UNLOCKING NIGERIA'S HYDROCARBON POTENTIAL: INSIGHTS INTO THE UPCOMING 2024 AND REOPENED 2022 NIGERIAN OIL LICENSING ROUNDS

I. OVERVIEW

According to Nigeria's National Bureau of Statistics, crude oil revenue surged from ₦9.570.22 trillion in H2 2022 to ₦18.846.31 trillion in H2 2023, significantly boosting Nigeria's foreign trade and exports in 2023. This underscores the continuing critical importance of the petroleum industry in driving revenue, diversifying the economy, increasing local content, supporting communities, and ensuring sustainable development.

This update provides an overview of Nigeria's upcoming 2024 oil licensing rounds and the reopened 2022 mini-bid rounds, emphasising key features and opportunities for investors. It delves into historical challenges and lessons from past licensing rounds, outlines the regulatory framework under the Petroleum Industry Act (PIA), regulations made pursuant to it, as well as the guidelines issued by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), and explores their broader strategic implications for the energy sector.

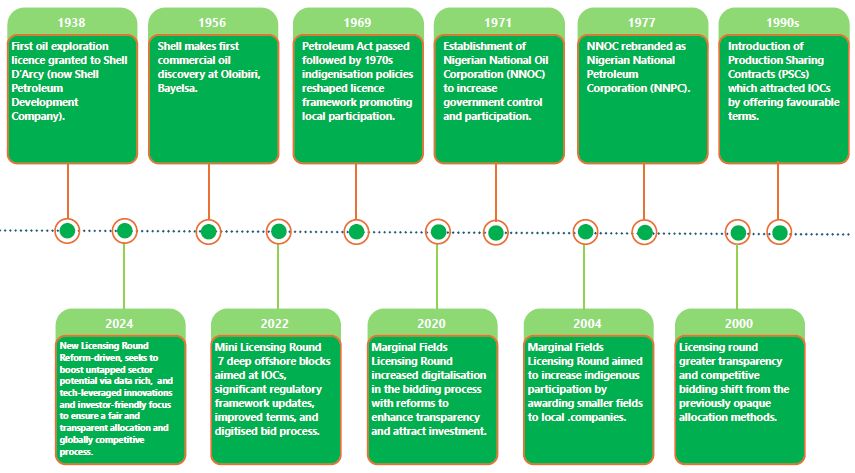

II. EVOLUTION OF NIGERIAN LICENSING ROUNDS – KEY MILESTONES (1938-2024)

II.1. Nigeria's oil licensing rounds have evolved significantly since 1938. Key milestones include the establishment of NNPC in 1977, which marked a shift to greater government control, and the promotion of local participation in the 1970s. The 1990s saw the introduction of favourable terms to attract international investment, while 2005 focused on increasing indigenous involvement. Transparency and digitalisation were enhanced in 2020. The 2022 and 2024 licensing rounds aim to further boost and diversify investment, integrate sustainable practices, and drive technological advancements in the sector.

II.2. Licensing Rounds: Challenges and Lessons Learned

Nigeria's licensing rounds for its petroleum sector have had mixed success. While these rounds have been instrumental in attracting investment, generating revenue, boosting government control and indigenous participation, and enhancing the development of the country's hydrocarbon resources, including marginal fields and frontier fields, they have also faced significant challenges.

Key concerns raised in relation to the licensing rounds preceding the Petroleum Industry Act 2021 (PIA) included a lack of clarity over the regulatory and fiscal framework. A shortage of comprehensive, consistent, and accessible detailed technical, geological, and geophysical data—such as seismic and well data—hindered the thorough assessment and evaluation of offered blocks. Additionally, allegations of unfairness and opacity in the bidding process, inconsistently applied regulations, and undue or arbitrary presidential or ministerial discretion in the allocation of blocks were prevalent.

In some pre-PIA licensing rounds, successful bidders were unable to pay signature bonuses. Some banks, overexposed to non-performing oil and gas loans, approached these rounds with caution. Inadequate technical and financial partnerships for marginal fields and failures to pay signature bonuses further impacted the success of some rounds.

These issues, combined with broader macroeconomic challenges, infrastructure deficiencies, declining production, oil price volatility, security challenges, and the global shift towards green energy, further undermined investor participation in the rounds and the stability of the sector prior to the passing of the PIA.

II.3. The Regulatory Framework For The Licensing Rounds

II.3.1. Regulatory Framework: The PIA

The PIA aims to address challenges such as regulatory inconsistency, bid process integrity, technical and financial capacity issues, and data accessibility restrictions, and to thereby enhance the effectiveness and success of Nigeria's licensing rounds. Sections 73 to 80 of the PIA outline detailed requirements and procedures for executing the licensing rounds.

Section 73, which mandates that licences and leases be awarded based on open and competitive bidding. It requires periodic and public advertisement of licensing rounds and bidding process plans and the involvement of diverse government representatives. These reforms aim to address historical challenges and allegations of opaque and corrupt practices.

The exercise of Ministerial discretion in the grant of licences and leases has historically raised concerns about transparency and undue influence as well as uncertainty over timing. While Section 75 preserves the Minister's discretion to determine the quantum of successful bidders' signature bonus payments, section 75 also subjects the discretionary power of the Minister of Petroleum in granting licences to the NUPRC's recommendation and requires that a decision be made within 90 days, failing which, the licence or lease shall be deemed to be granted. Ongoing adherence to such objectives and the prudent exercise of discretion will be crucial to allay previous concerns.

The PIA introduces various process refinements to enhance the licensing rounds. Section 76 prescribes pre-qualification criteria that companies must meet before participating in the bidding process, prioritizing technical and financial competence to ensure that only capable entities receive licenses, thereby reducing project abandonment risks. Section 77 defines bid parameters and introduces a points system for fairness and competitiveness, while Section 78 promotes transparency and efficiency through electronic bidding, contingent on robust data security. Additionally, Section 79 allows for the grant of licenses outside competitive bidding for strategic reasons under bilateral or multilateral agreements. These provisions collectively aim to streamline the licensing process, making it fairer, more transparent, and efficient.

Section 80 requires the Commission to develop model licences and leases with standard terms and conditions for each licensing round, supporting transparency and uniformity. The 2024 oil licensing round terms and conditions and model concession contracts are already available on the NUPRC's Nigerian Licensing Round Portal at https://br2024.nuprc.gov.ng/. The portal provides a central repository of information, provides interested parties with access to documents and updates regarding the licensing rounds.

II.3.2. Regulatory Framework: the Licensing Round Regulations and Licensing Round Guidelines

In addition to the PIA, comprehensive guidelines and detailed regulations that will govern the regulatory framework for the 2024 Licensing Rounds and the re-opened 2022 Licensing Rounds, are also available on the NUPRC Portal platform.

The PIA, regulations, and guidelines collectively provide a framework for a more transparent and efficient allocation of licences and streamlined monitoring and oversight by regulatory authorities. The availability of detailed information online should help to promote transparency, regulatory consistency, and remove data accessibility restrictions. Continuous vigilance and effective implementation are essential to sustainably achieve the objectives of the licensing round and to ensure that these reforms translate into tangible benefits for the industry and stakeholders.

III. THE 2024 LICENSING ROUNDS: WHAT'S IN STORE?

III.1. Objectives and Strategic Goals

The upcoming licensing rounds offer new opportunities for exploration and investment in Nigeria's petroleum sector, and aim to achieve several strategic objectives, including:

- increasing oil and gas reserves and boosting production levels, both crucial for stabilising supply;

- aligning with global energy sustainability and Environmental, Social, and Governance (ESG) (ESG) goals, including strategies to eliminate gas flaring and achieve net-zero carbon emissions targets; and

- promoting the transfer of technology, creating employment, building capacity and enhancing

- local expertise.

