IMPORTANT CASE LAWS

GOODS AND SERVICES TAX (GST)

- The Petitioner was denied opportunity to file reply to Form GST

DRC-01A issued under Section 73 of the Central Goods and Services

Tax Act, 2017 (the CGST Act). Such Form DRC-01A was uploaded along

with show cause notice (SCN) issued under Section 73(1) of the CGST

Act. The Petitioner filed Writ Petition (WP) challenging order

passed by the Department for denying opportunity to file reply to

Form DRC-01A.

The High Court held that the person who is liable to pay tax is entitled to receive an intimation from in Form GST DRC-01A so that he may respond to the intimation by filing reply before issuance of SCN. In the instant case, and the intimation in Form GST DRC-01A was uploaded simultaneously, therefore, the Petitioner was denied his right of filing reply. Accordingly, the impugned order passed by the Department ought to be set aside since the Petitioner was denied a valuable right of filing submissions in response to the intimation in Form GST DRC-01A.

Takeaway: Intimation Notice in Form DRC-01A and SCN issued cannot be uploaded simultaneously

[M/s Ravi Enterprises Vs. the CST & Anr., WP (M/S) No. 141 of 2023, Order dated February 23, 2023 (High Court, Uttarakhand)] - The Petitioner received summons in relation to a fake invoicing

case, to which Petitioner explained that it had no transactions

with the vendor in question. Subsequently, the Petitioner received

an e-mail regarding blocking of Input Tax Credit (ITC) under Rule

86A of the Central Goods & Services Tax Rules, 2017 (the CGST

Rules). Consequently, ITC was blocked on the instructions of the

Commissionerate of Central Tax. The blocked ITC was unblocked on a

date after the expiry of one year (going against the provisions of

law), and thereafter ITC was appropriated against tax demand

created on the same date i.e. expiry of one year of blocking

ITC.

Subsequently, the Petitioner filed WP challenging SCN and order passed by the Adjudicating Authority under Section 74 of the CGST Act and also, challenged the validity of Instructions dated March 08, 2022 issued by the Department of Trade and Taxes, Policy Branch (which directed the Officers to create a demand by disallowing ITC in cases where the ITC had been blocked).

The High Court held that the Department has no material information to form any opinion that ITC had been availed wrongly on account of fraud, wilful-misstatement or suppression of facts with an intention to evade payment of tax and has only proceeded on the basis of direction issued by the Central Tax Department. The impugned SCN was issued in a mechanical manner to comply with the directions given by the Central Tax Authority. The High Court further held that the proper officer cannot issue SCN without forming at least a prima facie view that tax has not been paid or short paid or erroneously refunded or the ITC had been wrongly availed or utilised by reason of fraud, wilful-misstatement or suppression of facts. The High Court, while setting aside the SCN and Order, held that the instructions by the Department of Trade & Taxes had been issued only to overcome the provisions of Rule 86A of the CGST Rules and thus, such instructions cannot be sustained to this extent.

Takeaway: ITC cannot be blocked on the basis of instructions received from another Department

[M/s Parity Infotech Solutions Private Limited Vs. Government of NCT of Delhi & Ors., WP (C) 7017/2022 & CM No. 21510/2022, Order dated March 7, 2023 (High Court, Delhi)]

- The Department issued summons under Section 70 of the CGST Act

to customers of the Petitioner directing them to stop making all

further payments to the Petitioner, until clearance received from

it. The Petitioner filed WP challenging summons issued by the

Department to the customers of the Petitioner.

The High Court held that the Department is empowered to issue summon under Section 70(1) of the CGST Act to any person whose attendance is considered necessary either to give evidence or to produce a document or any other thing in the enquiry. The Department cannot direct the customers of the Petitioner to stop making payment to the Petitioner. Hence, the Department has exceeded its powers beyond the scope of the CGST Act and thus the summons issued are set aside.

Takeaway: Department cannot direct customers of suppliers to stop making payment to its suppliers by way of issuance of summons

[M/s Sri Sai Balaji Associates Vs. The State of Andhra Pradesh, WP No. 4663 of 2023, Order dated March 7, 2023 (High Court, Andhra Pradesh)]

- The Petitioner filed application of refund for claiming refund

of the unutilized ITC. The Department issued SCN and alleged that

supplier of the Petitioner has been investigated by Directorate

General of Goods and Service Tax Intelligence (DGGSTI) in

connection of fake invoicing and therefore, the Petitioner is not

entitled to claim refund of ITC. Subsequently, the Department

passed order rejecting refund applications filed by the Petitioner

for the reason that the Petitioner is part of a supply chain

involving fake ITC. Being aggrieved by the order passed by the

Department, the Petitioner filed appeal before the Appellate

Authority, which got dismissed.

