On May 16, 2023, the Securities and Exchange Board of India ("SEBI") issued a consultation paper to invite comments from the public and market participants on the matter of, inter alia, providing special rights to unitholders of real estate investment trusts ("REITs") and infrastructure investment trusts ("InvIT") and the role of sponsor in REITs and InvITs. In issuing this consultation paper, SEBI had a 3 (three)-fold objective, which was to determine the following, based on comments received:

Whether any unitholder should be granted special rights to nominate a representative on the board of directors of the manager/investment manager of the REIT/InvIT ("Manager/Investment Manager") in order to empower unitholders of REITs and InvITs to monitor their investment in REIT/InvIT and aid in decision making as well as to strengthen corporate governance norms and if yes, what should be the threshold percentage of holding of units to provide such special nomination right to unitholders;

Whether applicable principles of stewardship code, which is currently applicable to mutual funds and all categories of alternative investment funds ("AIFs"), should also be made applicable to members/representatives nominated by unitholders on the board of the Manager/Investment Manager; and

What is the role of the sponsor and whether the concept of self-sponsored REITs and InvITs is in the interest of unitholders.

Background

REITs and InvITs were introduced in India to provide investors with an opportunity to gain exposure to real estate and infrastructure projects, respectively, with diversification of risks through pooling arrangement. It was envisaged that REITs and InvITs would provide investors with stable distributions through their passive ownership of income producing real estate and infrastructure projects, respectively. REITs invest majorly in completed and rent generating real estate assets. Privately placed InvITs can invest in under-construction assets as well as completed and revenue generating assets while public InvITs can invest majorly in completed and revenue generating assets. Therefore, privately placed InvITs were considered suitable only for institutional investors and their primary issuance was restricted only to body corporate and institutional investors. Consequently, such InvITs typically have large holdings by very few investors and are closely held by such investors with little to no trades in the secondary markets. These institutional investors, on account of their large quantum of investment sometimes require rights to nominate directors on the board of the Manager/ Investment Manager so that they exercise a certain degree of control over the operations of the REIT or InvIT. Consequently, such special/differential board nomination rights are being granted to certain investors / incoming unitholders in the REIT/InvITs, basis their quantum of investment. Further, in a few cases, it is noted that the sponsor also retains the right to nominate directors on the board of the Manager/Investment Manager post the listing of the REIT/InvIT to continue to exercise its control over the REIT/InvIT.

Existing Regulatory Framework

Regulations 4(2)(g) of the SEBI (REITs) Regulations, 2014 ("REIT Regulations") and provide that a unitholder of REIT cannot enjoy superior voting or any other rights over another unitholder of REIT. Similar provisions are also included under regulation 4(2)(h) of the SEBI (InvITs) Regulations, 2014 ("InvIT Regulations").

The rationale behind inclusion of such provisions in the regulations is that the units of REIT and InvIT are equal in all respects and hence, no unitholder can have any special rights based on the units held by it in the REIT/InvIT. It can be concluded that the Regulations do not explicitly provide for granting of any special rights to any unitholder.

Proposed Changes

- Granting nomination rights to unitholders of REITs and InvITs

SEBI is of the belief that a strong and independent element on the board of directors of the Manager/Investment Manager of REIT/InvIT is important. Numerous representations have been made to SEBI contending that such rights will enhance governance norms, and the unitholders will have a greater say in the investment decisions and day-to-day activities of the REIT/InvIT.

To give effect to such feedback and representations, SEBI has proposed the following options to unitholders of the REIT/InvIT:

a) Nomination rights to unitholders holding certain percentage of units and above, on the board of the Manager/Investment Manager

SEBI proposed that any unitholder holding a minimum of 10% of units, will be entitled to nomination rights, i.e., for every 10% held, the unitholder will be entitled to nominate 1 (one) director on the board of the Manager/Investment manager of the REIT/InvIT. SEBI also provided some flexibility in achieving the minimum percentage requirement, by permitting unitholders who are holding less than 10% unitholding on an individual basis, to join together such that their collective unitholding meets the minimum unitholding percentage.

However, this comes with a major disadvantage as it might result in the creation of a very large board. As a consequence of a large board of directors, there might be some difficulty in having efficient meetings, a risk of lack of engagement by all directors, an inability for directors to have their voices heard, and the risk of becoming ineffective or bureaucratic, which of course, is not an ideal state for any institution.

b) Constitution of unitholders council with nominees of unitholders of REIT/InvIT holding certain percentage of units and above

To counter the effects and inefficiencies of a large board of directors, SEBI has proposed an alternate, i.e., constituting a distinct unitholders council ("Unitholders Council" or "Council") with members nominated by the unitholders holding minimum 10% of units. SEBI plans to make it mandatory for the Manager/Investment Manager of the REIT/InvIT to constitute such a Unitholders Council. As provided in option (a) above, any unitholder having a minimum unitholding of 10% will be entitled to nominate 1 (one) member in the Unitholders Council and if there are some unitholders holding less than 10% on an individual basis, they can come together such that their collective unitholding amounts to 10% or more. It is argued that such a Council might aid in improving the activities of and oversight by the Manager/Investment Manager and the nomination of members to the Council would result in enhancement of the quality of decision-making process. Further, it is important to note that, in the event a Unitholders Council has been created, the unitholders will not have the right to nominate representatives on the board of directors of the REIT/InvIT.

The regulator has also proposed a constitution for the Unitholders Council. With regards to the procedure for operation, each member of the Council is entitled to 1 (one) vote for every 10% of unitholding represented by him/her and all decisions are to be taken by a simple majority of all members present and voting. SEBI has gone a step further, to provide the areas on which the Council can decide and the manner in which such matters are to be recommended to the Council. However, the members of the Unitholders Council will be responsible for ensuring that any and all decisions taken by the Council are in compliance with the provision of REIT Regulations, InvIT Regulations, disclosures in the offer document/placement memorandum and applicable laws.

