I. Background of the New Freelance Act in Japan

For a long time, issues have surrounded freelancers or persons who do various kinds of work but are not covered by employment contracts. As self-employed workers, freelancers have been traditionally excluded from social protections, such as those afforded by labor laws and social security, and they are often taken advantage of given their vulnerable position.

Recently, however, work styles have been drastically diversifying, and in particular, new forms of work utilizing technology, such as platform work and gig work, are becoming common not only in Japan but also all over the world. In fact, the population of freelancers in Japan has been increasing, and as of 2022, the number of people whose main livelihood is freelancing is estimated to be around 2.09 million, accounting for 3.1% of the entire working population.1 Hence, as a matter of course, there have been growing calls to protect freelancers.

The laws that protect freelancers include the "Act on Prohibition of Private Monopolization and Maintenance of Fair Trade"2 and the "Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors"3 (the "Subcontract Act ") to the extent they apply to transactions with freelancers. However, these laws do not provide freelancers sufficient protection.

To provide freelancers sufficient protection by creating an environment where they can work stably, the "Act on Improvement of Transactions between Freelancers and Undertakings,"4 or the so-called "Freelance Act" (the "Freelance Act"), was enacted on April 28, 2023, and promulgated on May 12 of the said year. The Freelance Act will take effect on November 1, 2024.

On May 31, 2024, the Cabinet Order, Rules of the Japan Fair Trade Commission (the "JFTC"), Ordinance of the Ministry of Health, Labour and Welfare (the "MHLW"), and guidelines were then published by the JFTC and the MHLW.

II. Outline of the Freelance Act

As described below, the Freelance Act provides freelancers certain protections similar to those contained in the Subcontract Act and labor related laws, and enables authorities to address violations of the Freelance Act.

1. Covered transactions

The Freelance Act applies to any "business consignment" by a consignor to a "specified consignee" (hereinafter referred to as a "freelancer" for ease of understanding)

Article 2.1 of the Freelance Act defines a freelancer as follows:

| Freelancer (Specified consignee) |

(a) The counterparty in a business consignment, and |

| (b)-(i) an individual with no employee;5 or (b)-(ii) a company with no officer (other than a legal representative) and no employee. |

A "business consignment" is defined as "an entrepreneur's agreement that entrusts to another entrepreneur the manufacture (including processing) of goods or the creation of information-based products as a part of its business" or "an entrepreneur's agreement that entrusts to another entrepreneur the provision of a service as a part of its business (including having another entrepreneur provide a service for its own services)."6 The entrepreneur making the business consignment shall be referred to herein as the "consignor."

Unlike the Subcontract Act, however, the Freelance Act has no capital requirement for it to apply to the parties involved. In addition, the transactions subject to the Freelance Act (i.e., any business consignment) are broader than those subject to the Subcontract Act.7

Moreover, as one can expect from the definition of a freelancer provided earlier, it could prove to be extremely difficult to determine whether every counterparty to a business consignment is a freelancer under the Freelance Act because there seems to be no other way but to ask each counterparty about its number of employees. Such information is not registered in the commercial registration of a company.

Therefore, it may be more practical to assume and treat micro-enterprises, including individuals, as freelancers under the Freelance Act and comply with the requirements thereof, rather than check each and every counterparty to determine whether or not it is a freelancer.

2. Regulations similar to the Subcontract Act

(a) Obligations of a consignor

- Obligation to clearly state the terms of the business

consignment8 (Article 3.1 of the Freelance Act)

When consigning a business to a freelancer, (i) the terms of the consignment, (ii) amount of the remuneration, (iii) payment date, etc., must be clearly indicated in writing or by electromagnetic means.

- Payment obligation (Articles 4.1 and 4.5 of the Freelance

Act)

The payment date must be fixed within sixty (60) days9 from the day the consignor receives the work from the freelancer or the day the freelancer provides the service. Payment must be made by such date.

(b) Prohibited acts

For any business consignment that lasts longer than the period specified in the Cabinet Order (i.e., one (1) month), the following acts are prohibited (Article 5 of the Freelance Act).

- Refusal to receive the work without any reason attributable to the freelancer;

- Reduction of remuneration without any reason attributable to the freelancer;

- Return of the goods without any reason attributable to the freelancer;

- Unjust setting of the remuneration at a level that is conspicuously lower than the price ordinarily paid for the same or similar type of work;

- Coercing the freelancer to purchase or use designated goods or services without any justifiable reason;

- Causing the freelancer to provide economic gain that unjustly injures its interests; and

- Causing the freelancer to change the content of the work or do a re-work without any reason attributable to the freelancer and which unjustly injures its interests.