Being aggrieved by the order of the Appellate Authority, the Petitioner filed WP against the order passed by the Department.

The High Court held that there is no conclusive finding based on any cogent material to show that the invoices issued by suppliers of the Petitioner are fake. The allegations of any fake credit availed by supplier cannot be a ground for rejecting the Petitioner's refund application unless it is established that the Petitioner has not received the goods or paid for them. Hence, the Petitioner shall be entitled to claim refund of ITC on goods exported by it.

Takeaway: Refund of GST to the Applicant cannot be rejected solely on the basis of allegations of fake invoicing on its suppliers

[M/s Balaji Exim Vs. Commissioner, CGST & Ors, WP (C) 10407/2022, Order dated March 10, 2023 (High Court, Delhi)]

- The Petitioner is an Indian Branch Office of M/s Ernst &

Young Limited, UK. The Petitioner entered into service agreements

for providing professional consultancy service to various entities

of Ernst & Young group (EY Entities) on arm's length basis.

The Petitioner applied for refund of ITC and availed for providing

its professional services for the period December 2017 to March

2020. Subsequently, the Department issued SCN and passed order

rejecting refund claimed by the Petitioner on the ground that the

services provided by the Petitioner were rendered on behalf of its

head office and therefore, qualifies as 'intermediary

services' and not 'export of services'. Thereafter, the

Appellate Authority upheld the order passed by the Department.

Subsequently, the Petitioner filed WP challenging the orders passed

by the Department and the Appellate Authority.

The High Court held that the Petitioner has provided professional consultancy services to EY Entities on its own account and was neither involved in arranging or facilitating of goods/ services. Therefore, the supply made by the Petitioner cannot be termed as intermediary services. Further, it has been held that the professional services rendered by the Petitioner shall fall within the definition of 'export of services' under Section 2(6) of the Integrated Goods and Services Tax Act, 2017 (the IGST Act) since the recipient of the services is located outside India. Accordingly, the Department was directed to process the refund application filed by the Petitioner.

Takeaway: Professional services provided by Indian Entity to entity located outside India shall qualify as 'export of services'

[M/s Ernst and Young Limited Vs. The Additional Commissioner, WP (C) No. 8600 of 2022, Order dated March 23, 2023 (High Court, Delhi)]

- The Appellant is engaged in business of sale of fashion and

lifestyle products through e-commerce portal. In order to enhance

its business, the Appellant proposes to run a loyalty programme

where loyalty points will be awarded on the basis of purchases made

by the customer on its e-commerce platform. The participation in

such program will be based on meeting the pre-defined eligibility

criteria and subject to acceptance of the terms and conditions by

the customer. The Appellant through its portal shall make the

vouchers and subscription packages available to those customers who

wish to redeem the loyalty points earned.

The Appellant sought Advance Ruling as to whether the Appellant is eligible to avail ITC on the vouchers and subscription packages procured from third party vendors which are made available to the eligible customers participating in the loyalty program?

The Authority for Advance Ruling (the AAR) held that the Appellant is not eligible to avail ITC on the vouchers and subscription packages procured by the Appellant in terms of Section 17(5)(h) of the CGST Act. Being aggrieved by the order of AAR, the Appellant filed appeal before the Appellate Authority for Advance Ruling (the Appellate AAR).

The Appellate AAR held that Hon'ble Karnataka High Court in the case of M/s Premier Sales Promotions Pvt Ltd Vs. UOI1, held that 'vouchers' are neither 'goods' nor 'services' and therefore, cannot be made amenable to GST. Hence, when the vouchers intended to be procured by the Appellant is neither 'goods' nor 'services', the question of eligibility of ITC does not arise.

