INCOME TAX

Changes in ITR for AY-2019-20 as compared to AY-2018-19

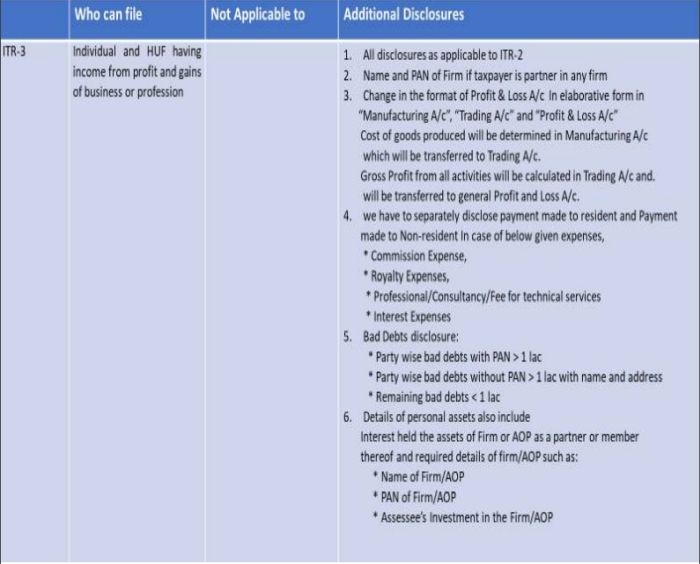

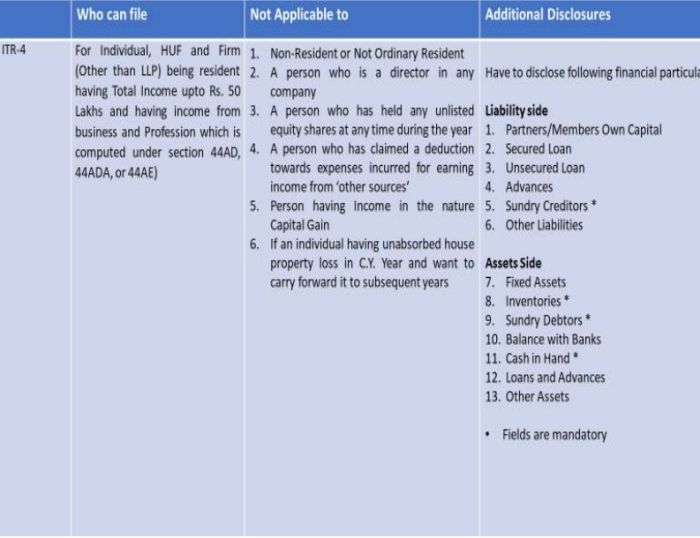

From the Assessment Year 2019-20 and onwards the forms for filing Income Tax Returns have been changed. There is substantial amount of additional information is required from specific category of persons including the persons having 'Capital Gains' during the financial year. Following is the chart that depicts what information is required to be disclosed by which category persons.

AUDIT

SA 720- Auditor's reporting responsibilities on Other Information included in entity's Annual Report

A. Brief Introduction:

The auditor's opinion on the financial statements does not cover the other information, nor does. SA 720 (Revised) require the auditor to obtain audit evidence beyond that required to form an opinion on the financial statements. As per this SA, other information defined as financial or non-financial information (other than financial statements and the auditor's report thereon) included in an entity's annual report. The SA 720 (Revised) requires an auditor to read and consider the other information to ascertain the cases where:

- There is a material inconsistency between the other information

- and the financial statements

- There is a material inconsistency between the other information and the auditor's knowledge obtained in the audit.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.