This article is the fourth in our series of alerts focused on the alternative protein industry. It explores legal considerations relevant to early-stage companies operating in the alternative protein space and, in particular, covers some key corporate responsibilities and governance considerations that such companies should bear in mind.

Newcomers may wish to read our previous articles, accessible via the following links: part 1, part 2, and part 3, of the series.

1. Corporate Responsibilities

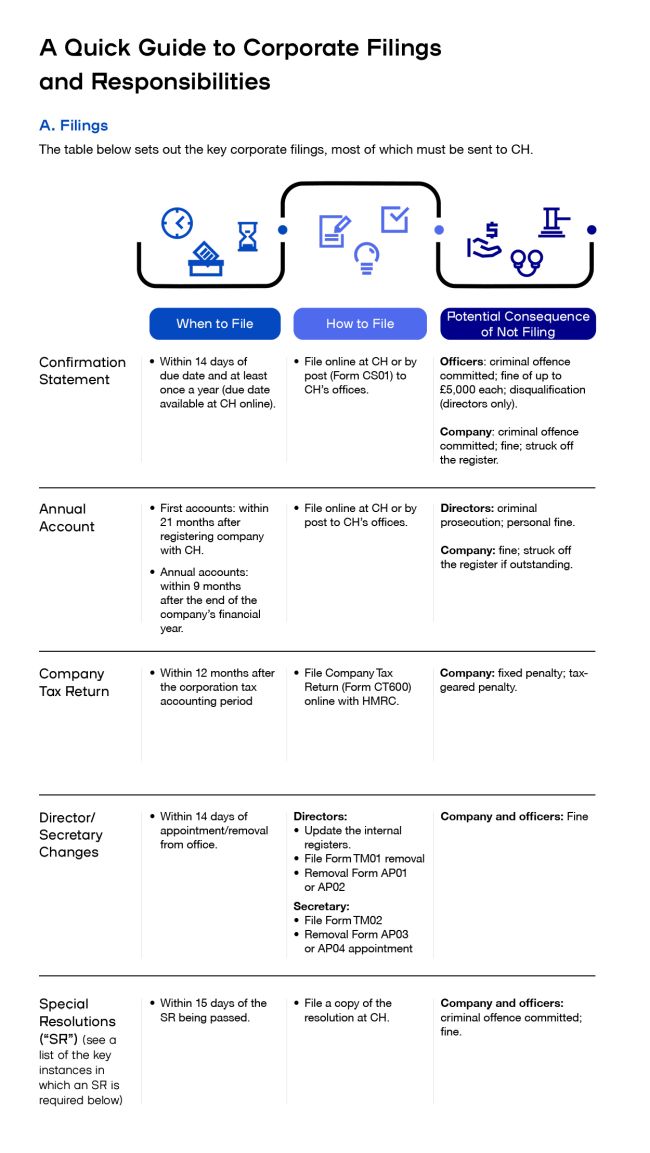

Companies in the UK are regulated by many statutes, ranging from those dictating how much tax they need to pay, to those centred on how they treat their employees. At a corporate level, the main statute that companies should be familiar with is the Companies Act 2006. The infographic below summarises the key administrative requirements when running a company in the UK and also summarises the duties of company directors.

Notes on no. 2 – The duty to promote the success of the company for the benefit of its members as a whole

The legislation setting out duty no. 2 above clarifies that directors should, in seeking to achieve this duty in normal circumstances, bear in mind at least the following:

- Likely consequences of any decision in the long-term;

- Interests of the company's employees;

- Need to foster the company's business relationships with suppliers, customers, and others;

- Impact of the company's operations on the community and the environment;

- Desirability of the company maintaining a reputation for high standards of business conduct; and

- Need to act fairly between members of the company.

This is known as the enlightened shareholder value principle and seeks to promote the idea that making strategic business decisions with a view to their likely consequences in the longer term and considering their impact on stakeholders, such as employees, customers and the environment, will make for more resilient and better-managed companies.

In many ways, the Companies Act 2006 can be considered a frontrunner in the global drive to ensure better governance; although, for a long time, monetary value has driven the consideration as to what constitutes success of the company. The importance of enlightened shareholder value has grown in all areas of the world in recent years with the rise in popularity of environmental, social, and governance ("ESG") reporting (discussed further below).