Takeaway: No ITC is available on purchase of vouchers to be provided to the eligible customers

[M/s Myntra Designs Private Limited, Order No. KAR/AAAR/03/2023, Order dated February 24, 2023 (Appellate AAR, Karnataka)]

VALUE ADDED TAX (VAT)

- The Respondent purchased green coffee beans for further exports

and domestic sales. The Department issued notice to the Respondent

under Section 39 of Karnataka Value Added Tax, 2003 (the KVAT Act)

upon finding irregularities in input tax rebate claimed by the

Respondent. On re-assessment, it was found that the Respondent has

claimed ITC from 27 sellers, out of which 6 were de-registered, 3

had not filed taxes despite selling to the Respondent, and 6 has

denied turnover and not paid taxes. As a result, ITC amounting INR

10.52 lakhs was disallowed.

The Respondent preferred appeal, but it was rejected by the first appellate authority. However, the second appellate authority allowed the appeal on the ground that the Respondent purchased coffee from the registered dealer under genuine tax invoices and consequently allowed the ITC claimed. Thereafter, the Appellant filed a revision application, which was dismissed by the Karnataka High Court. Aggrieved by the order of Karnataka High Court, the Appellant filed appeal before the Supreme Court.

The Supreme Court held that in the absence of any cogent material like furnishing the name and address of the selling dealer, details of the vehicle which had delivered the goods, payment of freight charges, acknowledgement of taking delivery of goods, tax invoices and payment particulars etc., and the actual physical movement of goods by producing the cogent materials, the Appellant was absolutely justified in denying the ITC. Mere production of the invoices or the payment made by cheques is not enough and cannot be said to be discharging the burden of proof cast under Section 70 of the KVAT Act. Accordingly, while restoring the order passed by the Appellant, the Apex Court quashed and set aside the impugned judgment passed by the Karnataka High court and order passed by the second appellate authority.

Takeaway: ITC not available to purchasing dealer in the absence of adequate proof regarding genuineness of transactions

[The State of Karnataka Vs. M/s Ecom Gill Coffee Trading Pvt. Ltd., Civil Appeal No. 230 of 2023, Order dated March 13, 2023 (High Court, Karnataka)]

SERVICE TAX

- The Appellant is a dealer of motor vehicles who is engaged in

sale and purchase of motor vehicles and also performs sales

promotion activities. The Appellant received certain discounts/

incentives from the manufacturer. SCN was issued by the Department

wherein it was contended that payment received by the Appellant as

incentive/ discount is consideration for rendering certain sales

promotion services by the Appellant to the manufacturer and passed

an order levying service tax on the same.

The Appellant contended that sale and purchase of motor vehicles constitutes transfer of title in goods which falls within the negative list and is excluded from the levy of service tax. Further, manufacturer provides discount in the sale value of the vehicle based on yearly sales performance and such discounts have no correlation with the sale promotion activities performed by the Appellant.

The Customs, Excise and Service Tax Appellate Tribunal (CESTAT), while setting aside the impugned order, relied upon the decision of Kafila Hospitality and Travels Pvt. Ltd. 1 wherein it is held that an air travel agent while promoting its own business may lead to incidental promotion of the business of the Airline. It held that similarly in the instant case, the activity of promoting the sale of motor vehicle owned by the Appellant is incidentally in interest of both the parties. CESTAT held that trading of motor vehicles is not a service as per Section 66D (e) of the Finance Act, 1994 and hence, the amount of incentives and discounts cannot be treated as consideration for any service and accordingly, no service tax is leviable thereon.

Takeaway: Incentive in nature of trade discount forming part of sale price cannot be treated as consideration for sales promotion service

[Prem Motors Pvt. Ltd. Vs. CCE & CGST - ST Appeal No. 58026/2021, Order dated February 23, 2023 (CESTAT, Delhi)]

- The Appellant is an authorized agent of a telecommunication

service provider engaged in finding prospective customers for

post-paid mobile connections, raising bill, receiving money and

other customer care services in exchange of a commission for each

post-paid connection. SCN proposing demand was issued wherein it

was contended that the activity of the Appellant is subject to

service tax.

The Appellant contended that the commission paid to the Appellant is out of the total amount received by the telecommunication service provider, which had already been subjected to service tax paid by the telecommunication service provider and that demand of service tax on commission would amount to double-taxation.

