Companies that wish to establish GCCs in India should carefully consider the various contracting models used to engage a local or international service provider.

TAKEAWAYS

- Under a services agreement model, the GCC will be solely owned by the Company.

- A joint venture model combines the elements of the service agreement model with the added layer that the service provider will hold a minority equity interest in the GCC.

- A joint venture model combines the elements of the service agreement model with the added layer that the service provider will hold a minority equity interest in the GCC.

Global Capability Centers (GCCs) located in India continue to evolve from labor arbitrage and cost savings initiatives to innovation centers for digital transformation, supporting cloud, mobile, data security, data analytics, AI, automation and other emerging technologies. Companies looking to establish a GCC in India (Companies) often engage a local or international service provider with in-country expertise, experience and professional connections (Facilitators) to facilitate setting up and operating the GCC.

A Facilitator may offer a range of services, including: (i) planning and setup services for the GCC, such as entity formation, registrations and regulatory filings, account openings, location selection, facility design and branding; (ii) ongoing back-office services supporting the operation of the GCC, such as finance and accounting, HR, talent acquisition, tax and regulatory compliance, procurement and local IT support; and (iii) provision of office space and related workspace services.

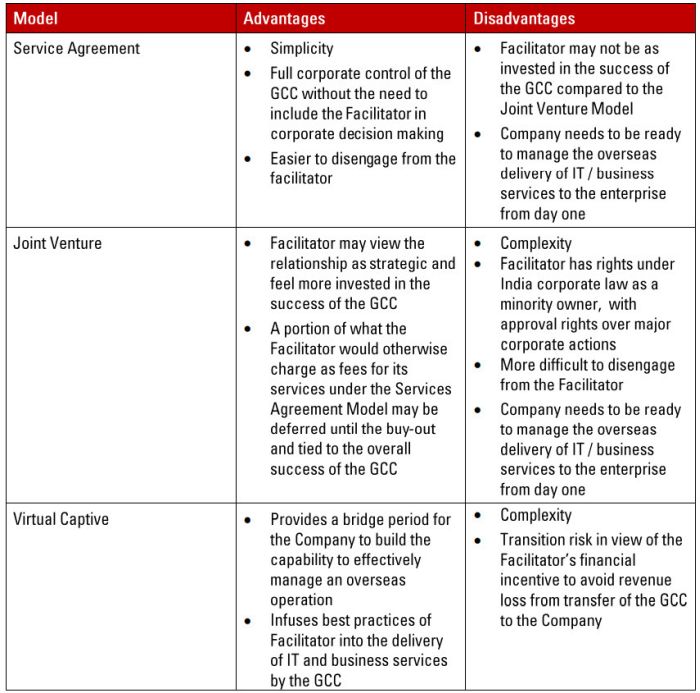

There are a variety of contracting models that can be used when engaging a Facilitator. This article outlines three of the more common ones: (1) services agreement model; (2) joint venture model; and (3) virtual captive model. Selecting the right model is a key decision for a Company in establishing a GCC, particularly when the GCC will serve a central strategic role for the enterprise.

Services Agreement Model

Under the services agreement model, the GCC will be solely owned by the Company. The Company will typically enter into a services agreement (or Statement of Work under an umbrella master services agreement) with the Facilitator for the planning and set up of the GCC and, once the GCC has been established, a separate services agreement (or Statement of Work) between the GCC and the Facilitator for ongoing back-office support services for the GCC. To reduce liability exposure, Companies will often use special purpose entities (SPEs) to hold their ownership interest in the GCC and in contracting with Facilitators.

The services agreement(s) with the Facilitator should include a robust description of the services to be provided by the Facilitator, service levels and other performance standards, intellectual property rights and data protection provisions, compliance obligations, indemnities, termination rights and disengagement assistance, and other provisions that are customary in sourcing transactions. In addition, the services agreement(s) should address issues that are of particular importance to GCCs, including the following:

- SEZ Compliance: If the GCC will operate in a special economic zone (SEZ), the Facilitator will be responsible for assisting the Company in securing SEZ status and the services agreement(s) should include commitments by the Facilitator to maintain that status.

- FCPA Compliance: The Facilitator will have responsibility for dealing with governmental agencies in India on behalf of the GCC, such as securing approvals in setting up the GCC and ongoing corporate and tax compliance. The Company should obtain commitments from the Facilitator to perform these activities in compliance with the Foreign Corrupt Practices Act (FCPA), the India Prevention of Corruption Act, and other applicable laws and regulations. U.S.-based Companies should implement an FCPA compliance program and require the participation of employees of the Facilitator who are involved in the operation of the GCC.

- India Goods and Services Taxes: Services provided by the Facilitator to the GCC in India will be subject to goods and services taxes (GST) under the India Goods and Services Tax Act; however, services delivered to businesses operating in an SEZ are "zero rated" (and therefore not taxed). The services agreement(s) should include provisions designed specifically for GST.

- Real Estate: Demand for desirable office space is high in technology hubs such as Bangalore. As a result, it is important to secure favorable long-term lease arrangements in setting up a GCC. If the Facilitator is furnishing the office space to the GCC as part of its offering under the services agreement(s), the Company should obtain an option to convert the office space into a long-term lease upon expiration or termination of the Facilitator's other services to the GCC. The key lease terms can be set forth in the services agreement(s) and/or the parties can agree on a form of lease deed.

