Concept of deemed dividend

Dividends traditionally have been taxable either in the hands of the company as Dividend Distribution Tax or in the hands of the shareholders as 'Income from Other Sources.' However, to avoid paying such tax, many closely held companies resorted to providing loans or advances to shareholders or to the concern in which such shareholders had substantial interest or made payments on behalf of or for the individual benefit of such shareholders. To tax such situations, the concept of deemed dividend was enacted as an anti-avoidance measure. These provisions widened the tax net and covered the above-mentioned payments as income in the form of deemed dividend to the extent of accumulated profits of the closely held company.

Section 2(22)(e) of the Income-tax Act, 1961 (the Act) is a deeming fiction that seeks to consider the following transactions briefly listed, which are otherwise not in the nature of income to be deemed dividend income, to the extent of accumulated profits:

- Any payment by a closely held company (i.e., a private company) of any sum by way of advance or loan to a shareholder, who is the beneficial owner of equity shares holding not less than 10% of the voting power (hereinafter referred to as 'such company' and 'such shareholder' respectively); (First limb);

- Or to any concern in which such shareholder is a member or a partner and in which he has a substantial interest; (Second limb);

- Or any payment by any such company on behalf, or for the individual benefit, of any such shareholder. (Third limb).

Furthermore, the term 'substantial interest' is defined under the Act to briefly mean beneficial ownership in the company's share capital, carrying not less than 20% of the voting power.

In whose hands shall deemed dividend (second limb) be taxable?

Though the definition of income was amended to include deemed dividend transactions, there was no express provision under the Act to specify in whose hands such dividend shall be taxable. The answer to this question is easier in the case of first the limb where the shareholder himself is the recipient of the 'loan' or 'advance.' However, in the case of second limb, confusion arose as to whether it should be taxable in the hands of the entity/concern who received the loan or advance in which the shareholder has substantial interest, i.e., the recipient entity or in the hands of such shareholder who did not receive such loan or advance?

This issue has been a matter of substantial litigation, where tax authorities primarily alleged the said transaction to be taxable in the hands of recipient entity, whereas the recipient entity contended the same to be taxable in the hands of shareholder. The said question of law traveled to the Courts to interpret and decide whether deemed dividends in the case of second limb shall be taxable in whose hands.

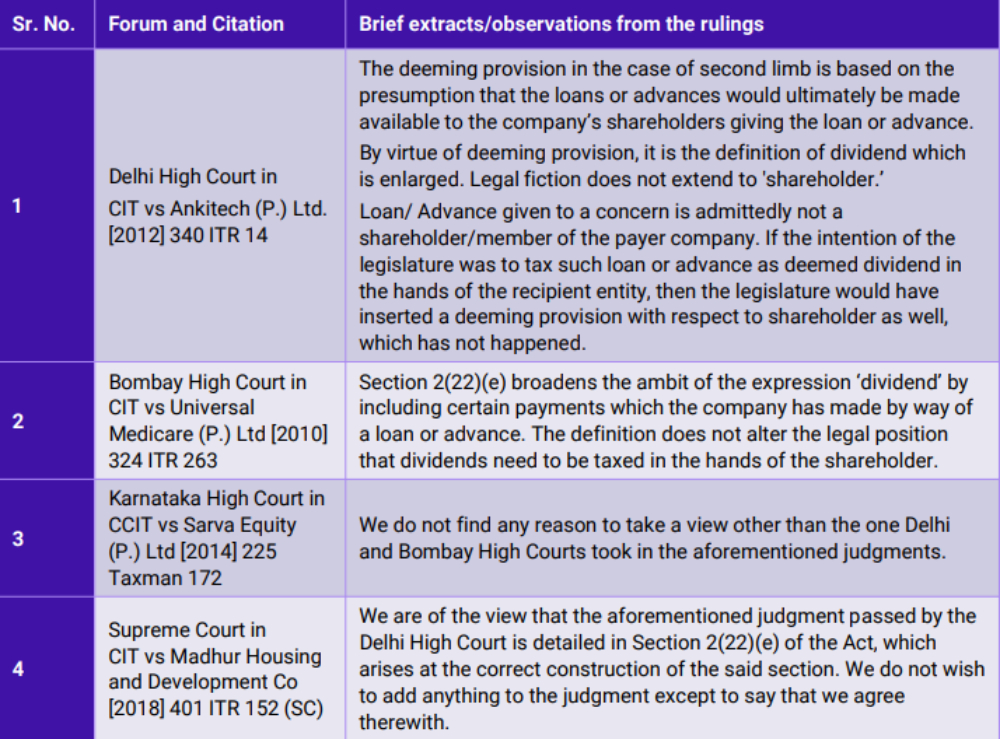

In this regard, the Courts predominantly ruled that deemed dividends in the case of second limb shall be taxable in the hands of shareholders holding a substantial interest in the recipient entity. Relevant observations of the Courts are briefly summarized below:

Hence, in case of transactions of a loan or an advance falling under the second limb, the judicial view is settled in favor of the recipient entities that the same shall be considered as taxable income in the hands of the shareholders referred to in the section and not the recipient entity.

Who shall be considered as a shareholder for the purpose of deemed dividend?

Another controversy in the context of the deemed dividend taxability is who shall be considered as the shareholder as per Section 2(22)(e) of the Act. The said question has been discussed below in light of judicial precedents:

Section 2(22)(e) of the Act in the first limb talks about the shareholder, who is the beneficial owner of shares; also, the term 'such shareholder' is used in the second limb. However, the term 'shareholder' has not been defined under the Act. Hence, confusion arose whether the shareholder shall be construed as a person whose name appears in the register of shareholders (based on reference to Companies Act, 2013), or a beneficial owner of shares without their name being registered, or should be both registered and beneficial owner of shares.

In this background, various Courts1 held that shareholders shall mean only registered shareholders. However, the said rulings were overruled by the Hon'ble Supreme Court in CIT vs National Travel Services (2018) 89 taxmann.com 332 (SC), where the Court held that "The term 'shareholder' now, post amendment, has only to be a person who is the beneficial owner of shares.

One cannot be a registered owner and beneficial owner in the sense of a beneficiary of a trust or otherwise at the same time. It is clear therefore, that the moment there is a shareholder, who need not necessarily be a member of the company on its register, who is the beneficial owner, the section gets attracted without more."

Hence, only the beneficial owner of shares shall be considered after the said ruling. The said principle and ruling were also relied upon by the Kolkata Tribunal in its recent ruling in the case of Apeejay Surrendra Management Services Pvt. Ltd2 .

Conclusion

The topic of 'deemed dividend' has been a contentious issue and has been subjected to judicial analysis and interpretation time and again. Furthermore, it is also to be noted that in a case where tax audit is applicable, a separate reporting clause (i.e., clause 36A), which has been added in recent years, requires the tax auditor to report any instances of the deemed dividend received by the shareholder having investments in closely held companies that are greater than or equal to 10% of the voting power. Thus, it is crucial to understand the concept of deemed dividend and its rigors in the hands of shareholders, even in a situation where it was not actually received by such shareholders.

Footnotes

1. CIT vs Ankitech (P.) Ltd. [2012] 340 ITR 14 (Delhi HC); CCIT vs Sarva Equity (P.) Ltd [2014] 225 Taxman 172 (Kar. HC.); CIT vs Standipack (P.) Ltd. [2012] 206 Taxman 32 (Delhi HC)

2. Apeejay Surrendra Management Services Pvt. Ltd. vs DCIT [ITA Nos.987 & 988/Kol/2023]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.