As 2020 draws to a close, the Luxembourg Financial Intelligence Unit published its annual report for 2019 highlighting over 50,000 declarations and blocked funds which exceeded EUR 231 million.

As 2020 draws to a close, the Luxembourg Financial Intelligence Unit (FIU) (the Cellule de Renseignement Financier (CRF)) published its annual report for 2019 highlighting over 50,000 declarations and blocked funds which exceeded EUR 231 million.

Evolution of the number of declarations

The number of declarations received was 52,374, decreasing from 55,948 in 2018. The FIU saw an increase in the number of declarations received from banks, investment firms and other professionals of the financial sector, with a decrease from online providers.

Blocking

The FIU is empowered to instruct declarants to not perform transactions.

Since 2018, the FIU's ability to block is no longer limited in time. However, the law of 10 August 2018 does provide recourse to the courts.

In 2019, the CRF took 89 blocking measures (compared to 53 in 2018) for a total amount of EUR 231,148,557.05 (EUR 87,407,533.78 in 2018). 48 blocking instructions were linked to fraud.

Banks

The number of declarations made by traditional banks increased by 19.39% between 2018 and 2019.

Corruption declarations also increased. This trend can be explained by negative press articles published in 2019, as well as heightened awareness of declarants in relation to inconsistent transaction schemes and suspicious documents. There was heightened focus on loan or advisory agreements and cases where the economic justification for those agreements was uncertain.

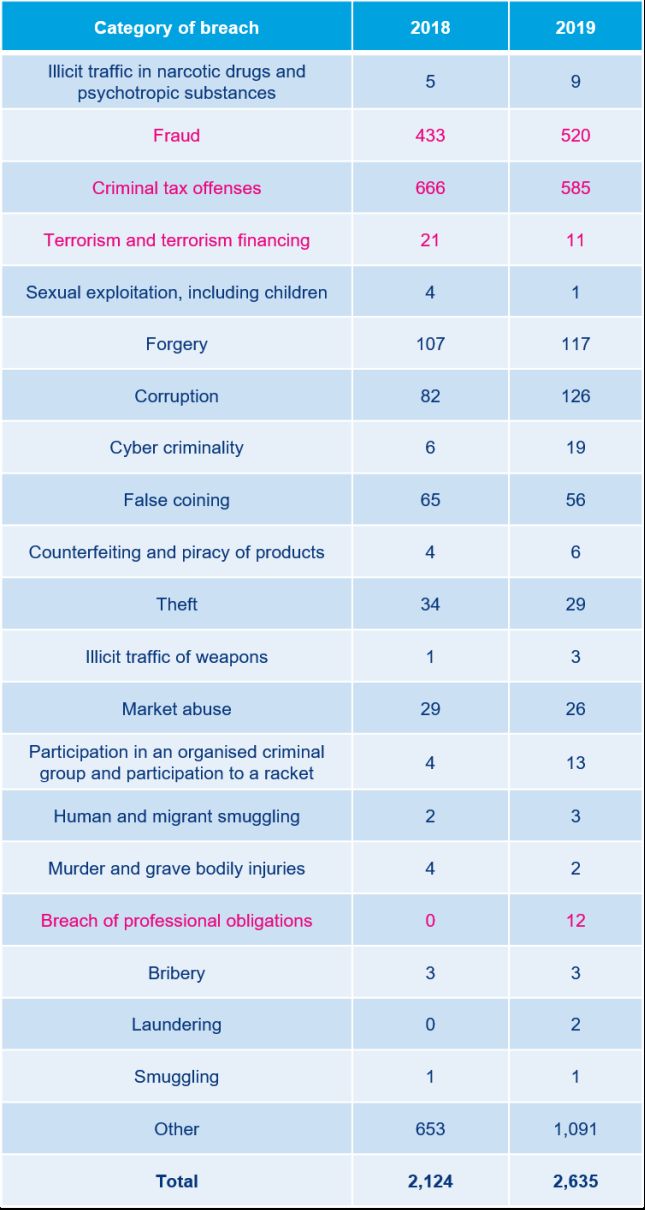

The 2019 Annual Report contains the number of declarations for primary offenses reported by all entities in the banking sector:

Insurance

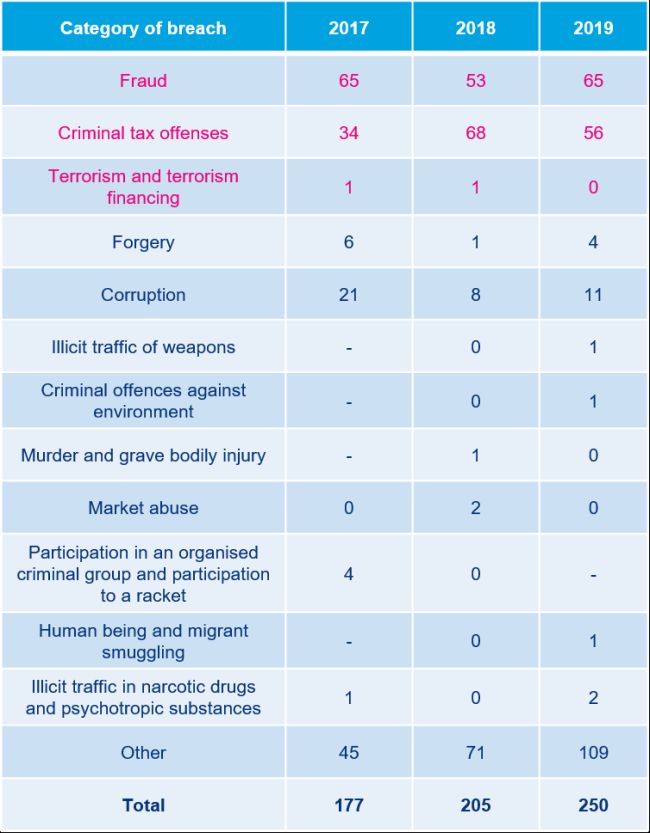

Actors in the insurance sector which registered for the FIU's online "goAML" tool doubled during 2019 as a result of an awareness campaign led by the insurance regulator, the Commissariat aux Assurances.

In total, there was an increase of 45 suspicious transaction reports compared to 2018.

Referral to the Prosecution

In 2019, 219 reports (compared to 91 reports in 2018) were sent by the CRF to the relevant prosecution teams.

Conclusion

The 2019 statistics demonstrate a consistent and mature reporting environment. For banks and insurers alike, criminal tax offences and fraud remain areas where there are a high number of reports. Banks and insurers must ensure they have robust policies and procedures in place to detect and manage suspicious cases. It is essential that all staff, internal control functions, management, and the board of directors stay up-to-date on the latest developments in this area.

Click here to access the CRF annual report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.