For the past 2 years, predictability has been in short supply. It's been especially hard on retailers who have seen demand and supply continuously lurching in and out of sync for many of the things that we buy today, or in modern parlance, wait for.

Unpredictability hits retailers especially hard. Business models are fine-tuned according to expected customer and supplier behavior, and cost is squeezed out, to compete on price, leaving low margins leave little room for error. In fact, the average net margin in both UK and US retail hovers somewhere between 1 and 5%. This varies according to what specific form of retail, but in comparison to other sectors, retailers have some of the slimmest margins on the planet.

When supply markets, or customers behave unexpectedly those finely tuned business models come under stress, as do margins. Lots of things can happen because of supply chain disruption, but the most common, as we have seen over the last 2 years are stock shortages, longer lead times, and or cost/ price increases. The effects of these can be circular, spooking buyers, leading to more unexpected behavior and thus prolonged crisis.

We can all look back, reflect, and recall what went on over the last 2 years, most of us know, we were there and are still dealing with the fallout. But in the here and now, there are three questions being asked in most boardrooms; What happened? How we can see the next one coming? How can we be better prepared?

And for most that means thinking about balancing risk and resilience.

Risk or resilience, stick or twist?

Was retail an accident waiting to happen? Of course, it was. In fact, all the disruptive events that have occurred over the last two years were predictable. The likelihood of them happening altogether in the same period, now that's different. Also, the cost of managing all those risks out of the supply chain to cope with such an event? That was prohibitive for most, given the likelihood of occurrence.

And that's what risk management has always been; a gamble. Gambling that parts of the system wouldn't break, and if they did, that the impact or cost to fix, would be less than the cost of building a risk management program in the first place. The decision process of what risks to manage is commonly referred to as a 'risk appetite'.

But businesses don't shy away from risk programs just for cost reasons. Can we even do risk management today to the degree required to respond to pandemics?

A key challenge in risk management is that businesses are aware that they must build complete transparency and collect real-time data across supply chains but their ability to do so is an entirely different case.

It's almost the unspoken secret, for many it can't be done because of the following factors:

- Lack of affordable enterprise tech to offer supply chain transparency and tracking

- Lack of skills to architect, implement and embed the best of breed tech that does exist

- Adoption and change management internally and supply side is hard and fails a lot

- Budget vs other business priorities

Number 4 on that list may have changed as a result of the pandemic. The other three have not. In fact, in a recent survey, only 6% of retail respondents professed to be very confident in their systems and capabilities for end-to-end supply chain visibility.

And that's why many CFOs are opting for resilience over risk as the immediate strategy, although its not always clear that this strategy is actually being put into action. The challenges are clear with resilience costs high, dual sourcing ramping up and capacity buffers in highly globalized price sensitive markets.

Particularly when the system is snarled up by everybody attempting to do the same things at the same time.

Is big tech coming to the rescue?

The sad fact is that for the many, comprehensive risk programs are expensive, and hard to build, with skills and emerging tech-focussed very much on the organizations with the budget and appetite to implement. At the bleeding edge, some remarkable things are happening. Look at Orbital Insights and Unilever for example, or the rapid growth of a business like Interos taking strategic investments from both Accenture and Coupa, and gaining Unicorn status in the process.

Industry 4.0 is going to enable us to join up supply chains through people and tech building the risk and resilience models of the future. It's principally focussed on automation and data exchange and the early adoption cases point towards manufacturing its potential application is ubiquitous. But the key thing here is the use of the future tense, all of this is happening at the bleeding edge. For many, a comprehensive, global risk management framework is out of reach as a result of a lack technology, capability and due to unrealistic costs.

Surely not? But what about all the tech that we read about? Sadly, a lot of enterprise tech in the risk space falls short of where we imagine it should be. Some of the best-in-class systems out there remain highly manual, and the is an ongoing debate as to the merits of platforms vs best of bread, breadth vs depth. Paralysis is often the outcome until affordable utilities arrive that are easier to understand and implement.

