I. Introduction

On August 31, 2023, the Ministry of Economy, Trade and Industry formulated and announced the Guidelines for Corporate Takeovers (the "Guidelines").1 The Guidelines clearly state that the economy of Japan is aiming to have a soundly functioning market in acquisitions involving the transfer of corporate control and welcomes active acquisitions that contribute both in enhancing corporate value and securing the interests of shareholders. The Guidelines also aim to meet the expectations of domestic and foreign stakeholders, including investors active in international markets. The purpose of the Guidelines is to present principles and best practices that should be shared in the economy to develop fair rules for acquisitions, with a focus on how parties should behave in the context of acquiring corporate control of a listed company. While the Guidelines are not legally binding, referring to and taking action based on the best practices presented therein would likely reduce the risk of directors breaching their duties of care and loyalty, and courts will likely respect the transaction terms agreed upon between the parties more.

This article has been divided into two parts. Part I discusses the scope, basic principles, and perspectives of the Guidelines as well as the code of conduct that directors and the board of directors must observe concerning acquisitions. Part II in the next newsletter will cover increased transparency of acquisitions and takeover response policies and countermeasures.

II. Scope of the Guidelines

The Guidelines primarily address transactions where the purchaser obtains corporate control of a listed company by acquiring its shares, regardless of whether the offer or bid is solicited or unsolicited. Concerning the structure of the acquisition, the Guidelines focus on cases where the shares of the target company are acquired through tender offers, open-market purchases, or negotiated transactions, in each case, for cash consideration. However, the Guidelines may also apply to cases where corporate control is acquired through stock for stock acquisitions or through organizational restructurings, such as mergers, share exchanges, and share deliveries.

III. Principles and Basic Perspectives

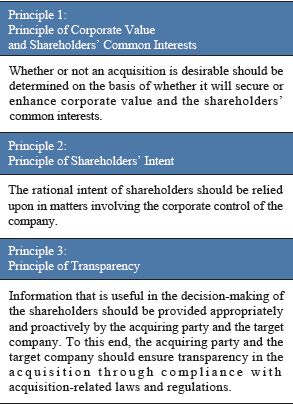

The Guidelines present the following three principles that should generally be respected in acquisitions of corporate control of listed companies:

To facilitate desirable acquisitions that enhance corporate value and secure the shareholders' common interests, a code of conduct is required, and the parties and other participants involved in an acquisition must respect and abide by it. Although, in principle, the rational intent of the shareholders should be relied upon in matters involving the corporate control of a company, there are often information asymmetries between the acquiring party and the target company's board of directors on the one hand, and its shareholders on the other. Sufficient information must therefore be provided so that the shareholders can make a correct decision on the merits of the acquisition and the transaction terms (informed judgment).

IV. Code of Conduct for the Directors and Board of Directors on Acquisition Proposals

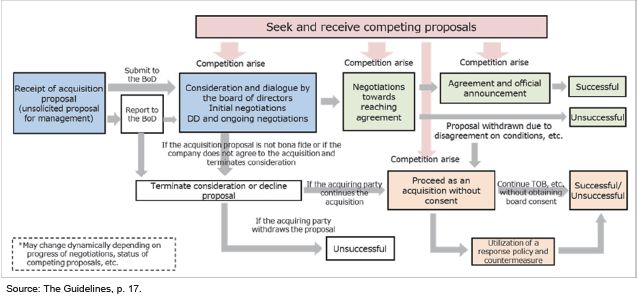

The Guidelines provide a phase-based approach to the code of conduct for each director and the board of directors for proposals that seek to acquire corporate control.

An example of the flow of issues to be considered in connection with an acquisition proposal is illustrated below:

To view the full article please click here.

Footnote

1. Available at https://www.meti.go.jp/shingikai/economy/kosei_baishu/pdf/20230831_3.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.