The CESTAT, while confirming the demand of service tax, observed that where the Appellant is not only engaged in sale and purchase of SIM cards, but is also performing the activity of procurement of clients, promotion of sales and other customer care services, which would be taxable. Accordingly, the Appellant is liable to pay service tax on the commission received for the services provided to the telecommunication service provider. Further, it held that since Appellant was under bonafide belief that they were not liable to pay service tax, penalty imposed was set aside by invoking Section 80 of the Finance Act, 1994 which provided that penalty is not to be imposed in cases when the assessee is able to establish reasonable cause for non-payment of service tax.

Takeaway: Commission agent providing various services on its own account is liable to pay service tax on consideration received for such services

[Apex Cel Link Vs. CCE & ST - ST Appeal No. 41339/2013, Order dated March 7, 2023 (CESTAT, Chennai)]

- The Appellant is set up as a nodal agency for promoting

agricultural activity in the State of Gujarat by disbursing the

Government subsidy to various farmers of identified target group

and charged 5% of the subsidy as management fee. The Appellant paid

services tax under category "Management Consultancy

Service" but later on, claimed refund of service tax on the

ground that they had paid such tax through oversight without

collecting any tax amount from customers. Refund application was

rejected on the ground that services provided by the Appellant are

covered under Management Consultancy Services and is subject to

service tax. The Appellant filed appeal and contended that

disbursal of subsidy is a sovereign function of the State

Government and cannot be classified as Management Consultancy

Services.

The CESTAT held that the Appellant is a nodal agency for implementation of a government subsidy scheme and such activity cannot be equated to a government carrying out statutory function. Further, the definition of Management Consultancy Services is comprehensive enough to cover any technical advice, assistance in relation to any financial management, which in the instant case the Appellant is providing, and so, service tax is rightly discharged. Hence, the instant appeal is rejected.

Takeaway: Activities of a nodal agency on behalf of a government cannot be equated to sovereign functions of a State and hence, would be subject to service tax.

[Gujarat Green Revolution Co. Ltd. Vs. CCE & ST - ST Appeal No. 318/2010-DB, Order dated March 21, 2023 (CESTAT, Ahmedabad)]

CENTRAL EXCISE

- Bilag Industries Limited (BIL) and Aventis Crop Science India

Ltd (Aventis India) are subsidiaries of AgrEvo SA. BIL sold goods

to Aventis India for subsequent sale to customers. The Department

issued SCN alleging that BIL and Aventis India were 'related

persons' and as per Section 4(4)(c) of the Central Excise Act,

1944 (the CEA), the price at which goods were sold to end customers

should be the assessable value of the transaction; and thereafter,

proceeded to confirm the demand. The Appellant preferred an appeal

against the impugned order before the CESTAT, which was decided

against the Appellant. Subsequently, an appeal was filed before the

Supreme Court.

The Appellant's main contention was that the Department failed to apply the test to decide if an entity was "related" to another.

The Supreme Court held that the Department's decision in rejecting the value at which the goods were sold, by treating the assessee as a related person, was erroneous and held that the proper test contemplated under Section 4(4)(c) of the CEA should be inferred while concluding the relationship between the parties. Supporting documents submitted by the Appellant indicated mark up towards profit margin and rather there is no finding that the price of goods was lower than the price of such goods in the market. Hence, the Department's order rejecting the value at which goods were sold was set aside.

Takeaway: Assessable value of transactions between related party should be determined by applying logical tests

[Bilag Industries Pvt. Ltd. & Anr. Vs. CCE, Civil Appeal No. 9195-9196/2010, Order dated March 22, 2023 (Supreme Court)]

CUSTOMS

- Containers of the exporter containing tuvar dal, red choli,

etc. which were cleared for exportation by the Customs Department

could not be physically exported due to non-availability of

shipment. Subsequently, notification amending the Import Export

Policy to prohibit export of tuvar dal, whole gram choli was issued

with retrospective effect due to which the containers were not

permitted to be exported and continued to lie at the port incurring

ground rent/demurrages charges.

The question before the High Court was whether the Department of Revenue Intelligence/Custom Authorities can be directed to pay the demurrage/ detention charges.

The High Court held since clearance certificate had already been issued for the containers before the issuance of prohibiting notification, the right of exporter to export goods couldn't have been curtailed as per the provisions of import export policy. The action of the Customs Authority detaining the goods was illegal even though they acted as per the notification issued by the Government. In absence of any provision absolving the Customs Authority from the liability arising out of illegal action, they would be liable to bear the demurrage charges.

