Co-working is a business model in which businesses work independently or collaboratively in shared spaces. Having a physical premise to carry on business activities is a major constraint for most of the businesses in the service sector. Co-working of spaces is the most feasible solution for startup founders or freelancers or any small service providers who do not want to invest in office premises and burn the cash flow.

As per the provisions of the GST Act, any person supplying goods or provider of services exceeding the specified threshold limit of turnover is liable to get themselves registered. One of the important documents to be submitted for registration is the address proof of the principal place of business. Usually, in the case of owned premises, monthly utility bills and in case of rented or leased premises rent or lease agreement suffice to be the address proof. However, the main problem arises in the case of co-working spaces, where companies operate from the same shared spaces. GST Authorities have refused to grant registration to such co-working space owners, because already another company is registered at the same address. This approach of the authorities was to stop the practice of illegal registration and prevent leakage of revenue by generating fake invoices and claiming input tax credit which existed on papers only.

In a recent ruling by, The Kerala Authority for Advance Ruling, Goods and Service Tax Department, Thiruvananthapuram in the case of M/s Spaceline Office Solutions Pvt Ltd. AAR held that, in this fast-changing world traditional office culture is being replaced by virtual offices and is the only option for small businesses and start-up founders to operate at lower cost. GST Act does not prohibit registration to shared office space or virtual offices, if the landlord permits such sub-leasing. GST registration is based on PAN and so, identification of the taxpayer is not a problem if such shared spaces are demarcated with separate suit or desk numbers. AAR further held that, rent agreement between the landlord and lessee along with agreement between lessee and sub-lessee shall be uploaded as address proof of principal place of business. Monthly utility bill in connection with payment for the common services availed by the respective suit or desk number shall also be uploaded.

Kerala Authority for Advance Ruling states that an agreement between lessee and sub-lessee shall be uploaded as address proof. In practical life, lessee and business owners of such shared premises do not enter into a formal agreement. Generally, a memorandum of understanding is signed between both the parties. Similarly, the ruling makes it mandatory for demarcation of separate suit or desk number for a particular business. This again becomes impossible if the space is used by one business for some days of the week and by another business for the rest of the week.

Considering the hardships faced by the genuine businesses using these shared premises, necessary amendments have been made to the GST REG-01- Application for Registration.

Business owners in co-working space can choose "Nature of premises as- Shared" in Form GST REG-01, while applying for registration.

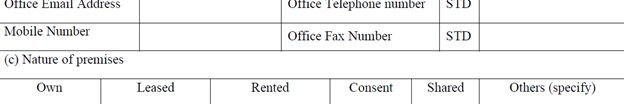

In column No. 16, Address of principal place of business – point (c ) Nature of premises – gives the option to select Shared. Relevant extract of the form is as follows:

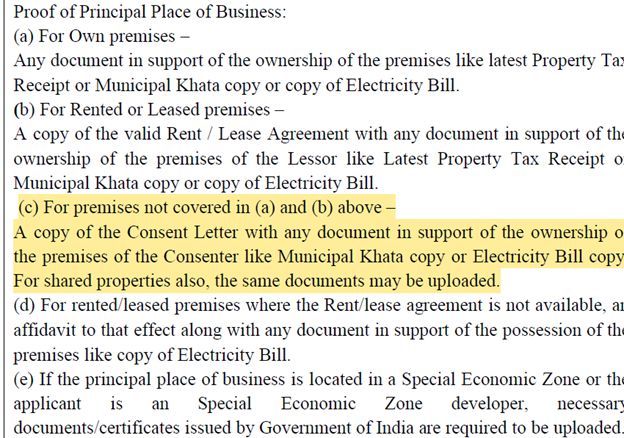

Furthermore, in the list of documents to be uploaded as mentioned in Form GST -REG 01, it is stated that where the premises are not owned or rented or leased, a copy of consent letter from the owner of the premises along with utility bill in the name of owner can be uploaded as proof of principal place of business.

Relevant extract from Form GST REG – 01 is highlighted for reference.

In order to ease difficulties of the business owners on the grounds of technicalities in the procedure of obtaining registration, GST council has simplified the process by specifying the bare minimum requirement and adding "Shared premises" as the one of the option to be selected in "Nature of premises".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.