The India-Australia Economic Cooperation and Trade Agreement (ECTA) came into force on 29th December 2022. Accordingly, the Ministry of Finance notified the Rules of Origin applicable on the goods traded between the countries under the ECTA. Under these Rules, the two governments have notified the criteria to identify the goods originating either in India or Australia, in order to claim the preferential tariff rates. Further, the Rules lay down the guidelines for issuance of Certificate of Origin and for imports under the Agreement.

The members of the WTO provide preferential treatment to other member nations in the form of lower customs duties to products originating in such member countries. In such arrangements between two countries, such as free trade agreements (FTAs), preferential trade agreement (PTAs), Comprehensive Economic Partnership Agreements (CEPAs), Rules of Origin play a very crucial role. Rules of Origin are the criteria which determine the nationality of goods or where the goods were made in order to determine whether the imported goods will receive Most Favoured Nation (MFN) treatment or preferential treatment in the form of reduced duties under the respective trade agreement. Thus, they are the norms used to establish the origin of a product.

Interim agreement between India-Australia

India has entered into FTAs and CEPAs with several member countries, including Japan, South Korea, Singapore, the ASEAN and UAE, with the aim of reducing or even eliminating import duties on a number of goods in order to give bilateral boost to trade between the nations. Recently, India entered into an interim trade agreement with Australia. The India-Australia Economic Cooperation and Trade Agreement (ECTA) came into force on 29th December 2022. Subsequently, the Ministry of Finance notified the Customs Tariff (Determination of Origin of Goods under the India-Australia Economic Cooperation and Trade Agreement) Rules, 2022. The said rules provide for the criteria to determine whether goods imported into India have originated in Australia, in order to be eligible for preferential treatment. Further, the rules also lay down the conditions for obtaining Certificate of Origin for goods exported from India under the ECTA. The Rules also came into effect from 29th December 2022. The key features of the Rules are as below.

Determination of Country of Origin

The Rules provide that the following goods shall be considered as originating from Australia / India –

a. Where goods are wholly produced using materials that have been obtained or produced in Australia / India, they shall be treated as originating in that country.

b. Where goods are not wholly produced in the country, they must satisfy the following two conditions to be eligible for preferential treatment under the ECTA –

i. They must satisfy Product Specific Rules of Origin or have undergone at least a change in tariff sub-heading; and

ii. They must meet the Qualifying Value Content (QVC) requirement of not less than thirty-five percent of the FOB value as per build-up formula or forty-five percent of the FOB value calculated as per build-down formula.

The formula for calculation of QVC is as below.

(a) Build-Down Formula: based on the value of non-originating materials

![]()

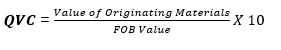

(b) Build-up Formula: based on the value of originating materials

c. Where the FOB value of material procured from other countries does not exceed 10% of the FOB value or weight of the goods being exported, such goods will be treated as originating in the exporting country.

d. Where only minimal operations have been performed on materials in the exporting country, such goods will not be treated as originating in such country.

e. Packaging materials and containers of the imported goods will not be a relevant consideration in the determination of the origin of such goods.

f. Accessories, spare parts and tools for the imported goods may be considered as originating in the exporting country subject, to some conditions.

Issuance of Certificate of Origin and imports under ECTA

In order to avail the benefit of lower customs duties under the ECTA, importers are required to present a Certificate of Origin issued by relevant authorities in India or Australia. The certificate would be valid for twelve months from the date on which it was issued and would apply to a single shipment of one or multiple goods. Such certificate must be issued before or within 5 working days from the date of exportation. It may also be issued retrospectively, in exceptional situations, with proper disclosure and reasoning.

In order to obtain a Certificate of Origin, an exporter is required to file an application along with commercial invoice and other documents outlined in Annexure A to the Rules. Such application must be made to the issuing body or authority as designated by the Governments of India and Australia. Both India and Australia were required to notify the other country of the name of such issuing body or authority along with its specimen seal and the signature of authorized signatory, latest by 28th January 2023.

As per the Rules, in order to receive the preferential tariff treatment, an importer will be required to –

i. make declarations stating that the goods qualify as originating goods;

ii. provide a valid Certificate of Origin; and

iii. demonstrate compliance of certain requirements of the Rules in case consignments have been transported directly from the exporting country or through third countries.

The exporters, importers and authorities must maintain the records of the documents for at least five years from the date of importation of the goods. The requirement for Certificate of Origin can be waived off by the importing country. The rules also allow for relaxation to importers to claim reduced tariffs by way of refund of duties paid, upto 12 months from the date of importation.

Verification of claims under ECTA

The Rules provide that the concerned authority in India may conduct random pre-export verification of the documents filed by an exporter or the Customs authority may conduct a verification process to determine the origin of the goods. In certain situations, the Customs authority may deny the preferential tariff treatment or temporarily suspend the preferential treatment in case the goods do not satisfy the criteria laid down to identify the origin of goods or where the exporter does not provide complete information, to the satisfaction of the authorities. Further, the Rules lay down measures of civil, administrative, and criminal sanctions in case of violation of customs laws and regulations.

The ECTA is intended to boost bilateral trade in goods and services between the two countries. While India is offering duty free market access to almost 90% tariff lines from Australia, India will benefit from zero customs duty on all tariff lines exported to Australia. The Rules of Origin will ensure that the goods exported under the ECTA are identifiable as goods originating in the country of export and that all procedural requirements are met therein. This will help avoid any malpractices and ensure that all bona fide traders are able to reap the benefits of the preferential tariff rates under the ECTA.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.