3. Regulations similar to labor related laws

- Display accurate and up to date recruitment information in advertisements (Article 12 of the Freelance Act)10

- Give consideration for pregnancy, childbirth, childcare, or caregiving for any business consignment that lasts longer than the period specified in the Cabinet Order (i.e., six (6) months) (the " Continuous Business Consignment "), if requested, so that the freelancer can balance such circumstance and the work (Article 13 of the Freelance Act)

- Establish a consultation system and take measures to prevent harassment to ensure that the work environment is free from sexual harassment, maternity harassment, power harassment, etc. (Article 14 of the Freelance Act)

- Give prior thirty (30) days' notice of termination or non-renewal of a contract for a Continuous Business Consignment (Article 16 of the Freelance Act)

However, the prior notice requirement above would not apply if it has become difficult to give such notice due to a natural disaster or any other compelling reason, or in the cases specified by the Ordinance of the MHLW, such as where it is necessary to terminate an agreement with the freelancer immediately due to a reason attributable thereto. However, please note that the guidelines state that this should be limited to very serious and extreme cases from the viewpoint of protecting freelancers. Therefore, contracts with freelancers are recommended to be reviewed because immediate termination clauses may be considered to violate the Freelance Act.

4. Enforcement

Freelancers may request the relevant authorities11 to take appropriate measures if there is any factual circumstance that is in violation of the provisions of the Freelance Act (Articles 6 and 17 thereof). Such authorities have the power to investigate, conduct on-site inspections, give guidanc e or recommendations, issue orders, etc. (Articles 7-9, 11, 18-20 of the Freelance Act). In case of any violation of any administrative order, a fine of up to 500,000 yen could be imposed and there is a dual penalty clause that punishes both the violating employee and the employer thereof (Articles 24 and 25 of the Freelance Act).

5. Summary of the Freelance Act

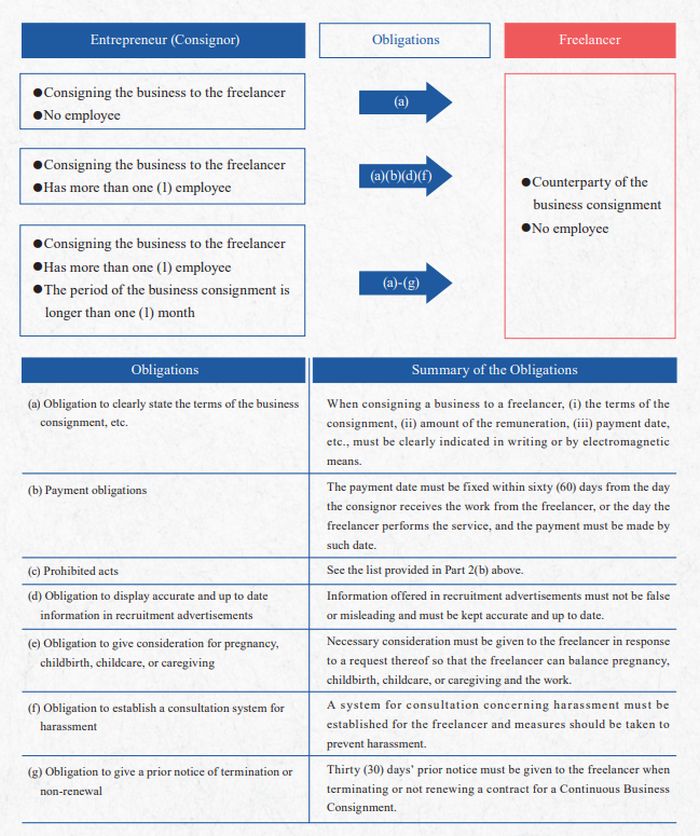

Below is a summary of the Freelance Act.

6. Remaining Issues

The enactment of the Freelance Act is a major step towards protecting freelancers and should be praised as such, however, the following important issues remain unresolved.

(a) Disguised freelancers

There has been a growing social issue concerning companies bringing in freelancers to have them work like their employees, i.e., "workers" under the Labor Standards Act,12 but without employee benefits. If someone is a "worker" under the Labor Standards Act, he or she is protected by various labor related laws, such as the Labor Standards Act, the Labor Contracts Act,13 the Industrial Safety and Health Act,14 and the Labor Union Act.15 Workers are also afforded social security. Under the Freelance Act, if someone who has been treated as a freelancer is found to be a "worker," then the Freelance Act would not apply to such "worker" and, instead, such "worker" must be protected by the various labor related laws mentioned above.