2. Corporate Governance and ESG Considerations

a. Corporate Governance

Good corporate governance is not only important for the smooth operation of a company, but is increasingly something that investors will look at when evaluating a proposed investment, in determining how reliable and organised a company is and, importantly, in seeking to understand how well that company is likely to respond to challenges or market turmoil. Maintaining a high standard of corporate governance will provide clarity and reassurance to investors when they examine how a company is being run to determine if it is worth their investment. Some key governance points to bear in mind are listed below.

i. Decision Making

- Directors should either make decisions at board meetings (which are well recorded in board minutes) or by written resolutions. The company's articles of association will provide more details on how decisions should be made. The company should keep detailed and accurate board minutes for a minimum of ten years and the better the minutes, the better record a company has that it has considered relevant matters and taken appropriate actions.

- Shareholder approval is also required for the directors to make certain decisions as a matter of company law in the UK. Some matters will require an ordinary resolution (a vote by a simple majority – i.e., members holding shares entitling them to over 50% of the votes), and others will require a special resolution (members holding shares entitling them to over 75% of the votes). Shareholders can vote at meetings or with written resolutions. Shareholder approvals may also be required under investment or contractual documentation among shareholders (and sometimes the company). The information below summarises the standard decisions which require shareholder approval as set out in the Companies Act 2006. However, it is important to check the company's articles of association, as they may add additional requirements or increase the relevant thresholds.

|

Decisions requiring shareholder approval by ordinary resolution |

Decisions requiring shareholder approval by special resolution |

|

|

ii. ESG

ESG factors and how they are accurately reported are becoming increasingly necessary and important considerations, even for early-stage companies active in the alternative protein industry. As frontrunners in the fight against climate change, alternative protein businesses will be well-positioned to excel in this space and well-regarded investors will value any such sustainable enterprise that accurately reports on relevant ESG criteria.

ESG reporting entails recording and publishing accurate information about how a company is seeking to and successfully adding value in an environmental, social, and governance sense.

An early-stage company looking to excel in this space should focus on being able to clearly demonstrate (and record) how sustainable and financially responsible it is and how ESG considerations have been factored into management decisions. More specifically, but in brief:

- From an environmental perspective, a company should assess its environmental footprint and manage environmental risks;

- From a social perspective, a company should evaluate how it manages relationships with stakeholders, including employees, suppliers, customers, and communities where it operates. It should consider and keep under review working conditions, employee relations, diversity, operations in conflict regions, and health and safety; and

- From a governance perspective, a company should ensure decisions by directors are well reasoned, transparent and recorded (as discussed above). A company should have strong internal controls and regular audits. Its leadership should operate fairly, and the company could consider having policies regarding executive pay, gender equity and equal pay, bribery and corruption, and board diversity.

Approaches to ESG reporting vary globally and are also evolving. Reporting has traditionally covered policies for ESG-related issues, overarching objectives, and strategy. It has also been largely centred on how ESG strategies were being implemented.

Now, ESG reporting trends and expectations are more focused on the results of these actions or the sustainability outcomes of investments. In particular, in recent times, there has been a clear move to reduce "greenwashing", especially in relation to investment products marketed under the ESG umbrella. The drivers behind this trend include demands for transparency from retail investors, fund members/beneficiaries, and potential shareholders, and the scale of some apparent discrepancies between the outward actions of a corporation in general and the results indicated in its ESG reporting.1

3. Conclusion

This article is intended to provide a brief overview for early-stage companies preparing to search for investors or that may one day look to partner with other commercial entities or enter a sale process with respect to their businesses. Investors and potential acquirers will be encouraged to find a company that has managed its corporate responsibilities and governance carefully and correctly, particularly a high-growth company operating in a novel market, such as the alternative protein space.

Julia Kotamäki and Michelle Luo, London trainee solicitors, contributed to the drafting of this alert.

Footnote

1. For more details on ESG reporting trends, see the Principles for Responsible Investment Review of trends in ESG reporting requirements for investors, published 3 August 2022, accessible here: https://www.unpri.org/driving-meaningful-data/review-of-trends-in-esg-reporting-requirements-for-investors/10296.article.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved