1 Overview

Nigeria is endowed with vast reserves of natural resources such as energy minerals like coal and lithium, metallic minerals like gold and lead-zinc and industrial minerals like limestone and barite. The country was a major exporter of tin, columbite and coal in the 1960s to early 1970s. However, activities in this sector nose-dived considerably by the mid-1970s due to several political and economic factors, especially following the discovery of crude oil in Oloibiri, Bayelsa State. This discovery brought about a transformative era for Nigeria's economy and crude oil export become a major source of foreign exchange earnings for the country.

The significant export earnings from crude oil led to the neglect of the mining sector and the country became a mono-product economy, vulnerable to international oil politics and attendant uncertainty of export earnings. Successive Governments at the Federal level have demonstrated some level of commitment to revamping the sector, with minimal successes recorded. For example, in 1999, a new national focus and strategy on mining evolved and this culminated in the enactment of the Nigerian Minerals and Mining Act (the Act or NMMA) in 2007, amongst other policy efforts. However, these efforts only led to a stunted growth in the sector; with the sector's contributions to the nation's Gross Domestic Product (GDP) remaining at less than 1% as at 20231.

To demonstrate Government's commitment to enhancing the sector's contribution to the GDP and facilitating the diversification of the economy, the erstwhile Ministry of Mines and Steel Development (MMSD or the Ministry) issued a revised sector growth and development roadmap (Roadmap for the Growth and Development of the Nigerian Mining Industry – the "Roadmap") in 2016, with the objective of addressing the key challenges identified in the sector and outlining strategies for rapid development and utilization of key minerals and metals. One of the targets of the roadmap is the growth of the sectors' total contribution (direct and indirect) to Nigeria's GDP to about 10% by 2026. Pursuant to this target, the Government launched a N30 billion intervention fund to open up the sector to multinational companies. The fund was to be used to promote exploration and research. Despite these significant efforts, only little traction was achieved across the mining value chain, as the sector only contributed 0.77% to the GDP in 2023 according to the National Bureau of Statistics (NBS)!

Nigerian's mining value chain can be categorized according to the key activities in the sector - exploration and mining (upstream), processing and beneficiation (mid-stream), and marketing and transportation (downstream). Historically, only the upstream and downstream subsectors were active. However, the past f ive years have seen a remarkable growth with more mining companies investing in the mid-stream subsector, by engaging in the processing, beneficiation and .or refining of minerals. To further enliven the mid-stream subsector, the Government signed the Nigeria's Mineral Value Chain Regulations, 2021 ("the Regulation") in July 2021. The Regulations are primarily aimed at boosting the country's revenue through the local development (processing and refining) of raw materials into refined products before export. The Government's resolve to maintain this outlook was also re-emphasized in 2023 in the renowned Tesla story.

Whilst the downstream subsector appears to be dominated by individuals and indigenous companies, the upstream subsector is dominated by small scale/ artisanal miners, and local integrated manufacturing companies (for example, cement manufacturers that extract limestone as input for their production). Also, a few junior mining companies have executed joint venture arrangements with indigenous companies for mining operations.

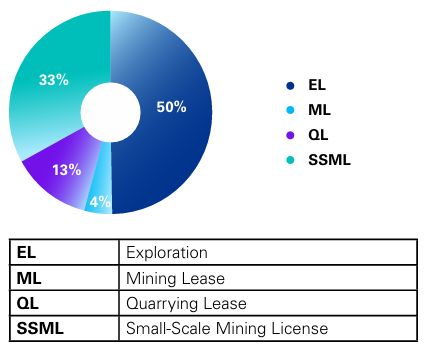

As of May 2024, a total of 7,182 companies and individuals were licensed to operate in the upstream subsector. The distribution of the entities approved, based on the type of licences held, is shown in the diagram below. Further analysis of the types of licences held per state, and the minerals licensed are shown in Appendix 1 2

The Nigerian Minerals and Mining Act is the principal legislation that regulates the sector. The Act vests the control, regulation and ownership of all mineral resources in the Federal Government of Nigeria (FGN). The Minerals and Mining Regulations and the National Minerals and Metals Policy also govern the sector.

The erstwhile Ministry of Mines & Steel Development (MMSD) oversaw the mining sector in Nigeria, pre-2024. However, the administration of President Bola Ahmed Tinubu split the Ministry into two (2) separate ministries in 2023 for more focused and effective administration. The new ministries are the Ministry of Solid Minerals Development (MSMD) with focus on all minerals in the value chain of the mining sector other than steel, and the Ministry of Steel Development (MSD) with the sole mandate to accelerate the development of the country's steel potentials. Both Ministries administer the provisions of the NMMA as applicable. The Ministries are supported in performing their functions by the following statutory departments.

- Mines Inspectorate Department

- Mines Environment and Compliance

- Mining Cadastre Office

- Artisanal and Small-scale Mining Department.

There are other departments created under the Ministries to aid the performance of their functions, prominent of which are:

- The Metallurgical Inspectorate and Raw Material Development Department

- Steel & Non-ferrous Metals Department.

The functions of each department are discussed in greater details in Section 3.

Some of the key challenges facing the sector include, but are not limited to, the following:

- Limited geoscience data and information

A major issue facing the sector is the apparent lack of adequate, accessible and reliable geological data on available mineral resources and their locations, which affects the sector's ability to attract investors. Every investor requires access to credible data to facilitate investment decision making. Most of the available geological / geoscience data are dated. This raises questions about the credibility of the resource information and impacts the bankability of mining projects.

The FGN in May 2024, through the office of the Nigerian Geological Survey Agency introduced the Nigerian Mineral Resources Decision Support System (NMRDSS). This is a web-based application that provides read-only access to geo-scientific and geo-economic data of Nigeria. The NMRDSS allows users to analyze mineral occurrence locations and make informed decisions regarding mining activities. The NMRDSS is still quite new and the effectiveness of the resource is yet to be adequately tested. Nevertheless, it is envisaged that the NMRDSS will significantly alleviate the data challenge currently being faced in the Sector.

- Infrastructure development

Lack of critical infrastructure, particularly adequate electricity supply and access roads to sites of mineral deposits is a major challenge facing operators.

However, the privatization of the national utility and reform of the power sector are potential stimuli for private investment in the sector. As capacity increases with new investments in the generation, transmission and distribution of electricity, the shortages currently being experienced will be overcome. Pending the resolution of the power problem on a national scale, mining investors can meet their power needs by engaging independent power producers for captive generation and supply of energy to the mines.

With the various efforts being harnessed via the Public Private Partnership (PPP) route, and fiscal incentives being offered by the federal government (e.g., through the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme), it is expected that access roads to mine sites will ultimately improve over time. The ongoing rehabilitation of the rail lines will also facilitate effective pit-to-port evacuations across the country.

- Security

A number of the mineral rich communities in the Northern region of Nigeria have now been liberated from the occupation of terrorist group and insurgency. However, communal and religious conflicts occur intermittently in the middle belt region of Nigeria, which is known to be rich in minerals and metals.

The country's security apparatus is being equipped to respond appropriately to social conflicts as and when they arise, while the Ministries are strengthening the operations of the Mines Surveillance Task Team to tackle the challenges of illegal mining. Furthermore, the recent inauguration of the Transport and Mining Marshals by the Honorable Minister of Solid Minerals Development is a step in the right direction as it could help to foster a more secured climate for operators. Security concerns are therefore expected to abate overtime given the efforts of the FGN in this regard.

- Illegal mining and community challenges

Illegal mining activities in some of the regions poses attendant Health Safety & Environment (HSE) risks and community challenges. However, it is expected that with the strengthening of the nation's security apparatus, it will help to contain and curtail the nefarious activities of illegal miners.

The MSMD, in November 2023, launched the "Guidelines for the production of Community Development Agreement (CDA) in the solid minerals sector". The Guidelines are aimed at harmonizing the process of agreeing and documenting a CDA, to ensure the following objectives are fulfilled:

- Provide an acceptable structure / template for CDAs;

- Outline the key elements and general contents of a typical CDA, including dispute resolution;

- Proffer appropriate monitoring frameworks for its implementation; and

- Suggest ways by which the community may participate in the planning, implementation, management and monitoring of activities carried out under the CDA.

The expectation is that as stakeholders and mining communities adopt the provisions of these Guidelines in formulating or crafting their CDAs, mining operations will be conducted in an atmosphere of peace and cordiality with the host communities.

- Project funding

Nigeria has continued to struggle to attract the necessary investments into the sector due to a combination of factors, including but not limited to, insufficient bankable projects (due to limited geoscience data about reserves), policy uncertainty, security concerns and global economic dynamics.

In 2023, the Africa Finance Corporation (AFC) and the Solid Minerals Development Fund (SMDF) partnered to co-fund and co-develop commercial scale 'eligible' mining projects in Nigeria. The partnership, through a dedicated project development facility is aimed at fast tracking the development of priority mining projects in Nigeria, mitigate risks and create a pipeline of high-quality projects with economic impact. It is expected that similar interventions will be rolled out subsequently to maximize the reach and close the funding gap.

- Lack of robust fiscal framework

The existing fiscal framework for investors in the mining sector is not attractive enough and does not consider the peculiar nature of the sector, particularly, its long gestation period. In addition, incentives for miners appear to be scattered in pieces of different and independent fiscal legislation, which urgently calls for harmonization, to provide clarity to operators as to which should prevail (e.g., incentives in the NMMA and Companies Income Tax Act, CITA). Typically, fiscal incentives should be codified into the relevant corporate tax law to avoid overlaps and / or inconsistencies. Therefore, the FGN needs to revisit the entire fiscal framework for the taxation of mining operation, to bring it in alignment with global best practices to attract mining majors and foreign investors.

Apart from the harmonization of the fiscal incentives, the revision of the NMMA is long overdue, as some of the provisions may no longer be in tandem with current realities. Hence, the urgent need for an update to ensure the provisions align with global best practices and address the current realities of the mining ecosystem in the country.

In 2022, KPMG published the 9th Edition of its 'Investment in Nigeria' guide. This guide provides readers with detailed information on doing business in Nigeria, including; the requirements for incorporating a business, statutory filing requirements, regulatory agencies, etc. This report can be accessed online using the link in the footnote below3

Footnotes

1 Based on the Nigerian Gross Domestic Product Report for Q4 2023, published by the National Bureau of Statistics, the total contribution of the Mining sector (i.e., coal mining, metal ores and quarrying and other minerals) to the 2023 GDP is about 0.77%.

2 Some companies hold multiple licences, for example, a Company may hold a mining lease and quarry lease with respect to different minerals.

3 https://assets.kpmg.com/content/dam/kpmg/ng/pdf/investment-in-nigeria-guide-2022.pdf

Click here to read the full report.

The opinion expressed in this article is solely personal and does not represent the views of any organization or association to which the authors belong.