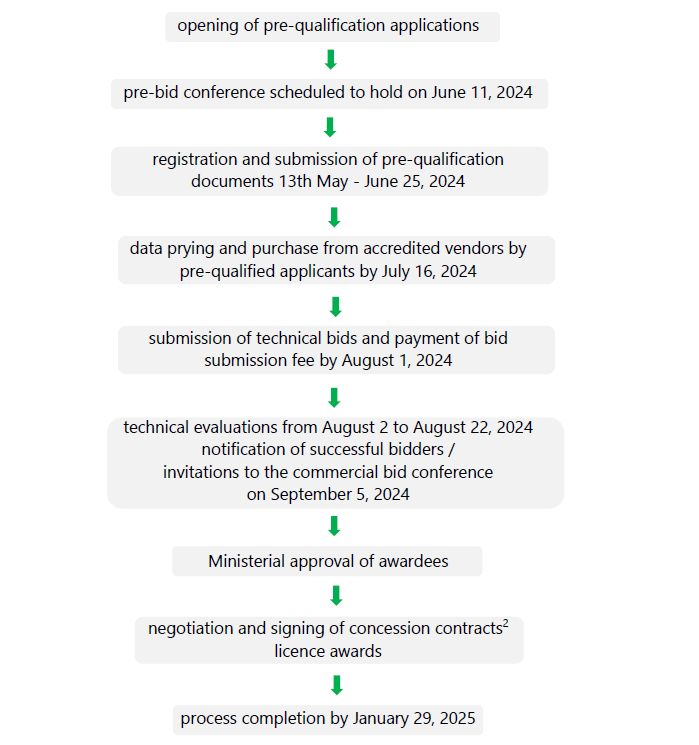

III.2. Bid and Licensing Process and Schedule

To facilitate stakeholders' understanding of the 2024 and reopened 2022 licensing round processes and requirements, the NUPRC announced on 31st May 2024 that it will host a pre-bid conference on 11th June 2024 to clarify the procedures and expectations. This event is part of a key step NUPRC has laid out a detailed bid process and schedule for the upcoming licensing rounds, aiming to achieve a structured and transparent approach to awarding oil and gas licences. In summary, the process will comprise the following steps:

III.3. Available Blocks

The 2024 licensing round offer the 12 newly offered blocks in the first table below, which are strategically selected across diverse geological terrains, including onshore basins, continental shelves, and deep offshore territories. It will also include the reopening of the 2022 licensing rounds, which had initially offered 7 deep offshore blocks covering approximately 6700 km² to conclude the process that stalled during the changes in administration in 2023, providing broader opportunities for investment and development in Nigeria's deep offshore territories.

III.3.1. 2024 Licensing Round Blocks

| Block Name | Size (Square Kilometers) |

Terrain | Location |

|---|---|---|---|

| PML 51 | 245 | Continental Shelf | Niger Delta |

| PPL 267 | 350 | Continental Shelf | Niger Delta |

| PPL 268 | 350 | Continental Shelf | Niger Delta |

| PPL 269 | 35.70 | Continental Shelf | Niger Delta |

| PPL270 | 10.00 | Onshore | Niger Delta |

| PPL 271 | 14.30 | Onshore | Niger Delta |

| PPL 300 – CS | 1,024.72 | Continental Shelf | Benin Basin |

| PPL 301 – CS | 1,024.72 | Continental Shelf | Benin Basin |

| PPL 2000 | 1,000 | Deep Offshore | Niger Delta |

| PPL 2001 | 1,000 | Deep Offshore | Niger Delta |

| PPL 3008 | 993.50 | Deep Offshore | Benin Basin |

| PPL 3009 | 1,16620 | Deep Offshore | Benin Basin |

III.3.2. Reopened 2022 Licensing Mini-Bid Round Blocks

| Block Name | Size (square km) | Terrain |

|---|---|---|

| PPL 300-DO | They cover an area

of 6,700km and a water depth of 1`,150 to 3,000 metres |

Deep Offshore |

| PPL 301-DO | Deep Offshore | |

| PPL 302-DO | Deep Offshore | |

| PPL 303-DO | Deep Offshore | |

| PPL 304-DO | Deep Offshore | |

| PPL 305-DO | Deep Offshore | |

| PPL 306-DO | Deep Offshore |

IV. CONCLUSION

The upcoming 2024 oil licensing rounds and the reopened 2022 rounds are pivotal for Nigeria's energy sector. The regulatory framework established by the PIA and the regulations and guidelines made pursuant to it are structured to address certain historical challenges and aim to enhance fairness, transparency, and efficiency in the licensing process, improve regulatory oversight, and foster sustainable development.

Furthermore, these licensing rounds present valuable opportunities to integrate green energy initiatives, technologies, and Environmental, Social, and Governance (ESG) principles, which can help diversify Nigeria's energy mix and contribute to global efforts to combat climate change. The NUPRC has emphasised the importance of incorporating ESG standards to mitigate environmental impacts, promote social responsibility, and uphold governance best practices

The strategic implications of the 2024 and reopened 2022 licensing rounds are significant, potentially reshaping Nigeria's energy landscape. Stakeholders must navigate the evolving regulatory environment effectively to harness the opportunities presented while mitigating risks and ensuring that the benefits extend beyond immediate economic gains to incorporating green energy and ESG principles for long-term sustainable development and an energy-resilient future.

Footnote

2. Concession contracts are agreements granting rights to explore and produce oil and gas in a specific area.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.