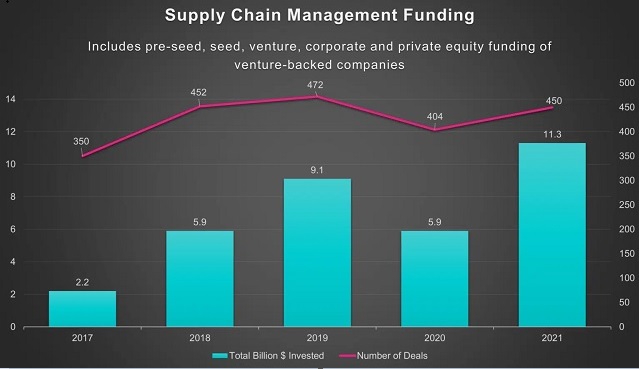

But tech will eventually come to the rescue and supply chain management technology, 'risktech' and 'sustaintech' are attracting astronomical levels of investment. The markets are placing their bets here and so the solutions will come, although caution for buyers – risk, is in a large part a data problem, which can only be solved by tech, but not solved exclusively by tech. The application and implementation must be practical, not theoretical.

Source: Crunchbase new

Transparency is the destination

Transparency is the goal. That's where we want to get to; a real-time view of the supply chain at the click of a button thanks to predictive "decisioning" based on pattern analysis. For retailers, having oversight of the whole supply chain provides the ability to know the location of products and where demand will come as well as spotting the challenges before they occur.

However, due to the interconnected and international nature of today's supply chain, it is no easy task for large retailers who have supplier networks across the globe. Difficult, but not necessarily impossible for selected products, or supply chains.

Through engaging suppliers and implementing technology solutions to provide real-time analytics, improved transparency can help protect against supply chain shocks and create a smoother customer experience.

This is where risk appetite comes back in as part of a structured program to decide where and how to embed risk management. It pays for software vendors and consultants to overcomplicate this, but broadly it means the following:

- Get a grip on what you buy and where it is from

- Assess the different risks and impacts relative to point 1 (creating a common taxonomy or language)

- Decide on your risk appetite relative to 2 (segmenting suppliers/ supply chains into relevant groups)

- Define a course of action for each group, creating a risk framework or specification

- Figure out how to operationalise that using people and tech – is it possible? What would it cost?

In the absence of a perfect risk solution, resilience prevails

So, if you can't manage out all the risks, your options are to do nothing or embed greater resilience in supply chains. The thought process behind resilience is not dissimilar to that behind risk. Few will be able to take the costs of a perfect solution, and so the answer will be to place bets on where resilience is the right strategy.

When it comes to building a resilient retail supply chain, there are some key considerations. When starting off, it is vital that your strategy is informed by the products that you are selling. For instance, fast-moving products such as clothing will need an increased level of resilience as speed of delivery is key.

This is a different story for slower-moving products where perhaps less innovation is needed and retailers have more time. These retailers may have more leeway as it would take more significant shocks to cause disruption, and perhaps something as simple as buying further out will work. However, it is more a question of how early, where, and how much you invest rather than if you invest.

There are also choices to be made when it comes to warehousing and shipping as capacity is tight and it's a situation that isn't going to improve quickly. Several organizations talk proudly of plans to build next-generation warehousing facilities but try accelerating a digital warehouse today. You can't. Space is short, skills are stretched, and costs are spiraling. Even pros like Ocado are taking serious P+L hits on current investments, and Peloton has recently canceled their place to build a next-generation facility in Ohio.

There are big serious strategic decisions. As such, at the same time as considering "build", retailers should be looking at their outsourcing options and identifying where third parties can provide support and help build resilience.

The global shipping industry has experienced significant disruption due to port issues and driver shortages. What this means is that retailers are being offered longer-term contracts with fixed prices. This offers security as it means guaranteed space but also means there is no flexibility in prices should the situation shift. So, the question is, do you stick or twist?

Ultimately, those that get the balance right between risk, resilience, and speed are likely to see the most success. The goal really should be predictability. Retailers must equip themselves with as much information as possible about where customer demand will come and where the supply chain might become strained. If this is achieved, critical resilience can be built-in and can be used as a foundation for current operations and future growth.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.