- Governing Law/Dispute Resolution: Services delivered in India by the Facilitator to the GCC will be governed by India law; however, the parties have flexibility in selecting the forum and location of dispute resolution and Companies should require arbitration in their home country.

Joint Venture Model

The joint venture model combines the elements of the service agreement model with the added layer that the Facilitator will hold a minority equity interest in the GCC. In addition to the services agreement(s) described above, there will be a joint venture agreement setting forth the rights and obligations of the parties with respect to the governance of the GCC and the parties' ownership interests in the GCC. The joint venture agreement will provide for the formation of either a private limited corporation (PLC) or a limited liability partnership (LLP) in India as the GCC entity, with an agreed upon split of ownership interests. Either corporate formation or partnership formation documents, consistent with the terms of the joint venture agreement, will need to be prepared and filed with the India Ministry of Corporate Affairs. Typically, the parties to the joint venture agreement and holding interests in the PLC or LLP will be SPEs of the Company and the Facilitator.

The Company will hold a majority equity interest in the GCC and control decision-making by its governance bodies (e.g., board, executive committee). Notably, the Facilitator will not be a traditional joint venture partner with ongoing capital contribution obligations and upside and downside risk based on equity interests.

Under the joint venture model, there will be a mandatory buy-out of the Facilitator's interest in the joint venture at a specified time (typically, five to seven years from contract signing) and upon certain key events, such as termination of the services agreement(s). The Company may also have the right (but not the obligation) to buy out the Facilitator's interest in the GCC upon the occurrence of certain other events, such as breach of contract or change of control of the Facilitator. In addition, the Company should negotiate a right to purchase the Facilitator's interest for convenience at any time, subject to a reasonable premium on the buy-out price.

The buy-out price will often be based on metrics tied to indicators of success of the GCC, such as growth in GCC headcount, cost savings, and/or service level achievement by the Facilitator in supporting the GCC. To avoid a contentious dispute at the time of the buy-out (when the Facilitator may not have an incentive to act as a motivated business partner), the buy-out formula should be defined with precision using metrics that are easily measurable. The Company should require that the accrued value of the buy-out price be measured and signed off on periodically (e.g., quarterly) by the parties.

Virtual Captive Model

The virtual captive model is a hybrid model that provides a bridge period during which the Facilitator sets up, owns and operates a "virtual" GCC that is dedicated to providing IT and business services to the Company until the Company is prepared to assume ownership and operation of the GCC. Facilitators under the virtual captive model are typically large service providers with substantial operations in India (e.g., Accenture, Deloitte, TCS). Unlike the services agreement and joint venture models in which the Facilitator only supports the back- office operations of the GCC, a Facilitator under the virtual captive model will be directly involved in the provision of IT and business services to the Company.

During the bridge period, the Facilitator will furnish the personnel resources required to deliver the desired IT and business services to the Company, subject to significant input and approval rights by the Company. The Facilitator will also be tasked with infusing best practices and the Company's culture into the operations of the GCC. While most of the personnel furnished by the Facilitator will be hired specifically for and remain with the GCC, the Facilitator may also "seed" the GCC with certain personnel who will be retained by the Facilitator following transfer of the GCC to the Company.

The virtual captive model is documented in a services agreement between the Facilitator and the Company. Similar to outsourcing agreements between U.S. and other western Companies and India service providers, the agreement is typically governed by the laws of the Company's home country.

The services agreement will include an option for the Company to assume ownership and operation of the GCC at a specified time (e.g., two to three years after contract signing) or upon the occurrence of specified events. The Facilitator may not want to see this option exercised as it will lose a potentially large revenue stream upon the transfer of the GCC to the Company. It is therefore important that the structure and terms of the transfer be described in detail in the services agreement. Key questions to be considered upfront and addressed in the services agreement include:

- Corporate/Tax: How will the transfer be structured (e.g., share transfer, asset transfer or business transfer) in light of corporate and tax considerations?

- HR Transfer: How will the transfer of personnel be accomplished (e.g., a Section 25FF transfer without entitlement under the India Industrial Disputes Act or a transfer under a termination/resignation and re-hire model)?

- Real Estate: Will office space of comparable quality be available for the GCC following the transfer at the same location or in close proximity to the location used prior to the transfer in order to avoid a disruptive relocation that could result in significant loss of GCC personnel?

- Intellectual Property: What license rights will the Company have to intellectual property used by the Facilitator in the GCC prior to the transfer (e.g., proprietary processes, methodologies of the Facilitator)?

- Back-Office Operations: How will back-office functions of the GCC (e.g., finance and accounting, HR, procurement and regulatory compliance) that were handled by the Facilitator's internal organization prior to the transfer be performed following the transfer?

Is There a Preferred Model?

There are advantages and disadvantages to each of the contracting models described above that Companies should consider in selecting the model that is best suited to meet their objectives.

Careful planning and execution are required for any of these contracting models to be successful. Companies should consult with expert legal advisors before agreeing to a particular contracting model.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.