The determination of whether or not a person is a "worker" under the Labor Standards Act is made by comprehensively considering various items,16 however, the standard has been criticized for its uncertainness and difficulty in predicting whether or not one is a "worker." Thus, there is a need to make the criteria to determine the status of a "worker" clearer and establish a system in which the labor standard offices can appropriately respond to in order to protect "workers" who are not being treated as "workers."

(b) Social security for freelancers

Since freelancers are not considered "workers" under the Labor Standards Act, currently, it is almost impossible for them to have workers' accident compensation insurance, employment insurance, health insurance, or employees' pension insurance, except for a very few exceptions. Therefore, freelancers are not entitled to receive, a mong other things, workers' accident compensation, even if they get injured from a work-related accident, or unemployment benefits when they lose their jobs. To solve this issue, a study group of the Japanese government has suggested that the government consider providing social security to freelancers/gig workers who are not considered "workers" under the Labor Standards Act. Such discussion is expected to develop in depth to provide freelancers further protection.

Footnotes

1. Bureau of Statistics of the Ministry of Internal Affairs and Communications, "Survey on the Labor Market in 2022," available at (https://www.stat.go.jp/data/shugyou/2022/pdf/kgaiyou.pdf) (in Japanese).

2. Shitekidokusen no kinshi oyobi kouseitorihiki no kakuho ni kansuru houritsu [Act on Prohibition of Private Monopolization and Maintenance of Fair Trade] Law No. 54 of April 14, 1947, as last amended by Law No. 63 of June 16, 2023.

3. Shitaukedaikin shiharai chien boushi hou [Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors] Law No. 120 of June 1, 1956, as last amended by Law No. 51 of June 10, 2009.

4. Tokutei jutakusha ni kakaru torihiki no tekiseika ni kansuru houritsu [Act on Improvement of Transactions between Freelancers and Undertakings] Law No. 25 of May 12, 2023.

5. The guidelines published by the JFTC and the MHLW define an "employee" as (a) a worker with more than twenty (20) hours of normal working hours a week, and (b) a worker who is expected to be employed for more than thirty (30) consecutive days.

6. The Freelance Act, art. 2.3.

7. For example, an entrepreneur's use of outsourcing for its own services is not subject to the Subcontract Act.

8. This obligation applies even when the consignor does not have an employee (the Freelance Act, arts. 3 and 2.5). All other obligations, prohibited acts, etc., would only apply to such consignor if it has more than one (1) employee.

9. If the original consignor consigns the business to an entrepreneur (other than a freelancer) and then re-consigns the business to a freelancer, the date of payment of the remuneration for the re-consigned business must be fixed within thirty (30) days from the date of payment of the remuneration for the original consignment (the Freelance Act, art. 4.3).

10. This rule is almost the same as that provided in Article 5-4 of the Employment Security Act (Shokugyo antei hou [Employment Security Act] Act No. 141 of November 30, 1947, as last amended by Act No. 68 of June 17, 2022).

11. Such authorities include the JFTC, the MHLW, and the Small and Medium Business Administration.

12. Roudou kijun hou [Labor Standards Act] Law No. 49 of April 7, 1947, as last amended by Law No. 71 of December 12, 2018.

13. Roudou keiyaku hou [Labor Contracts Act] Act No. 128 of November 28, 2007, as last amended by Act No. 71 of December 28, 2018.

14. Roudou anzen ensei hou [Industrial Safety and Health Act] Act No. 57 of June 8, 1972, as last amended by Act No.68 of June 17, 2022.

15. Roudou kumiai hou [Labor Union Act] Act No. 174 of June 1,1949, as last amended by Act No. 53 of June 14, 2023.

16. The determination of the status of a "worker" under the Labor Standards Act is made by comprehensively considering the following items: (a) whether it is possible to reject a work request; (b) whether there are directions and orders regarding the content of the work and the manner in which the work should be done; (c) whether there is a degree of binding effect with respect to place and time; (d) whether someone else is allowed to step in as a substitute for the person who is to provide the services; (e) whether the remuneration bears the characteristics of consideration for the provision of labor; (f) whether there are characteristics showing that the person is a business operator; and (g) whether the person is providing the services exclusively to the employer.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.