal Actions Against Kim Kardashian.

First, a class of EMAX purchasers moved against Ms. Kardashian in a class action – brought in California federal court -- alleging aiding and abetting, violations of California's unfair competition law and Consumers Legal Remedies Act, among other claims, and sought money damages and injunctive relief. That case is ongoing.

Now, the SEC alleges that Kardashian's promotion violated section 17(b) – the so-called "anti-touting provision" – of the federal Securities Act of 1933. The SEC Order (which you can read here) explains that it is unlawful for any person to publish, give publicity to, or circulate any advertisement, among other communications, describing a security for a consideration received or to be received, without fully disclosing the receipt and amount of consideration.

Legal Backdrop.

In the highly uncertain legal environment surrounding cryptocurrency and other digital assets, much attention is paid to the words and actions of U.S. regulators, especially the SEC. The SEC's position in this action was that the EMAX token constituted a "security" – an investment contract – for purposes of federal securities laws. Why? In SEC v. W.J. Howey Co., 328 U.S. 293, 289-99 (1946), the Supreme Court set out the elements for determining whether a particular scheme constitutes an "investment contract" under the Securities Act, directing courts to examine whether there is: (1) an investment of money; (2) in a common enterprise; (3) with the expectation of profits derived solely from the efforts of others.

More recently, the SEC issued a framework ("Framework") for how the Howey investment contract analysis applies to digital assets. According to the Framework, digital assets are investment contracts when (i) the digital asset is purchased or otherwise acquired in exchange for value, whether in the form of real or fiat currency, a digital asset, or other consideration; (ii) there is investment in a common enterprise; and (iii) there is a reasonable expectation of profit derived from others' efforts (which often happens with digital assets when value of the asset is linked to the success of a promoter's efforts).

In the Kardashian case, the SEC asserts that the EMAX tokens constitute securities. As their Order noted: "Based on EthereumMax's marketing materials, as well as public statements by EthereumMax affiliates, the EthereumMax website, and EthereumMax social media handles, purchasers of EMAX tokens would have had a reasonable expectation of profits from their investment in the tokens," and that EthereumMax had promised to develop certain "token enhancements," including ". . . future rewards and staking programs, national sporting and event partnerships, and a general expansion of the EMAX token ecosystem."

Takeaways.

There are a few important takeaways here for brands and agencies:

- The SEC is aggressively scrutinizing and enforcing against digital assets it deems securities. The SEC's action here is another stark example of the SEC's "regulation by enforcement." As Caroline Pham, the Commissioner of The Commodity Futures Trading Commission noted in a recent public statement: "Instead of crafting tailored rules in an inclusive and transparent way, the SEC is relying on these types of one-off enforcement actions to try to bring all digital assets into its jurisdiction, even those assets that are not securities." Those looking to promote crypto projects to consumers, to develop tokens for brands or celebrities, or to hire or act as endorsers in the crypto space – should now consider whether SEC rules may apply to their projects.

- #AD may not be enough when securities are involved. When promoting digital assets, compliance with Federal Trade Commission material connection disclosure rules may be necessary but not sufficient. Here Kardashian's post included the material connection disclosure #ad, but that disclosure was not a defense and the SEC still moved against her. Other regulators (including the SEC), as well as private plaintiffs, may also have skin in the game. As is clear from the SEC's settlement with Kardashian, to the extent the underlying asset is deemed a security, the receipt and amount of consideration must also be disclosed.

This alert provides general coverage of its subject area. We provide it with the understanding that Frankfurt Kurnit Klein & Selz is not engaged herein in rendering legal advice, and shall not be liable for any damages resulting from any error, inaccuracy, or omission. Our attorneys practice law only in jurisdictions in which they are properly authorized to do so. We do not seek to represent clients in other jurisdictions.