Takeaway: Export consignments with clearance certificate not to get affected by Notification changes, when such Notification is issued after issuance of clearance certificate.

[UOI Vs. Asian Food Industries, R/Letters Patent Appeal No. 665 of 2021, Order dated February 24, 2023 (High Court, Gujarat)]

INDIA REGULATORY & TRADE HIGHLIGHTS

FOREIGN TRADE

- Import of 10000 MT of marble [under ITC (HS) Codes 2515 and 6802] allowed from Bhutan without Minimum Support Price each year, subject to valid Registration Certificates issued by the Directorate General of Foreign Trade (DGFT). The procedure for issuance of Registration Certificate to be notified separately. [Notification No. 60/2015-2020 dated March 14, 2023].

- 18 tariff lines falling under HS Code 5208 added in Appendix 4R under Remission of Duties or Taxes on Export Products (RoDTEP) for exports made from March 28, 2023. [Notification No. 63/2015-2020 dated March 25, 2023].

- Due date for mandatory electronic filing of Non-Preferential Certificate of Origin through the Common Digital Platform extended to December 31, 2023. [Trade Notice No. 27/2022-2023 dated March 28, 2023].

- Based on the final findings of the Authorized Officer i.e., the Directorate General of Trade Remedies (DGTR), vide Notification No. 22/6/2019-DGTR dated September 30, 2021, country-wise Quantitative Restrictions on import of Isopropyl Alcohol, have been notified for a period of one year i.e., 2023-24, effective from April 01, 2023 upto March 31, 2024. The Central Government may, however, review the policy and make any changes at any point, as deemed fit. [Notification No. 64/2015-2020 dated March 31, 2023].

THE DIRECTORATE GENERAL OF TRADE REMEDIES, MINISTRY OF COMMERCE & INDUSTRY

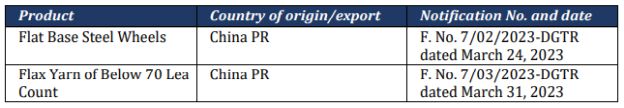

- Initiation of Sunset Review Investigation of Anti-Dumping Duty

imposed on import of:

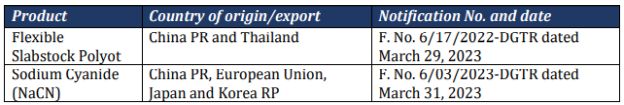

- Initiation of Anti-Dumping Duty Investigation on import

of:

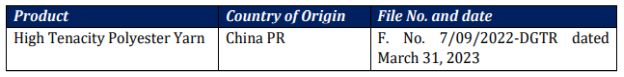

- Final Findings regarding Anti-Circumvention Investigation

concerning Anti-Dumping Duty imposed on import of:

INDIAN CUSTOMS HIGHLIGHTS

- Notification No. 50/2017 – Cus dated June 30,

2017 (Mega Exemption Notification) amended

- Food for Special Medical Purposes (FSMP) now eligible for exemption from basic customs duty (BCD) along with drugs and medicines used for treatment of rare diseases.

- BCD exemption on import of parts & raw materials for manufacture of goods for off-shore oil exploration or exploitation extended upto March 31, 2024.

- BCD exemption on import of shuttleless looms and its parts and components has been extended upto March 31, 2025. The three types of shuttleless looms eligible for the exemption are Rapier Looms (above 650 rpm), Waterjet Looms (above 800 rpm) and Airjet Looms (above 1000 rpm).

- BCD on specified types of weaving, knitting, sewing, garment panel cutter, garment making machine, ink jet printing machines, machinery for non-woven textiles along with their parts exempted upto March 31, 2025.

- BCD exemption withdrawn from import of Flat Panel Detector, including Scintillators and X-ray Tube w.e.f. April 1, 2023.

- BCD exemption withdrawn from import of raw material, parts or accessories for use in manufacturing of Medical Grade Monitor, Flat Panel Detector, including Scintillators and Xray Tube w.e.f. April 1, 2023

- BCD on drugs, medicines or FSMP used for treatment of rare diseases imported exempted subject to new conditions i.e.,

- The goods are imported by an individual for personal use;

- It is certified in the form by the Director General (DG)/Deputy DG/Assistant DG, Health Services, New Delhi; and

- The importer produces the said certificate to Customs Authorities at the time of clearance.