- Extending the applicability of the Stewardship Code to entities having representation on the Board/Unitholders Council

In addition to the proposals regarding nomination rights, SEBI also proposed that certain principles of the stewardship code, which is currently only applicable to mutual funds and all categories of AIFs ("Stewardship Code"), be made applicable to the entities having representation on the board of directors of the Manager/Investment Manager of the REIT/InvIT and/or the Unitholders Council, as the case may be (hereinafter referred to as "Such Entities"). Such Entities are obligated to act in the best interests of the REIT/InvIT and its unitholders as a whole; and are also responsible for formulating various policies, including, inter alia, a policy on the discharge of stewardship responsibilities, policy on managing conflicts of interest in fulfilling stewardship responsibilities, policy on intervention in the REITs/InvITs and their holding companies and special purpose vehicles.

- Role of the sponsor in REITs and InvITs

REIT Regulations and InvIT Regulations defines a "sponsor" as a person who sets up the REIT/InvIT and is designated as such at the time of application for registration. SEBI, on February 23, 2023, issued a consultation paper on "Holding of Sponsor in REITs and InvITs" inviting comments from the public on, inter-alia, the proposal to have at least one sponsor throughout the life of the REIT/InvIT and mandating the sponsor to hold a certain percentage of units in the REITs/InvITs on a perpetual basis.

Keeping in line with the suggestions and comments received from the market participants, SEBI has also proposed the following changes to the role of the sponsor in REITs and InvITs:

a) Providing a maximum cap on the locked-in units, in terms of the amount; and

b) Provision of self-sponsored REITs/InvITs.

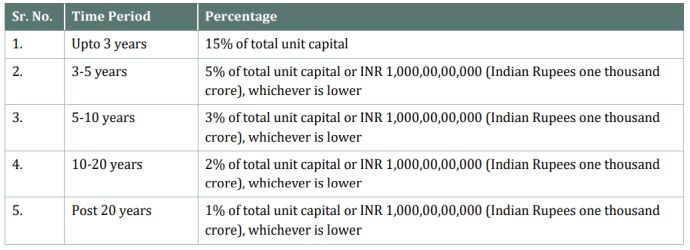

As opposed to the locked-in units being a certain percentage of the total unit capital, the revised lock-in requirements as given as under:

Further, SEBI received feedback from the market participants, stating that there may be certain REITs and InvITs which have evolved beyond substantial dependencies on the Sponsor and hence, the regulator proposed to introduce a framework for self-sponsored REITs and InvITs which will, besides creating space for independent and professionally managed Managers/Investment Managers to emerge, also provide an exit option for the sponsor in addition to the exit option currently envisaged under the REIT Regulations & InvIT Regulations. In order to give effect to the same, SEBI has listed certain conditions which would have to be met by the Manager/Investment Manager, for becoming a self-sponsored REIT/InvIT and has provided some flexibility in complying with such conditions. However, it is noteworthy that if these proposed changes are accepted, it would result in the deletion of the present declassification norms given under regulation 7A of the REIT Regulations and InvIT Regulations.

JSA Comment

While the consultation paper is an attempt to bridge the gap between the expectations of incoming investors of REITs/InvITs and the prevailing law, it merely addresses the tip of the iceberg. At present, majority of the REITs/InvITs listed in India comprise majorly the assets which were earlier with the sponsor or the sponsor group. The future acquisition of assets and growth is also deeply reliant on contribution of assets from the sponsor and sponsor group to the trusts. We still have a long way to go before we conclude whether REITs and InvITs can be run without their sponsor in long term. A deep dive into the Manager/Investment Manager will show that the control of such Manager/Investment Manager is primarily retained by way of equity or other interest, by the sponsor and sponsor group enabling them to run the show by appointing the directors on the board of the Manager/Investment Manager. The consultation paper fails to answer the major query as to if the shareholder of the Manager/Investment Manager can appoint directors on the board of the Manager/Investment Manager basis the rights the shareholder has under the Companies Act, 2013, enabling it to circumvent the REIT Regulations and the InvIT Regulations. Further, a 10% threshold for appointment of directors on the board of the Manager/Investment Manager will mean that there can be a board of 20 (twenty) directors which will include 10 (ten) independent directors and 10 (ten) nominee directors as at least half of the InvIT board must comprise independent directors. The regulations do not answer if the incoming nominee directors of the unitholders will be able to perform executive functions of the trust in a proactive manner or will they solely be working for the interest of their nominating investors. Accordingly, we believe that there is still room for further clarity on these aspects.

Securities Law Practice

JSA has an active Securities Laws practice that covers (a) acquisitions involving the takeover regulations and taking companies off the stock exchange under delisting regulations; (b) advisory services to listed companies; and (c) advisory work for securities market intermediaries ranging across stock brokers, merchant bankers, mutual funds, venture capital funds, alternate investment funds, asset management companies, underwriters and the like, for statutory and regulatory compliance, registrations with the Securities and Exchange Board of India (SEBI).

JSA is adept at handling proceedings before the Securities Appellate Tribunal (SAT), SEBI, stock exchanges, High Courts of different states and the Supreme Court. The firm has handled a wide variety of matters dealing with violation of provisions of SEBI (Prevention of Insider Trading) Regulations, SEBI (Prevention of Unfair Trade Practices) Regulations, SEBI (Stock Exchanges and Clearing Corporations) Regulations, SEBI (Intermediaries) Regulations, etc. The firm regularly advises high net worth individuals, listed entities, brokers and other intermediaries, private equity firms, mutual funds, key managerial personnel of intermediaries, etc.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.