Of the many challenges that have stultified the development of the Nigerian Electricity Supply Industry (NESI), illiquidity remains the most significant.

As part of efforts to address this problem, the Nigerian Electricity Regulatory Commission (NERC) has exercised its powers under section 17(a) & (b) of the Multi-Year Tariff Order 2022 (MYTO 2022), adopting its first Supplementary Order to MYTO 2022 on the Implementation of Regulatory Net-Offs 2022 (the Net-Off Order).

are specific directives issued by NERC to the Principal Collection Accounts Settlement Administrator on net-offs (+/-) in a fixed sum requiring no calculation, applied to an electricity distribution company's (Disco) minimum remittance obligations to the Market Operator (MO) or to the Nigerian Bulk Electricity Trading Company Plc (NBET) for a specific number of months to accommodate financial offsets by market participants and/or amortization of deferred assets, as approved by NERC.

In this Newsletter, we take a panoramic view of the NetOff Order, highlight its provisions, and discuss its impact on NESI and investors.

HIGHLIGHTS OF THE ORDER

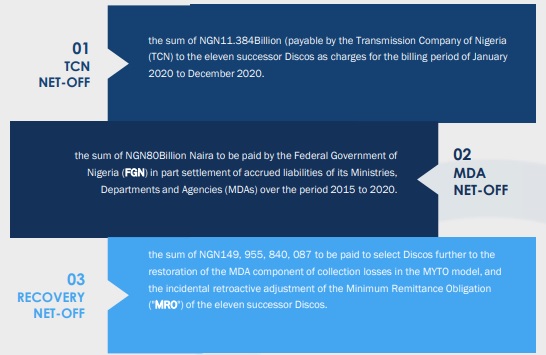

In thumbnail sketch, the Order provides for the following Regulatory Net-Offs:

We will consider the rationale for each of these heads of net-off in turn below:

The TCN Net-Off

As part of its obligations to enforce and ensure compliance with its Economic Merit Order Dispatch (EMOD) 1 and hold TCN financially responsible for unfavorable deviations from the prescribed EMOD and consequent failure to deliver a Disco's contracted load due to TCN's network constraints, NERC sanctioned TCN in the sum of NGN11.384Billion for non-compliance with the EMOD between January and December 2020. This sum is to be recovered from the amount payable to the TCN in twelve equal instalments over the period July 2022 to June 2023 and paid to the Discos within this period. The MO is required to reflect this monthly deduction in the revenue accruable to TCN.

Without any doubt, the implementation of this surcharge against TCN for failure to meet its EMOD is consistent with good market practice. It is hoped that as a result of the Net-Off Order, the TCN would be appropriately incentivized to improve its network infrastructure to avoid future sanctions.

The MDA Net-Off

Non-payment of electricity bills by MDAs is a major liquidity constraint within the NESI that has rendered Discos unable to meet payment obligations to the MO and NBET. By July 2021, the estimated monies owed to Discos by MDAs was in excess of NGN202 Billion - aggregating both verified and unverified debts.

Commendably, the FGN has provided the sum of NGN80Billion for the settlement of MDAs' accrued liabilities to Discos from 2015 to 2020, pending the completion of ongoing verification. As contemplated by the Net-Off Order, these monies will be disbursed to all eleven (11) successor Discos in equal proportion and utilized to settle market obligations to the MO and NBET over the billing period of July 2022 to June 2023.

Although this Regulatory Net-Off will bring meaningful relief to the Discos, we query whether this will offer a long-term solution to the perennial problem of nonpayment of bills by MDAs. In connection with this, it is recommended that subject to prescribed thresholds of unpaid bills, a Disco should be permitted by relevant regulation to disconnect non-paying MDAs from its network. Such an approach is more likely to be effective in motivating the right behavior on the part of the MDAs, as well as assisting Discos to mitigate their exposure.

The Recovery Net-Off

Sometime in 2015, NERC revised and amended the MYTO 2.1 by restoring the collection loss component of the retail Disco tariff – this revision resulted in MYTO 2015, which was meant to regulate the applicable tariffs for the period between 2015 and 2024. In practical terms however, the reinstatement of the collection loss component was not reflected by a commensurate downward adjustment of the remittance obligations of the Discos. As a result, a retroactive adjustment of the MRO ( in relation to the MDA collection losses) of the eleven successor Discos has been given effect under MYTO Order 2022 to enable the Discos recover payments made to the market in excess of regulatory obligations due during the billing period of January 2015 to December 2021. As a result of this shortfall, the cumulative sum of NGN149,955,849,087 is payable to eight (8) successor Discos (namely - Benin, Eko, Enugu, Ibadan, Ikeja, Jos, Kaduna, and Yola), between July 2022 and June 2023.

It is not altogether clear from the Net-Off Order, the basis for NERC's exclusion of the other three (3) successor Discos, that is, Abuja, Kano and Port Harcourt from the Recovery Net-Off.

CONCLUSION

It is without doubt in the interest of the sustainability of the NESI that Discos (being the last mile in the value chain) remain liquid and viable to keep up with their respective MROs and other market commitments. In the event, the introduction of the Regulatory Net-Off mechanism which allows recovery of monies owed over a period is an ingenious initiative by NERC. Overall, as NERC sustains its drive to enforce compliance within the sector, we expect to see more liquidity for the Discos and increased efficiency on the part of market participants in general.

It is the also the hope that the FGN will sustain its willingness to settle all verified MDA debts to Discos, and that beyond the commitment of NGN80billion, a similar net-off mechanism shall be applied with respect to all due balances of MDAs in the near term.

Footnote

1. "Economic dispatch" or "merit order" is a mechanism for ranking electricity generators in ascending order based on the price of producing each MW of electricity, so that the generators that produce the cheapest electric power are dispatched first by the TCN.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.