- Pembrolizumab (Keytruda) added in the list of life saving drugs or medicines thereby exempting it from levy of BCD.

- List of rare diseases inserted specifying 51 rare diseases.

- The above Notification is applicable w.e.f. March 30,

2023.

[Notification No. 17/2023 dated March 29, 2023]

- Notification No. 08/2020 – Cus dated February 2,

2020 (Notification dated February 2, 2020) amended

- Notification dated February 2, 2020 provides Health Cess

exemption to the following goods used in the manufacture of X-ray

machines subject to procedure set out in the Customs (Import of

Goods at Concessional Rate of Duty or for Specified End Use) Rules,

2022:

- Static User Interface

- X-Ray Diagnostic Table

- Vertical Bucky

- X-Ray Tube Suspension

- High Frequency X-Ray Generator

- X-Ray Grid

- Multi Leaf Collimator/ Iris

- Medical Grade Monitor

- Flat Panel Detector, including Scintillators

- X-ray Tube

- Health Cess Exemption to above mentioned items was available earlier as well. This amendment has been brought to align Notification dated February 2, 2023 with the amendments brought in the Mega Exemption Notification.

- The above Notification is applicable w.e.f. April 1,

2023.

[Notification No. 18/2023 dated March 29, 2023]

- Notification dated February 2, 2020 provides Health Cess

exemption to the following goods used in the manufacture of X-ray

machines subject to procedure set out in the Customs (Import of

Goods at Concessional Rate of Duty or for Specified End Use) Rules,

2022:

INDIA GST HIGHLIGHTS

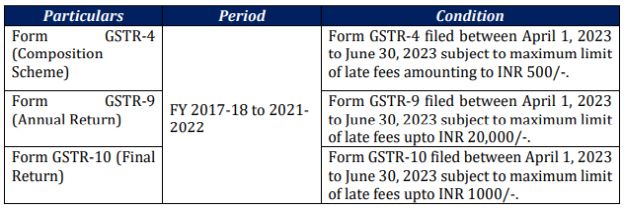

- Waiver of late fees for filing specified returns

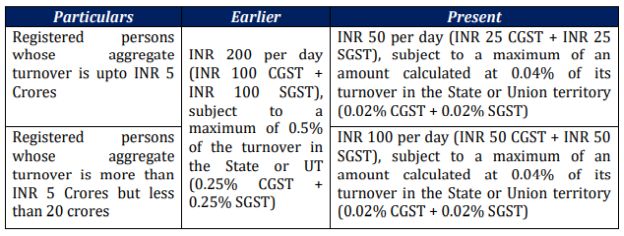

[Notification No. 2,7 & 8/2023- CT dated March 31, 2023] - Rationalization of late fees for filing annual return

from FY 2022-23 onwards

[Notification No. 7/2023-CT dated March 31, 2023]

- Taxpayers whose registration has been cancelled on or before December 31, 2022, can file an application for revocation of cancellation before June 30, 2023. Such taxpayers can file such application for revocation only after filing of returns till date of cancellation of registration and making of payment of tax, interest and penalty. [Notification No. 3/2023-CT dated March 31, 2023]

- Best judgment assessment order passed by proper officer till February 28, 2023 shall deemed to be withdrawn in case relevant return (which was due to be filed within 30 days of services of such order) is filed on or before June 30, 2023; and interest and late fees is paid thereon. [Notification No. 6/2023-CT dated March 31, 2023]

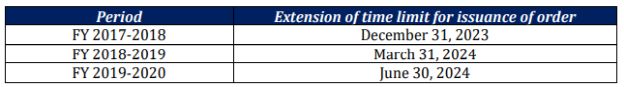

- Extension of time limit for passing order under Section

73(10) of the CGST Act

[Notification No. 9/2023-CT dated March 31, 2023] - Biometric based Aadhar Authentication and taking photograph of the Applicant has been added as a requirement under Rule 8(4A) of the Central Goods and Services Tax Rules, 2017 and would be applicable to the States as notified by the Government. [Notification No. 4 & 5/2023-CT dated March 31, 2023]

- Section 163 of the Finance Act, 2023 regarding levy of compensation cess on pan masala and tobacco on the basis of retail sale price (RSP) has been notified w.e.f. April 1, 2023. [Notification No. 1/2023-Compensation Cess dated March 31, 2023]

- Change in rate of specified goods related to tobacco and pan masala from ad valorem basis to RSP based. [Notification No. 2/2023-Compensation Cess (R) dated March 31, 2023]

- Clarification regarding rate of tax and classification

of supply of 'Rab'

- GST @ 5% is leviable on supply of Rab, when sold in pre-packaged and labelled w.e.f. March 1, 2023.

