Central Bank Digital Currencies (CBDCs) are a hybrid between physical banks and digital money. CBDCs are a form of digital currency which must be issued and regulated by a country's central bank, the value is fixed by said central bank and is equivalent to the country's fiat currency (a currency declared as legal tender however has no fixed value and is not backed by a commodity). The relevancy of CBDCs is ever-growing due to the direction our society is taking, we are heading further towards a cashless society with a preference for electronic transactions, hence demand is being created for CBDCs.

To further understand CBDCs they should be compared to crypto-assets and stablecoins. Stablecoins and crypto-assets are issued privately whereas CBDCs are state issued and operated. Furthermore, crypto-assets are often said to be volatile, whereas CBDCs are potentially more stable as argued by the Bank of England.

CBDCs cater for a wide market, this is clearly displayed by their categorisation into two types, thus demonstrating that they not only target financial institutions:

- Wholesale CBDC: Type of CBDC specialised for financial institutions, used commonly for interbank settlements and associated wholesale transactions. These will make cross-border transactions faster and easier; and

- Retail CBDC: Distributed directly to individuals from a central bank.

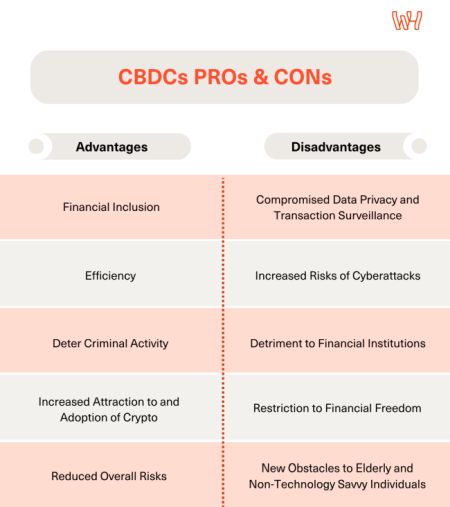

There are numerous arguments on whether CBDCs are viable. There are multiple advantages carried by opting for CBDCs, however it may be argued that they are a double-edged sword and with many of these advantages comes a contrasting view with significant disadvantages.

Advantages

Financial Inclusion

Credited digital wallets can be accessed on a variety of digital/electronic devices (mobiles, iPads, laptops, tablets etc.), this enables individuals to utilise financial services from more remote areas and at ease. By being more accessible, convenience and ease are heightened, therefore individuals are better able to participate in the economy and are more likely to do so due to its accessibility. Although, as discussed later there are implications to having an online nature, potentially having the opposite effect, and limiting access.

Efficiency

By reducing our dependency on banks, CBDCs consequently enhance efficiency, especially in comparison to our current banking sector. They minimise transaction fees, simplify the transaction process, and cut out an extra point of communication. Being centralized and controlled by central banks means that the issuing authority is capable of tracking and controlling the currency, therefore making the currency more manageable. Consequently, central banks can control money and thus manage the economy, this may involve changing interest rates thus preventing inflation. Additionally, the distinction between wholesale and retail CBDCs creates a more efficient system because it strictly categorises the target audience, the transaction scale, their privacy and anonymity measures and the desired technology infrastructure, therefore forming a devised and efficient system.

Deter Criminal Activity

Likely to be argued as the largest benefit of CBDCs is the reduction and deterrence of criminal activity. Financial fraud and tax evasion are the most prominent forms of white-collar crime, however there is potential for them to be reduced with the introduction of CBDCs. Digital wallets require a person's account to be backed with identification, making it easier to track and identify individuals. Furthermore, due to the online nature, it is far easier to trace individuals' transactions and thus the potential for financial fraud will be greatly reduced. Additionally, the use of a digital wallets avoids criminal issues caused by physical cash, such issues consist of, money laundering, tax evasion and counterfeiting. Many of the problems physical cash cause is due to its untraceable nature, this has large effects on the prevalence of criminal activities as individuals are aware that they can conduct crime without detection or tracing, hence why digital wallets would reduce prevalence.

Increased Attraction to and Adoption of Crypto

CBDCs have the potential of bringing an increased interest into the crypto industry, which may lead to the mass adoption of crypto assets, encouraging more people to become involved in digital finance. With 130 jurisdictions in the process of implementing CBDCs, there is likely to be an even greater attraction to crypto as we are slowly moving towards digitalisation. Having CBDCs accessible is likely to continue to grow this market and further encourage individuals to become involved with other digital currencies (such as crypto-assets). Additionally, the Retail CBDC is likely to attract a new market, as it is designed to target individuals and not financial institutions. These individuals may not necessarily have been involved in the financial market previously thus attracting a new audience.