- GST is not leviable on supply of Rab when sold in other than pre-packaged and labelled w.e.f. March 1, 2023.

- Also, issue for past period i.e. prior to March 1, 2023 is regularized on 'as is' basis.

[Circular No. 191/03/2023-GST dated March 27, 2023]

MOOWR – WILL IT STILL BE A "MAKE IN INDIA" SCHEME?

The Government of India has taken various initiatives to boost and incentivize domestic manufacturing for strengthening India's economy. One such scheme is the Manufacture and Other Operations in Warehouse Regulations (the MOOWR) Scheme. Under the MOOWR scheme, the bonded warehouse manufacturer is allowed to defer the payment of import duties i.e., basic customs duty (BCD), Integrated Goods and Services Tax (IGST) and GST Compensation Cess, on the inputs until clearance of finished goods in domestic market. Further, the benefit of deferred payment of import duties was available for capital goods till the time the same were cleared for home consumption. Where the finished goods are exported, the deferred import duty on the inputs was exempt.

With this Scheme, the Government aimed to provide indigenous manufacturers a level playing field as compared to cheaper products exported by foreign manufacturers and increase the demand of Indian manufactured products in the domestic as well as international market.

The MOOWR Scheme has been amended vide the Finance Act, 2023, whereby exemption of deferred payment of IGST and Compensation Cess have been withdrawn on imports made in the custom bonded warehouse. However, the benefit of deferred payment of BCD till the time of clearance of goods still continues. Consequently, a bonded warehouse manufacturer would be required to pay IGST and Compensation Cess at the time of import of inputs and capital goods in the bonded warehouse despite having MOOWR license.

Apart from the withdrawal of benefit of deferred payment of IGST and Compensation Cess on imports, a big procedural change has been introduced in terms of which, the process of filing Bill of Entry (BOE) for warehousing first and then BOE for home consumption has been done away with. Consequently, now only BOE for home consumption is required to be filed at the time of import of inputs and capital goods in the customs bonded warehouse.

Further, input Tax Credit (ITC) of the IGST and GST Compensation Cess paid at the time of import will be available to the manufacturers which can be used in making the payment of the output tax liability, however, payment of IGST and Compensation Cess will lead to accumulation of ITC for the new manufacturers thereby blocking the working capital till the finished goods are sold in the domestic market. Needless to say, this amendment would severally impact the sectors where GST credit is not allowed or sectors where accumulation of ITC is a problem.

Moreover, the withdrawal of benefit of deferred payment of IGST and Compensation Cess at the time of import will also have an adverse effect on the working capital of MOOWR manufacturer.

While removal of filing of BOE for warehousing and directly filing BOE for home consumption would reduce the compliance burden, it has to be seen how the Government implements these changes and whether there will be a separate BOE that needs to be filed for payment of BCD at the time of clearance of goods in domestic market, or such BCD would be paid vide a payment challan under the same BOE. However, the manufacturers exporters will have to face additional compliance burden in the form of filing of refund claims w.r.t., IGST and Compensation Cess paid at the time of imports.

Given the overall scheme of things, it appears that the MOOWR scheme may not be able to attract as many manufacturers as it used to do earlier. The manufacturers ought to evaluate the merit in continuing with the MOOWR scheme. Further, the need to evaluate becomes more important in light of Advance Authorization (AA) scheme and Export Promotion of Capital Goods (EPCG) scheme being continued in the Foreign Trade Policy 2023. Thus, these schemes may become more lucrative as compared to the MOOWR scheme for the manufacturer exporters keeping in view that customs duties are not payable at the time of import under the AA and EPCG schemes.

Footnotes

1. WP No. 5569 of 2022, Order dated January 16, 2023.

2. Kafila Hospitality and Travels Pvt Ltd Vs Commissioner of ST, 2012-VIL-101-CESTAT-DEL-ST.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.