Reduced Overall Risks

CBDCs do not only reduce criminal risks but they also reduce counterparty risks which include risks of delay and risks of trading private information. Counterparty risks are lessened as transactions are dealt with through the central bank, therefore meaning that it is not possible for an individual to not receive outstanding transactions. This is a large benefit as it means that there is zero counterparty risk, and one does not need to worry about another defaulting on payments which is an enticing characteristic of CBDCs. Likewise, Central banks will not be allowed to share/sell data and therefore the risks of your personal data being traded are greatly diminished, however this is not to say that there will not be large risks of cyber-security hacks and data privacy which will be discussed in turn.

Disadvantages

Compromised Data Privacy and Transaction Surveillance

Perhaps one of the biggest concerns with CBDCs is the implications it will have on user privacy. With CBDCs, transactions will most likely take place through a digital wallet which will be secured by the national central bank, thus all transaction data, even small day-to-day payments, will be processed and stored on the ledgers of central banks which could lead to governments having access to payment data. Even if central banks were to implement features which can hide certain transaction data such as the details of the payor and payee, digital transactions will not offer complete privacy like cash transactions do since every transaction will have a digital footprint which can easily be traced.

While states are required to comply with obligations set out under the GDPR, governments could still abuse of this power and monitor transaction data under the excuse of crime prevention, inflation control or management of economic instability. Although this can be beneficial at times, transaction surveillance will inevitably compromise user data privacy and economic freedom.

Increased Risk of Cyberattacks

Shifting public money into the digital sphere will undoubtedly expose the vulnerability of CBDCs to system attacks just like any other digital payment system. CBDCs will be particularly vulnerable since they have central bank backing, making them a stable form of digital currency. Furthermore, CBDCs will also be highly susceptible to hacks due to the fact that the payment information of the citizens of an entire country will be conveniently gathered in the database of the central bank. Central banks will need to be cautious of the possibility of such attacks arising to ensure that there are the proper security protocols in place as hacking of transaction data may lead to loss of funds, theft of personal information or even disruption of the central bank's financial system.

Detriment to Financial Institutions

Given that CBDCs will be issued by the central bank, it is likely that CBDC balance will also be directly held by the issuing central bank. If central banks become the holders of individuals' digital money, this could lead to less money going into financial institutions, negatively impacting the profitability and stability of licensed institutions such as PSPs and EMIs. With the introduction of CBDCs, financial institutions will need to rival central banks to mitigate loss of revenue. With less funds reaching these financial institutions they may be forced into reducing their operational output meaning that several employees may lose their jobs and the quality of services will be considerably reduced.

Ideally, financial institutions are allowed to take this as an opportunity to broaden their horizons and work alongside governments in this digital transformation. For instance, PSPs may be interested in offering digital wallets for clients to hold CBDCs, thus integrating CBDC into the private sector.

Restriction to Financial Freedom

While it cannot yet be said with absolute certainty, it may very well be the case that the introduction of CBDCs brings about new limitations to citizens' financial freedom if governments decide to impose spending caps or transaction limits in relation to payments made using CBDCs. Governments may be inclined to establish these restrictions in times of crisis when specific industries require additional help and even as precaution to prevent crimes such as money laundering and financing of terrorism from taking place.

In Malta, we have seen this happen already with physical cash, with the government imposing a €10,000 transaction cap on cash payments in an attempt to curb money laundering. With CBDCs, governments might be tempted to do the same by exploiting their privileged position to track their citizens' spending habits, imposing minimum or maximum transfer amounts on digital wallet owners.

New Obstacles to Elderly and Non-Technology Savvy Individuals

Being digital currencies, CBDCs will be accessed and transacted entirely electronically through the digital wallets which will be made available to users. This can pose great difficulties to persons who struggle to use technological devices such as elderly persons and individuals who do not own smartphones. As CBDCs become more widely accepted and used throughout the globe, it is important that governments ensure that physical cash remains available and is not replaced by its digital counterpart to avoid having a part of the population feeling excluded. Furthermore, should CBDCs be introduced, digital wallets should be user-friendly and easy to navigate, to encourage as many people as possible to start making use of them.

Despite the many concerns which are attached to CBDCs, its introduction is highly anticipated by many for the potential this digital transformation has to solve many of the problems currently being faced with digital payments. With over 130 jurisdictions currently at varying stages of exploring the idea of introducing CBDCs, we can expect to see the first CBDCs being introduced in the near future. In Europe, we can expect the digital euro to start being developed in the coming months after the Commission's legislative proposal was published last June. For more information about the digital euro read our recent article here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.